Warren Mosler, founder of Mosler Economics and co-founder of Modern Monetary Theory (MMT) with William Mitchell, is a key figure in reshaping economic thought. Despite correctly anticipating economic crises and providing solutions through deficit spending, he has yet to receive a Nobel Prize. Mosler’s major contribution is identifying currency as a state monopoly, offering a clear explanation for involuntary unemployment: it stems from the government not spending enough relative to its tax demands and the private sector’s desire to save.

His insights helped integrate monetary sovereignty into Mitchell’s employment stabilization framework, giving birth to MMT’s central idea: a Job Guarantee to ensure full employment. Mosler’s work demonstrates that taxation creates unemployment by forcing people to seek paid work in the state’s currency, and that only government spending can close the gap between taxes owed and currency available.

He redefines currency as a tax credit rather than simply a medium of exchange, showing that the government, as a monopoly issuer, sets the price level through its spending. Thus, unemployment and price instability are political choices, not economic necessities. Mosler also explains that higher interest rates, contrary to mainstream belief, are inflationary and regressive, as they increase government deficits and private sector financial assets.

Ultimately, Mosler’s MMT offers a scientific framework for understanding modern economies, emphasizing that deficits, debts, and public spending are tools for prosperity, not dangers. His vision could radically improve global economic management and promote peace, meriting not just a Nobel Prize in Economics, but also one for Peace.

More than 30 years after the publication of Soft Currency Economics (1993), and following multiple crises—each accurately predicted and ultimately resolved through deficit-financed government interventions, as he had suggested—it is legitimate to ask why Warren Mosler, founding father of Mosler Economics and co-founder, along with William Mitchell, of the now well-known Modern Monetary Theory (MMT), has yet to be awarded the Nobel Prize in Economics.

William Mitchell had already been developing, since the mid-1980s, his own theoretical framework centered on Buffer Stock Employment (BSE), which would later evolve into the Job Guarantee.

Notably, even at this early stage, his work represented a significant departure from and conceptual advancement beyond the IS-LM model, challenging its static equilibrium approach and its reliance on interest rate adjustments as the primary policy tool. His framework implicitly recognized that the state could actively stabilize employment levels, thereby circumventing the traditional trade-off between inflation and unemployment. It was precisely this intellectual trajectory that made the encounter between Mitchell and Mosler particularly transformative. When Mitchell was introduced to Mosler’s insights on currency sovereignty and the state’s monopoly over money issuance, the connection was immediate.

Mosler’s framework provided the missing theoretical foundation that allowed Mitchell to fully integrate monetary sovereignty into his employment stabilization model, leading to the development of what we now recognize as Modern Monetary Theory, with the Job Guarantee as one of its cornerstones.

Over time, a significant number of prominent economists joined their efforts, contributing to the establishment of a robust and scientifically rigorous corpus of economic research.

This document, however, focuses exclusively on Warren Mosler’s contribution to the emancipation of economic thought, particularly his pivotal insight into currency as a state monopoly and its far-reaching implications. His mathematical explanation of the phenomenon of involuntary unemployment—a subject of centuries-long debate on its origins among Keynesians, Post-Keynesians, and classical economists—represents a groundbreaking novelty in the field of economic science. It offers the potential to address one of humanity’s greatest sources of suffering and serves as the cornerstone for facing the advent of robotics and artificial intelligence without fearing the exclusionary impact on many workers.

In presenting his theories on the functioning of money and modern monetary systems over the years, the American economist has never claimed to invent something new. Instead, he has been the only one to identify currency as a state monopoly, successfully deciphering and clarifying topics that mainstream media, politics, and economists regularly portray as problems. These include public debts, government deficits, and the ever-present fear of uncontrolled inflation. The lack of work and the resulting involuntary unemployment are, without a shadow of a doubt, the root of all the issues characterizing monetary-based economic systems. This awareness seemingly extended even to many of the founding fathers of modern nations, as evidenced by the fact that numerous modern constitutions—not least the Italian one—place labor among the foundational principles of the state, guaranteeing the right to work for their citizens. Over the years, neither Post-Keynesians nor neo-classical economists have been able to provide a complete explanation of the origins of unemployment. Although some came close, none of them managed to connect the dots to deliver the definitive explanation that we now have thanks to Mosler.

The traditional economists of Keynes’s era, in developing their models, concluded that in a fully competitive market, unemployment would not exist. Therefore, unemployment could be attributed to imperfect competition, stemming from the presence of monopolies that restricted supply on the production side. In contrast, Keynes argued that mass unemployment could persist even in the absence of monopolies due to the intrinsic functioning of the monetary system, which can lead to a persistent weakness in aggregate demand. This stalemate remains today, with traditionalist neo-Keynesians modeling “sticky wages and prices” to explain persistent unemployment, arguing it would not exist if wage and price flexibility allowed the labor market to liberalize.

Identifying currency as a public monopoly, as Warren Mosler defines it, resolves this issue immediately. Unemployment is identified as the consequence of a monopolist restricting the supply of currency. Unemployment, therefore, becomes evidence that the state has not spent enough to cover the need for tax payments and to fulfill the private sector’s desire for savings. Both Keynes and the Classics were right, even though their intellectual descendants, to this day, continue to engage in a dialogue without truly understanding one another. This is because they fail to account for the missing piece in their thinking, which has been brought to light today by Mosler.

According to the Classical assertion, unemployment arises from a monopolist restricting supply, while Keynes’s perspective locates the restriction within the functioning of the monetary system. Keynes correctly described the functioning of the monetary system but did not explicitly identify it as a case of public monopoly. The Classics continue to focus on the restriction from the supply side, without realizing that only the currency monopolist can regulate aggregate demand. The analytical framework proposed by Mosler, which views currency as a state monopoly, provides the tools to address all criticisms leveled at Modern Monetary Theory (MMT).

Critics often dismiss MMT as incomplete or even absurd, particularly when it advocates for full employment, arguing that it fails to consider all the elements that constitute the so-called value chain. Political economy has always sought to answer the question: Where does value come from? The answers have varied widely, ranging from the scarcity of available goods, to their utility, to the need to remunerate the factors of production—including capital—and considering its remuneration—profit—as the reward for the abstinence of the capitalist, who can afford to forgo consumption in order to productively employ their wealth, and so on.

According to Mosler’s work, the theory of value primarily operates on two fundamental aspects: the value of the monetary system for society and the determination of nominal prices. While he dedicates only a brief discussion to the former, the latter is extensively addressed, with money modeled as a tax credit rather than merely a unit of account, as it has historically been understood. Through this lens, historical gold standards and labor value theories are seen as particular cases of a general theory. Within this framework, the inherent flaws in understanding monetary operations have undoubtedly undermined past and present attempts at determining value.

Regarding the macro-level value of the monetary system for society, there is no doubt about the validity of Mosler’s insight. It begins with the state’s desire to provision itself, generally and for specific purposes, with public infrastructure for public objectives. This includes the public infrastructure that supports the state’s vision for the socioeconomic framework of the private sector, including the institutional structure within which markets operate. The driving force, as mentioned, is the coercive tax liabilities (tax credits/currency) that create sellers of goods and services in that currency, which is a state monopoly and is used by the state to procure everything it needs. The monetary system, as Mosler explains perfectly, is politically neutral and describes all possible varieties of institutional and socioeconomic structures, from socialism, where the state owns the means of production, to capitalism, which supports private ownership of the means of production.

Regardless of the political parties or schools of thought shaping their ideals, the value society assigns to the monetary system is directly linked to the population’s perception of its worth. Although subjective, this value is continually subject to the electorate’s judgment, ongoing changes by the government, and constant debate. Regarding the second aspect, the determination of nominal prices, Mosler highlights how, historically, “relative value” pertains to the way goods and services are exchanged for one another, while “nominal price” refers to the specific prices expressed in a given currency. The conclusion of this analysis reveals that the value of all goods and services, including intangible ones, is necessarily expressed in relative terms.

Mosler highlights how the search for the source of the price level has been ongoing for decades. Current central bank economists model the exchange of goods and services, treating the nominal price level as an exogenous numerical input—essentially an assumption. The starting point, for instance, is often something like “yesterday’s closing prices.” From there, the models attempt to explain what drives changes in prices and the overall price level. However, there is no determination of the source of the price level beyond its historical context, leading to an infinite regression.

Mosler points out that the “Fiscal Theory of the Price Level” is a recent example of a failed attempt because it did not resolve this infinite regression dilemma. Continuing the analysis of nominal price determination, a key element is the identification of tax credits as intangible assets. Modern currencies issued by states function as tax credits, recorded as liabilities of the issuing entity and intangible assets of the holder. As such, Mosler specifies, they fit within the same analytical framework as goods, services, commodities, and other assets. Therefore, a nominal price is the expression of the relative value between tax credits (units of currency) and the goods and services, among other items, that are priced and expressed in terms of these tax credits.

Here we return to Mosler’s insight: when currency itself is modeled as a public monopoly, the tax credits spent by the state exist as intangible assets, with the state as the sole supplier and therefore the price setter when it spends. There is no invariant standard of value. The state’s price-setting when it spends establishes the terms of exchange between its tax credits and the objects of its expenditure. Market forces, within the context of the rest of the state’s institutional framework, then use this information to determine the value of those tax credits relative to other goods and services.

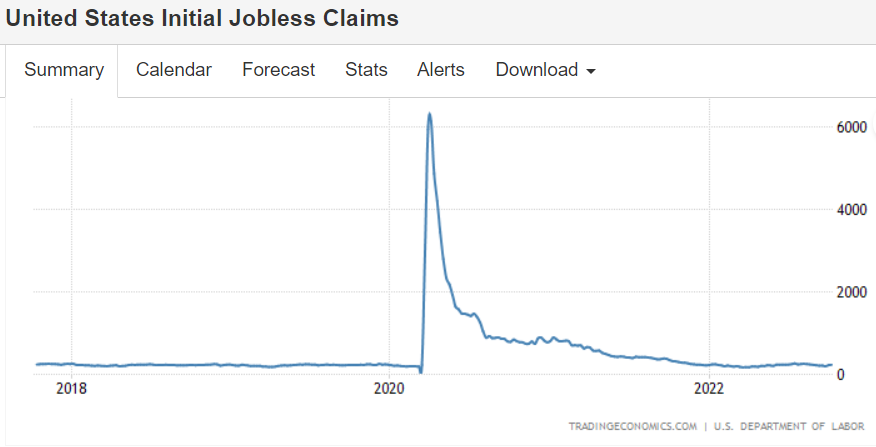

Here, the source of unemployment begins to take clear shape within Mosler’s framework. As we have seen, tax liabilities are designed to create sellers of goods and services seeking applicable tax credits in exchange, thereby initiating the process of state spending. This identifies tax liabilities as the direct cause of what we define as unemployment: people seeking paid work. There can be no other cause of unemployment. Without tax liabilities, there is no functioning state currency, and thus no one seeks employment in exchange for units of that currency. In simple terms, taxation creates involuntary unemployment.

The least a modern democratic state can do in such cases is to implement a job guarantee program to offset the currency shortfall caused by taxation.

In his papers, Mosler also outlines, in a schematic way, the proper sequence of the history of money and its movement within the economic system:

- A state desires to provide for itself;

- Tax liabilities create sellers of real goods and services (unemployment);

- The state then provides for itself by spending its currency, purchasing goods and services, and hiring those whom its tax liabilities have rendered unemployed, thus supplying the funds needed to pay taxes and achieve net savings;

- Taxes are paid, and any surplus funds received remain as net savings/public debt.

This sequence, in which state spending necessarily precedes revenue collection, deviates from traditional economic models that start with tax collection and assume that government spending is constrained by revenue, thereby implying a risk of insolvency. With the proper modeling of the sequence, as outlined by Mosler, concerns about state insolvency become irrelevant.

At this point, it becomes clear, through Mosler’s reconstruction of the monetary system, that the public sector is identified as a planned economy. Coercive taxation translates into a planned economy that serves to provision the government and supports the institutional framework of the state, within which markets and capitalism, if allowed, operate.

For example, if the state desires to maintain an army, society will produce and offer the soldiers and equipment the state wishes to procure; otherwise, it will face the consequences of failing to settle its tax liabilities. The same principle applies to all other state purchases necessary to provide public infrastructure, including the legal system, public healthcare, educational initiatives, transportation projects, and more. The private sector controls the remaining resources, though these are still subject to additional state rules and regulations.

Mosler emphasizes that the resources commanded by the government are a political choice, and while the monetary system is a tool for provisioning the government, it does not provide useful information for making those decisions. At this point, it becomes sufficiently clear how the role of the government is fundamental to the function of income distribution. This function, starting with how government tax liabilities are structured (as extensively explained by Mosler), is embedded within the institutional framework. With sufficiently enforceable tax liabilities in place, the government can directly hire people at wages of its choosing, whether they are executives or workers, up to the point where public spending matches the need to pay taxes and the desire to save. At the same time, the government can also hire contractors and even specify their profit margins and employee compensation. Moreover, the government can require business licenses that similarly specify what businesses are authorized to do and how they can operate. Income itself is measured in tax credits, with the state as the issuer of its tax liabilities, defining and serving as the sole provider of what is required for tax payment. Therefore, from the outset, the distribution of state currency income is entirely under the state’s control. Any deviation from state control results from the institutional framework of the state and is subject to ongoing modification by the state, presumably to serve public purposes. Tax liabilities are coercive and continuous. They establish a perpetual drain on the nominal wealth of the community, which has a profound and pervasive psychological impact on the population and the relationships within it.

The ongoing dependence on nominal income creates anxieties and fears that dominate and influence behavior, often leading to selfish, antisocial, and all too frequently destructive or criminal actions. This is a crucial point that highlights the importance of understanding, even on a societal level, the proper functioning and true vertical nature of money. Such understanding is essential to minimize situations of hardship, which are often the root causes of the most egregious crimes. The explanations provided by Mosler of the monetary system and his insight into currency as a public monopoly put an end to past and present attempts to view the state as merely a user of currency.

From communism to capitalism, passing through socialism and the current neoliberalism, none of these systems can function without the public monopoly on money. Based on Mosler’s explanations, it becomes clear that capitalism exists only within the broader institutional framework of the state. The profits earned by capitalists are the returns from owning the means of production and represent the driving force behind the desire to possess those means. In a monetary economy, the capitalist’s motivation is to increase nominal wealth. This is facilitated by state support for the means of increasing the capitalist’s nominal wealth, once again, presumably serving a public purpose. This support begins with legal protection of property and property rights, a corporate structure with limited liability, and financial backing that includes state-sponsored liquidity through a state-regulated banking system. Capitalism and its anticipated trajectory, as Mosler rightly asserts, are therefore a function of state policy.

Delving into the concept of “rents,” Mosler clearly states and explains how these rents derive from real estate ownership sanctioned by the state, along with the state protections of that ownership, which allow the designated owner to charge and receive rental payments. It can be assumed that this arrangement serves the public purpose better than state ownership of real estate. However, more often than not, private ownership falls within parameters established by the state. These include property taxes, zoning regulations, contractual rights regarding rent and leasing, eviction, and so on, all of which further serve the public purpose behind the presumed public benefit of private ownership over state ownership. However, not all real estate is designated as private property, as states maintain public ownership of substantial real estate when deemed useful for a public purpose. Rental value, measured in returns to owners for the use of their property, is thus also a function of the institutional framework, subject to ongoing changes, presumably again, to serve a public purpose. Rental value does not exist independently of the state’s institutional framework. What can be observed and calculated as the value of the rental property are the consequences of rents that stem from the institutional structure.

At this point, it is clear that the task of achieving the long-sought balancebetween rent and labor on the social scale of people is indispensably entrusted to governments that hold the monopoly on currency. According to game theory, the disparity of power in what is called the “labor market” means that, without external support, wages will fall to subsistence levels. This was fully understood by the man who is unanimously regarded as the first of the classical economists, the Scottish philosopher and economist Adam Smith:

“A landlord, a farmer, a master manufacturer, a merchant, though they did not employ a single workman, could generally live a year or two upon the stocks which they have already acquired. Many workmen could not subsist a week, few could subsist a month, and scarcely any a year without employment. In the long run, the workman may be as necessary to his master as his master is to him; but the necessity is not so immediate.”

As already stated, a state policy is necessary to change this outcome. A guaranteed jobs program, for example, can be implemented to support real wages at a politically desired minimum. Mosler, despite the elusive criticisms from those who have never read any of his work, perfectly defines the labor theory of value.

For the founder of ME-MMT, all production is the product of some form of human effort, which economists call labor.

From this, it follows that there is a quantity of hours of labor required for the production of goods and services. Given a price for one hour of labor, it is possible to calculate the nominal costs of goods and services, including the labor employed in all inputs for final products. Any price above this represents a profit for the capitalist who owns the means of production, which is called surplus value. And if rents are involved, part of the surplus goes to the real estate owner.

Political narratives generally focus on capitalists and property owners exploiting workers. However, the entire structure is created by the government, presumably to serve a public purpose, and is subject to continuous changes by the government, which then assumes responsibility for its choices. The government must make choices.

Ultimately, without profit, there will be no capitalists, and without rents, there will be no ownership of commercial property. Instead, the state will directly own the means of production and the associated real estate. And if public policy results in rents and profits set too high, the state creates a privileged class of high-income property owners who collect rent, alongside a class of low-income workers who do all the labor. In this context, the value of organization is also included, as production and economic growth are a function of labor hours and productivity, defined as output per hour of labor. Without productivity gains, we would still be hunters and gatherers.

In our modest opinion, Mosler’s understanding of currency as a state monopoly is comparable to the Copernican revolution, placing the State at the center of the economic system.

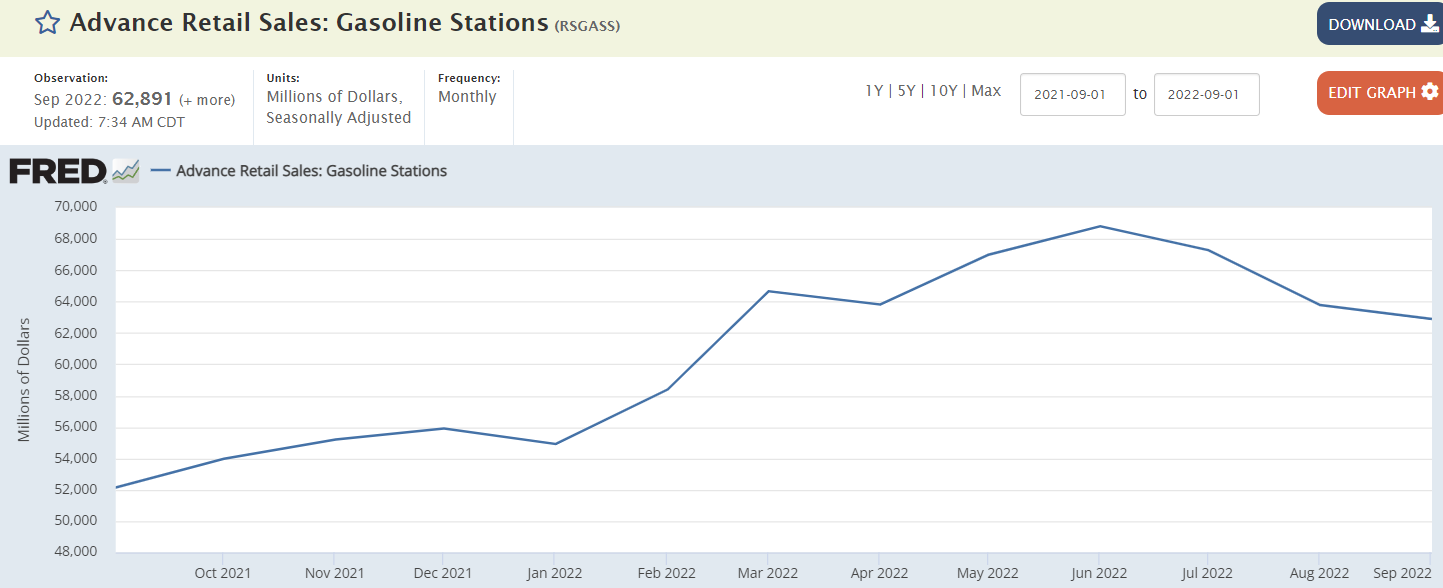

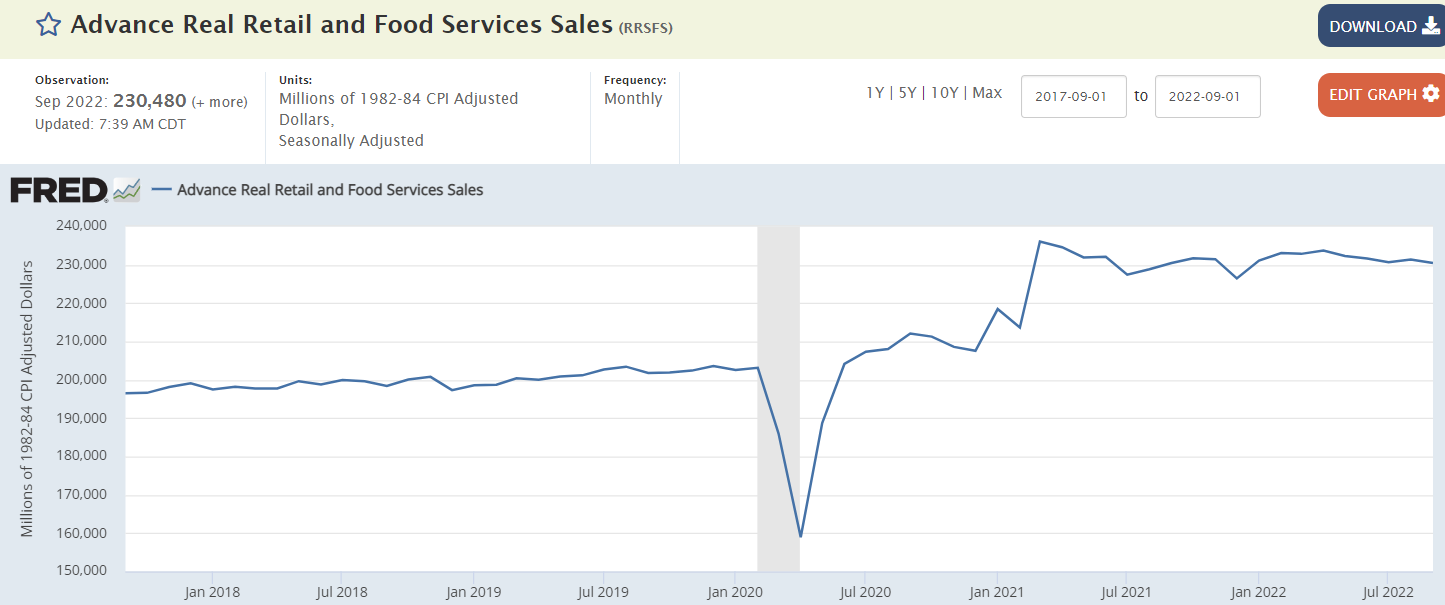

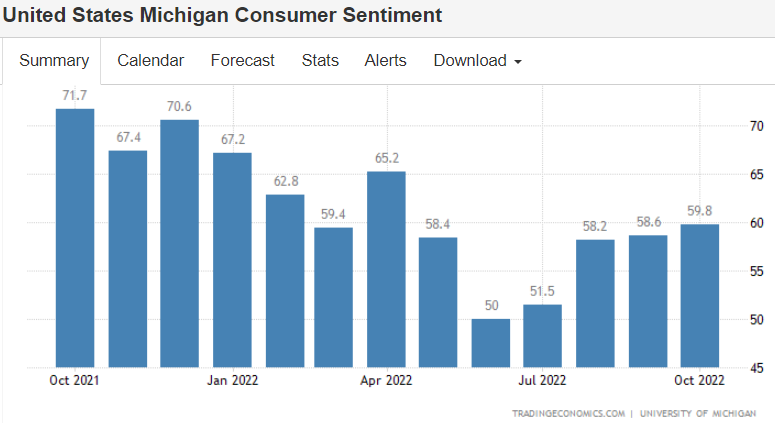

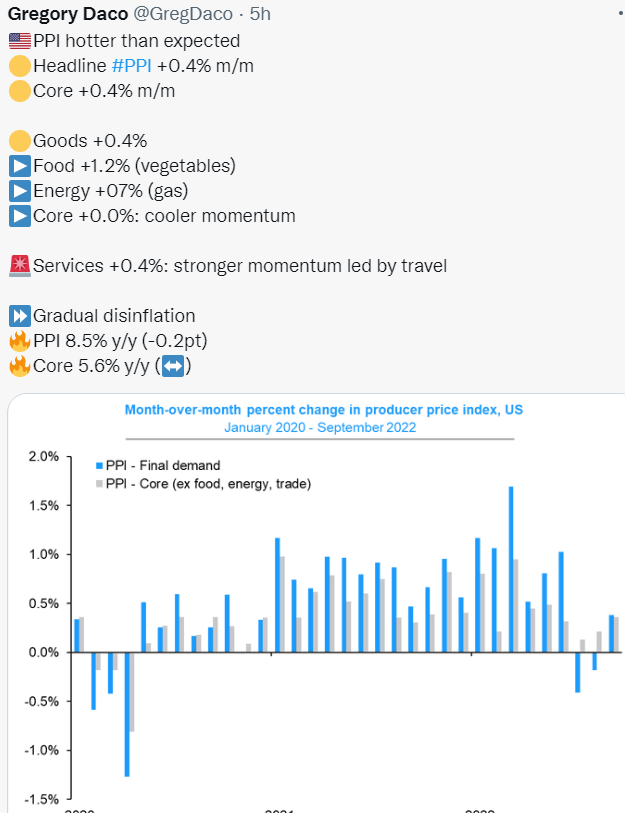

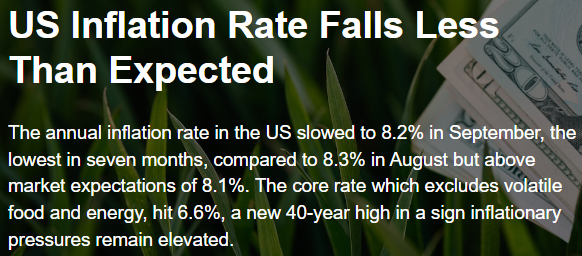

Another very recent example of Mosler’s accurate interpretation of monetary systems is the case of interest rates. All non-MMT schools of thought consider an interest rate hike by the central bank as a restrictive monetary policy operation. Mosler explains to us that, on the contrary, an interest rate increase is both an expansive and inflationary maneuver, as well as highly regressive. In fact, by raising rates, the central bank causes an increase in the government deficit, thus increasing the net financial assets of the private sector, allowing for greater spending capacity, without asking for a corresponding increase in production, which would instead happen with a guaranteed jobs program.

The more one delves into Mosler’s thought, the better one understands the reality that surrounds us. Many of the “myths” that have gradually emerged due to a lack of understanding of the workings of the monetary system and its dynamics—often presented as natural laws designed to hinder the development and material well-being of people—melt away like snow in the sun when analyzed through the lens of ME-MMT. To mention a few: the Phillips curve, Thirlwall’s law, original sin, the problem of public debt sustainability, the issue of the trade deficit, and the interest rate hikes to fight inflation. Ultimately, ME-MMT, as presented by Mosler, offers new institutional horizons that, in our opinion, will increasingly be adopted by politicians and, consequently, accepted by the academic world. This is significant, considering that academia still ostracizes MMT, particularly Mosler, as he, like Keynes, was not a professional academic. In this sense, Warren Mosler undoubtedly stands as the most important economic thinker of the last 50 years. While thinkers like Marx and Keynes have undeniably left a profound mark, Mosler is the one who, more than any other, allows for the first time a crystal-clear reading of reality.

Let us conclude by summarizing the key points of Warren Mosler’s Mosler Economics Modern Monetary Theory (ME-MMT):

- Currency is a state monopoly. The state creates currency when it spends, and destroys currency when it taxes;

- Involuntary unemployment is always a consequence of insufficient deficits by the monopolist;

- Rather than focusing on the numerical value of the deficit, the state should offer a guaranteed jobs program;

- The natural interest rate is zero; positive interest rates are expansionary, regressive, and inflationary;

- The price level of a country is determined by the state, the monopoly issuer of the currency;

- The issuance of public debt securities is a legacy of the gold standard; with a zero interest rate forever, it should cease immediately;

- Taxation should be minimal and non-regressive, for example, a property tax;

- Bank deposit guarantees should be unlimited to be consistent with a permanent zero interest rate;

- Commercial banks should have the ability to create money, but exclusively for real, non-financial activities, in order to prevent excessive parasitism from the financial sector and the emergence of speculative bubbles and related instability;

- To implement these points, a total non-convertibility of the currency is required, that is, a flexible exchange rate.

It is important to clarify that MMT is not something to be “adopted,” but rather a precise and scientific description of how the modern monetary system works.The true innovation of Mosler, therefore, lies not only in the theory itself but also in the practical recommendations that stem from the understanding of these mechanisms. If governments were to apply these principles, they could achieve extraordinary results in terms of full employment, social welfare, and economic management.

The value of MMT lies in making visible what already occurs in the modern monetary system and in providing a conceptual framework that enables the intelligent and sustainable use of the power to issue currency, promoting prosperity without the fear of debt or deficits, while always keeping a vigilant eye on inflation.

Mosler’s insight into Treasury and Central Bank accounting is the scientific core of MMT, which has the potential to rewrite the rules of global economic policy. It is a scientific approach that challenges many of the traditional beliefs about debt, public spending, and inflation. For this reason, it deserves recognition, such as the Nobel Prize in Economics.

Keynes wrote: “Practical men, who believe themselves to be entirely exempt from any intellectual influence, are usually slaves to some defunct economist.” However, this maxim does not apply to Warren Mosler, for the simple reason that his intuition arises from a meticulous accounting analysis of the operations between the Treasury, the Central Bank, and the banking system, independent of any economic theory. It should be emphasized that Mosler did not base his analytical approach on pre-existing theories, but rather created a completely new analytical framework which, by coincidence, validates and indeed clarifies in detail the role of the state in the economy to reduce unemployment, as explained by Keynes. If we must speak of influences, which can be a dangerous game, we might then say that MMT is the work of a thinker who, through a long career, paid his debt to the great thinkers who preceded him with his final work on the theory of value”.

Based on what has been presented here, we strongly and resolutely argue that the minimum recognition for the genius of Warren Mosler would be a double Nobel Prize—one obviously for economics, and the other for Peace—because adopting his economic recommendations would have a significant impact on the process of pacification, both at the national and international levels.

We hope that this writing will find a receptive audience within the highest institutions and encourage readers to make valuable use of it.

Signed by : Roberto Bazzichi, Fabio Bonciani, Olindo Cervi, Alex Cerroni, Francesco Chini, Dirk H. Ehnts, Yan Liang, Stuart Medina Miltimore, Riccardo Naldi, RED MMT España, Think Brics