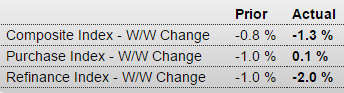

So much for housing leading the way up- looks to have gone from flat to down:

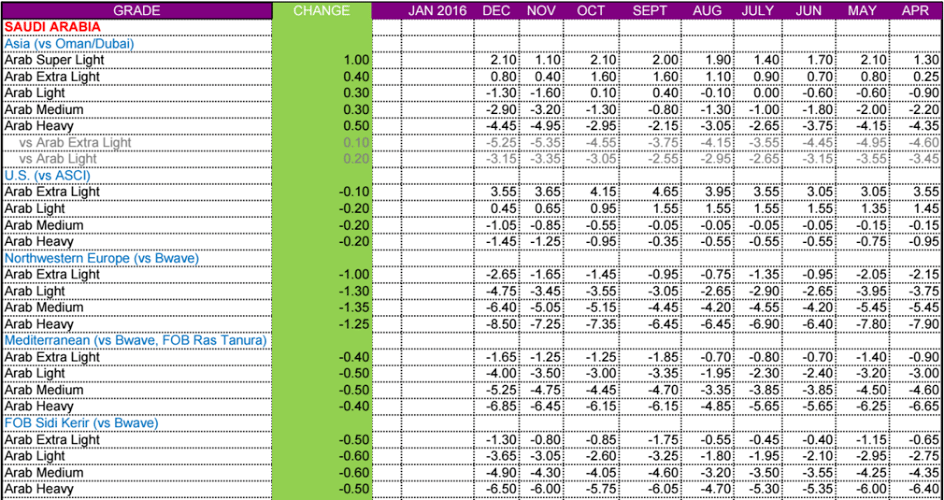

For the most part Saudis have been lowering premiums and increasing discounts which causes prices to fall to get their sales up to their pumping capacity:

Not without a bit of pain, which they may have come to believe inevitable due to long term supply/demand dynamics:

Saudi Arabia risks destroying Opec and feeding the Isil monster

(Telegraph) — The rumblings of revolt against Saudi Arabia and the Opec Gulf states are growing louder. The International Energy Agency (IEA) estimates that the oil price crash has cut Opec revenues from $1 trillion a year to $550bn. US output has dropped by 500,000 b/d since April, but the fall in October slowed to 40,000 b/d. Total production of 9.1m b/d is roughly where it was a year ago when the price war began. A confidential order from King Salman has frozen new hiring by the state, stopped property contracts and purchases of cars, and halted a long list of projects.

We’ll see what this means in actual practice:

Li promises full use of fiscal weapons

(Xinhua) — To lead to a major lift in the nation’s productivity, the government will ensure a steady business environment for all major sectors of the market, the president said. The government will make full use of fiscal policies, reduce taxes properly and help companies to overcome their difficulties and upgrade structure, Li told the meeting. The government will invest more to improve infrastructure in central and western China to achieve balanced development, and private companies are welcome to invest in such projects, Li said.