Not good:

Highlights

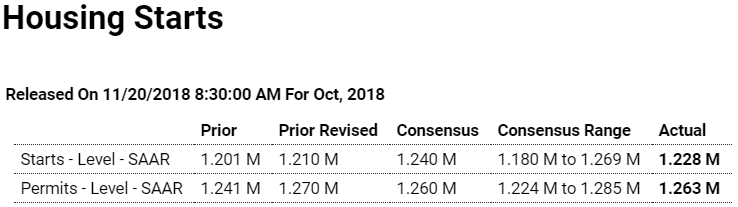

Yesterday’s housing market index may have unexpectedly plummeted but today’s housing starts and permits report, though soft, at least is in the ballpark of expectations. Starts in October rose 1.5 percent to a 1.228 million annualized rate that compares with Econoday’s consensus for 1.240 million. Permits edged past expectations, at a 1.263 million rate vs a consensus for 1.260 million though down 0.6 percent from September.

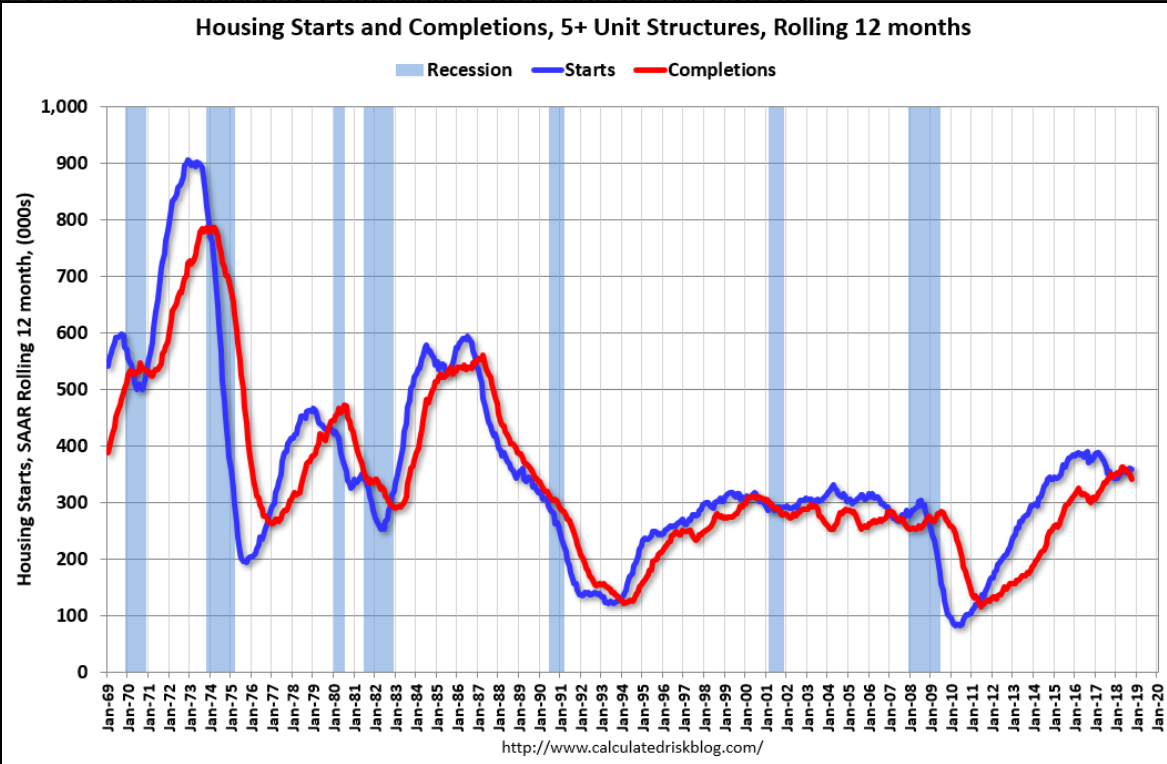

The good news on starts comes from multi-family units, jumping 10.3 percent to a 363,000 rate which offsets a second straight decline for single-family starts which slipped 1.8 percent to an 865,000 rate. Hurricane Michael which struck Florida and Georgia during October but did not skew the data as starts in the South rose 4.7 percent. Starts were also strong in the Midwest with the West and Northeast posting declines.

Permits show nearly equal declines for single-family and multi-units, down 0.6 percent and 0.5 percent respectively. The bad news on the permit side comes from the West which is a focused region for home builders and which declined 7.9 percent for a 17.2 percent year-on-year drop.

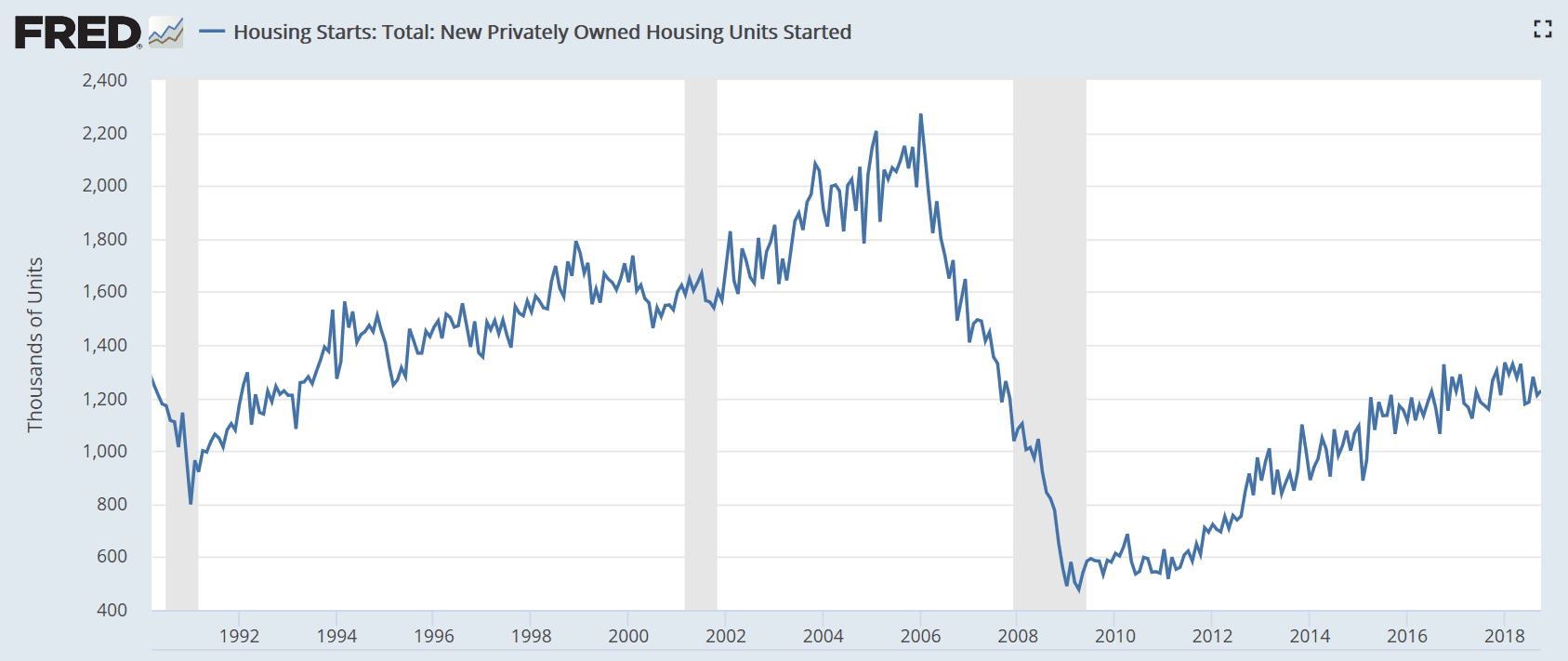

And the year-on-year rates do underscore the weakness in housing with total starts down 2.9 percent and total permits down 6.0 percent. Completions aren’t doing much better, down 3.3 percent overall in the month for a year-on-year drop of 6.5 percent. Single-family completions fell 1.2 percent in the month with multi-family completions down 9.1 percent in results that won’t be giving any boost to underlying sales.

Rising mortgage rates, tied directly to Federal Reserve rate hikes, are proving a major headwind for housing as are material and labor shortages. However strong the 2018 economy has been, housing is not part of the success story.