Still Trumped up expectations:

Highlights

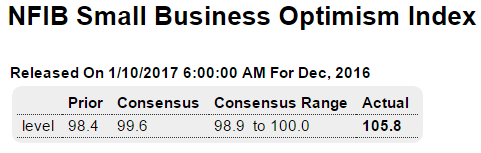

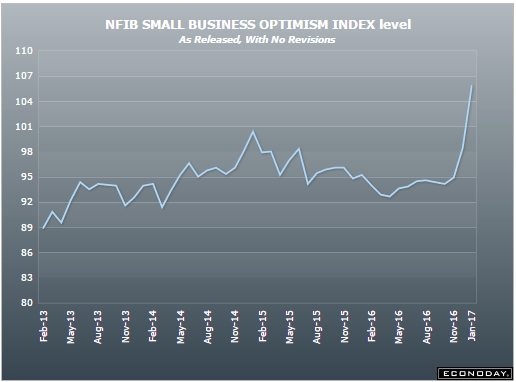

The small business optimism index soared 7.4 points in December to 105.8, the highest reading since December 2004. The outsized increase far exceeds expectations and follows a robust 3.5-point rise in November. NFIB said business owners who expect better economic conditions accounted for about half of the overall increase, with a net 50 percent of respondents expecting that the economy will improve, a 38 point leap up from November.

In a magnified repetition of the survey results for November, all but 2 of the 10 components posted gains. The two other optimism components making a big contribution to the index were higher real sales expectations, up 20 points to 31, and the view that now is a good time to expand, which was up 12 points to 23.

Capital outlays also figured prominently, with plans to increase capital spending jumping 5 points to 29 and 63 percent of respondents reporting outlays in December, 8 points more than in November. Even earnings trends were up 6 points, but remained in negative territory at minus 14.

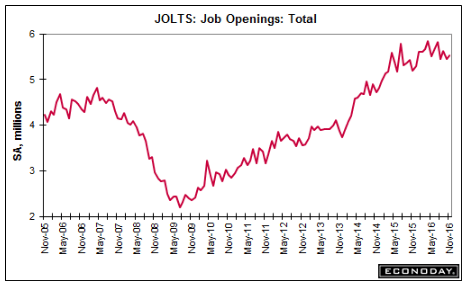

Optimism was somewhat subdued on the jobs front, however, as plans of owners to increase employment rose just 1 point to 16 and current job openings registered a 2-point decline, albeit to a still strong 29. According to NFIB, the labor market is getting tighter, allowing workers to ask for better wages, but small business owners are not yet confident enough to raise prices to offset any increase in labor costs. Higher interest rates apparently accounted for the drop in the other declining component, expected credit conditions, which fell 2 points to minus 6.

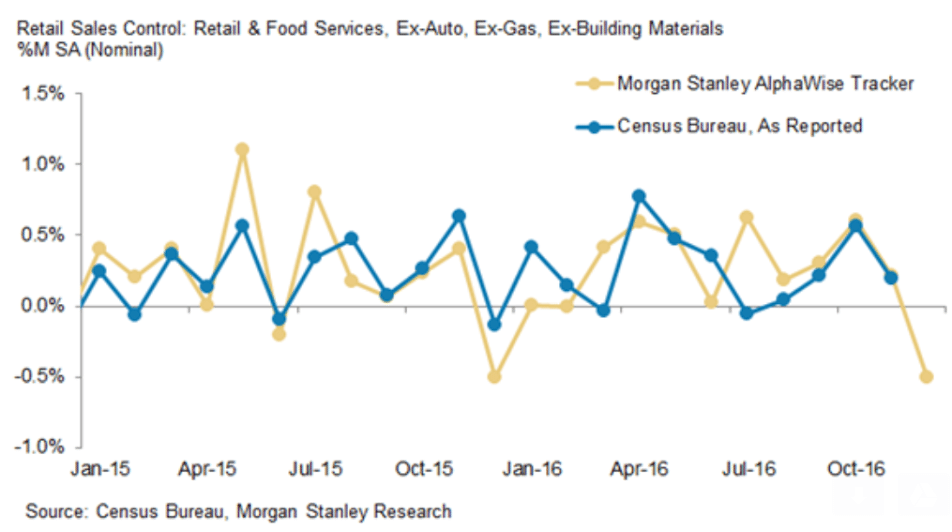

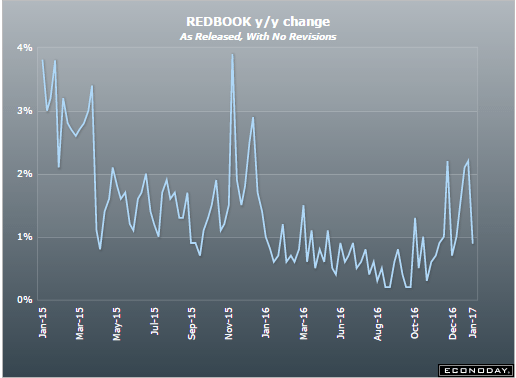

As previously discussed, looking like the spike is probably a one off event, same as last year:

Whatever this is, looks like it’s already rolled over…

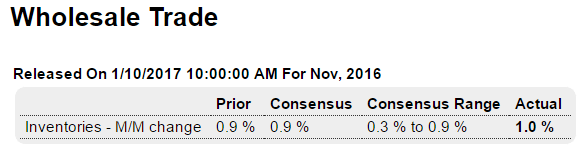

Looks like the unsold inventory isn’t under control yet, especially autos where productions cuts are underway:

Highlights

Wholesale inventories rose very sharply in November, up 1.0 percent compared to 0.9 percent in the advance report and a draw of 0.1 percent in October. The good news is that November’s build is centered in autos (+3.2 percent) where retail sales proved very strong in December. Sales at the wholesale level rose 0.4 percent which compared to the larger gain in inventories pulled up the stock-to-sales ratio to a less lean 1.32 from October’s 1.31. Excluding autos, however, the ratio held unchanged at 1.27.

Inventories were heavy going into the fourth quarter and though September proved stable, early indications on November inventories (which also include retail and manufacturing) are pointing to a big build. Whether this build will prove a problem for production and employment in the first quarter will depend on how strong consumer spending was during the holidays. Watch for December retail sales on Friday morning followed at midmorning by the business inventories report.

Production cutbacks building as US momentum slows

OEM discipline will be tested as sales growth slows. Already there are announcements of coming production cuts to manage inventory, writes Megan Lam

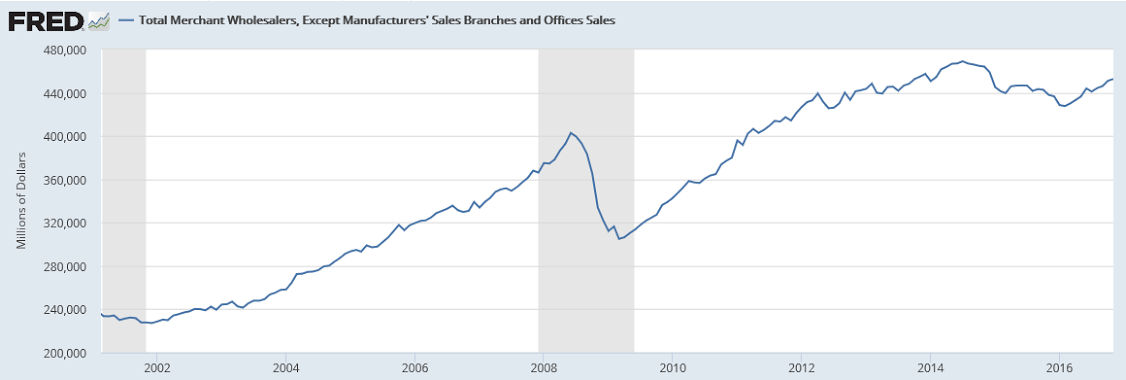

Total sales (not adjusted for inflation) are still below 2014 levels:

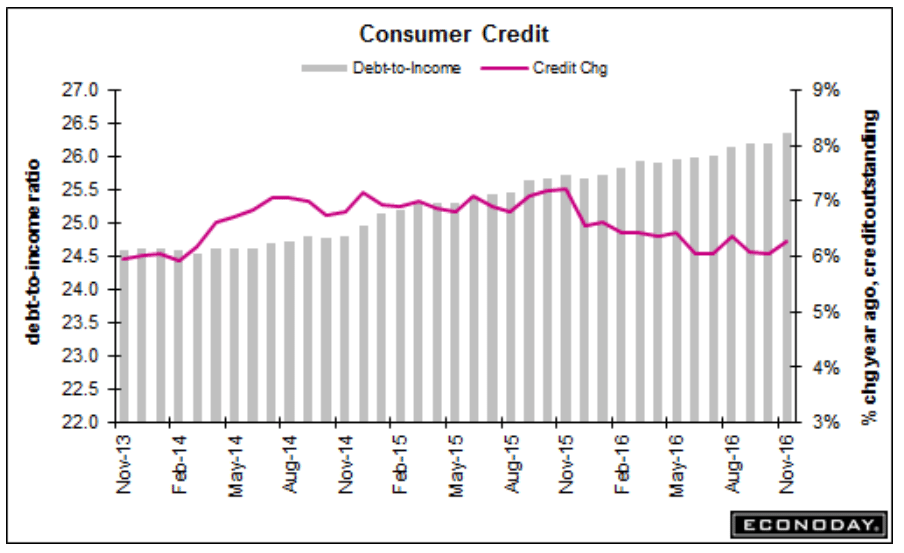

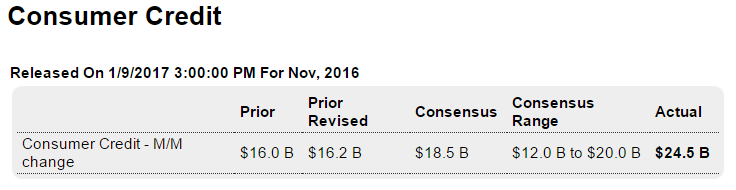

A bit stronger than expected but the year over year rate of growth continues to be trending lower even as the debt to income ratio increases, which could possibly mean consumers are borrowing more to pay monthly bills:

Highlights

A large increase in revolving credit, one of the largest of the cycle, is likely a positive indication for holiday sales. Revolving credit jumped $11.0 billion in data for November to indicate that consumers are increasingly running up their credit-card debt. Non-revolving credit, up $13.5 billion, is also positive, here reflecting demand for vehicle financing and student loans (which are tracked in this report). Total credit rose $24.5 billion in the month, well above the consensus and also above Econoday’s high estimate. Retail sales for December, to be posted Friday, will offer definitive data on the strength of holiday spending.