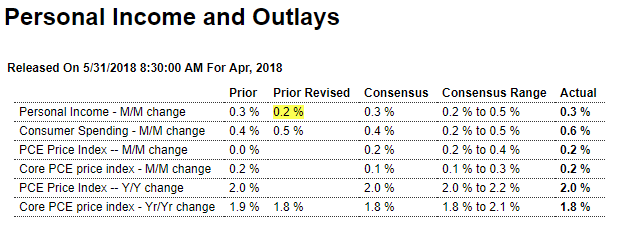

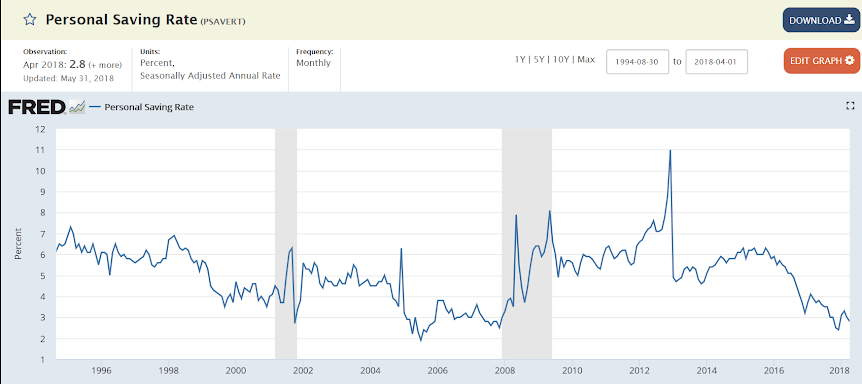

Spending was up, but unfortunately due to higher gas prices, which were paid for by further dipping into savings that were already far too low. So looks to me like q2 is off to a very uncertain start after a weak q1:

Highlights

Income isn’t quite as soft and spending isn’t quite as strong as they look while inflation readings are modest and steady. Income rose 0.3 percent in April but the wages & salaries component shows a solid 0.4 percent gain. Spending jumped 0.6 percent in the month led, however, by a 0.9 percent gain for nondurables which reflects April’s rise in gas prices.

Both the overall PCE price index and the core rose 0.2 percent in the month, the latter edging above Econoday’s consensus by 1 tenth, with the year-on-year rates hitting expectations, at 2.0 percent overall and 1.8 percent for the core.

Of note for the core is a revision to March’s year-on-year rate which has been downgraded to 1.8 percent. Also of note is a 2 tenths dip in the savings rate to an even lower 2.8 percent which suggests April’s spending, to a degree, was funded at the expense of savings.

Yet gas-driven or not, the rise in spending marks a strong opening for second-quarter consumer spending and, together with yesterday’s big improvement in April goods trade, are both early indications of strength for second-quarter GDP. More fundamentally, concerns in yesterday’s Beige Book that consumer spending was moderating look perhaps unwarranted and that steady growth, backed by respectable income, is now the more accurate description. For inflation, no alarms in this report with the overall rate holding on target for a second straight month but room still left to run for the core in its awaited approach to the Fed’s 2 percent line. Note that the Fed’s goal is to bring both the overall price index and the core to the 2 percent target and then to hold them there as steady as possible.

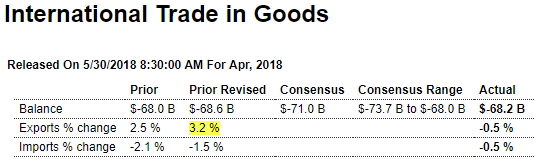

While the trade deficit was small than expected, the drop was due to weak US imports, which doesn’t bode well for domestic demand or for foreign economies:

Highlights

Second-quarter net exports open up on the positive side, at a goods deficit of $68.2 billion in April vs $68.6 in March and far better than expectations which were calling for a much deeper $71.0 billion deficit.

But the mix of the results are less favorable as exports of goods fell 0.5 percent to $139.6 billion reflecting sharp slowing for vehicles and also capital goods that offset gains for industrial supplies and especially food products. The import side is more favorable, falling 0.5 percent to $207.8 billion after March’s 1.5 percent decline with consumer goods falling very sharply, down 5.3 percent after March’s 1.7 percent dip.

The decline in exports aside, today’s results are positive and should give a lift to early estimates for second-quarter GDP.