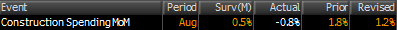

Came in less than expected and the chart looks bad as well, having topped out prior to year end as tax credits expired:

Construction Spending

Recent History Of This Indicator

Construction spending saw a broad-based gain in July. Construction spending rebounded 1.8 percent after a 0.9 percent dip in June. While all broad categories advanced, July’s increase was led by the public sector-up 3.0 percent, following a 1.8 percent decrease in June. Private nonresidential spending rebounded 2.1 percent in July after slipping 0.8 percent the month before. Private residential outlays gained 0.7 percent, following a 0.4 percent dip in June.

ISM manufacturing less then expected but still at reasonable levels:

ADP Employment Report

Highlights

ADP’s estimate for private payroll growth for September is 213,000 vs the Econoday consensus for 200,000 and vs a revised 202,000 for August. The corresponding consensus for Friday’s jobs report from the government is 215,000 vs August’s 134,000.

ADP contracted with Moody’s Analytics to compute a monthly report that would ultimately help to predict monthly nonfarm payrolls from the Bureau of Labor Statistic’s employment situation.

ADP used to report it’s payroll number, but a while ago ‘switched’ to using its internal numbers to try to forecast Friday’s non farm payroll report, so now we don’t see their actual payroll numbers, just their forecast for Friday

It’s all looking more and more like the ‘unspent income’ is winning, as happened in Q1, and it’s all on the verge of going into reverse.