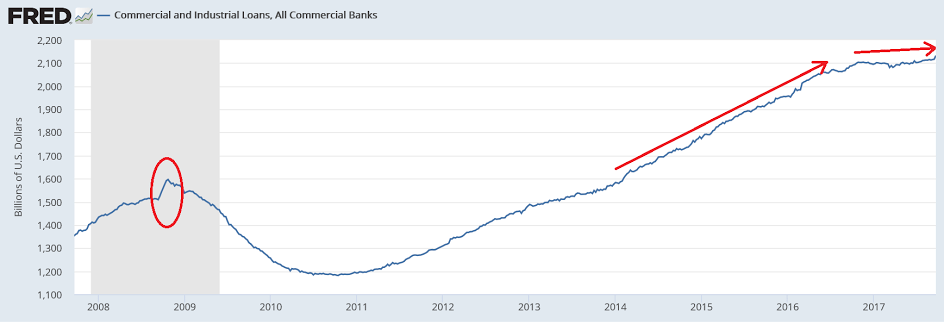

You may be hearing about ‘spike’ in lending last week, so I’ll try to give you some perspective using commercial and industrial lending charts before just showing year over year changes:

In this 10 year chart you can see how the growth in lending suddenly slowed back in November 2016. You can also see that last week’s spike up is something that’s happened many times and looks like ‘normal volatility’ and, at least so far, not an indication of something unusual happening that’s changed the overall outlook. Or, as also happened in prior cycles, a spike in borrowing can be a sign of distress, such as when inventories spike will falling sales, or when other shocks to cash flow force sudden borrowings:

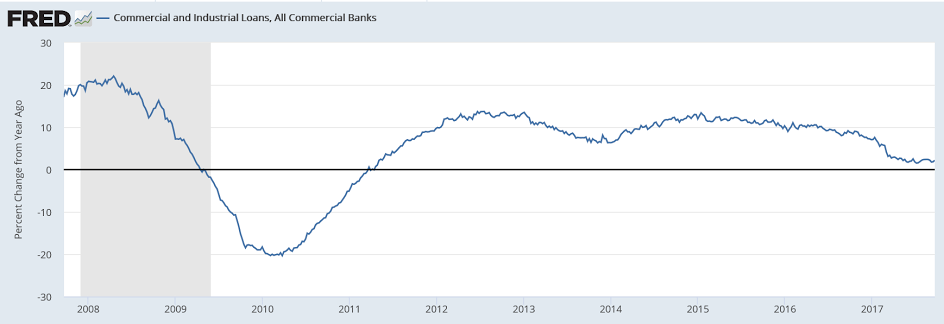

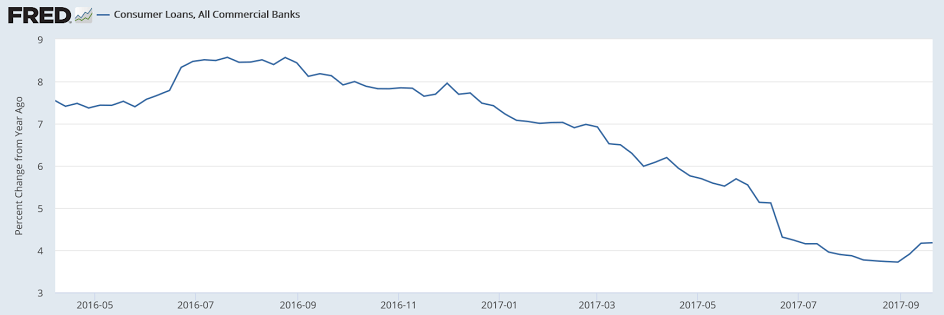

On a year over year basis last week’s increase in lending also doesn’t look to have changed the outlook:

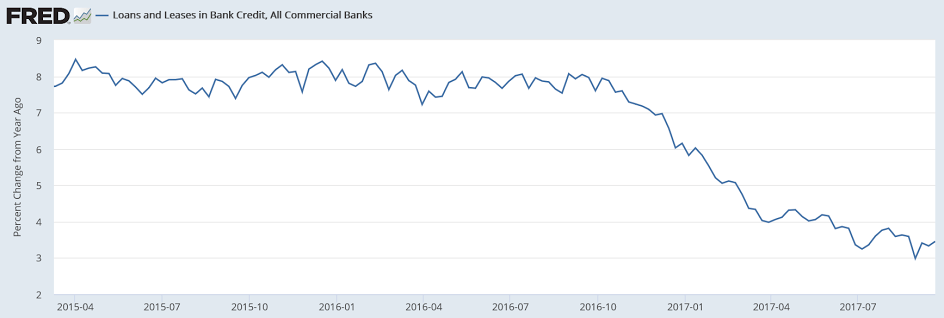

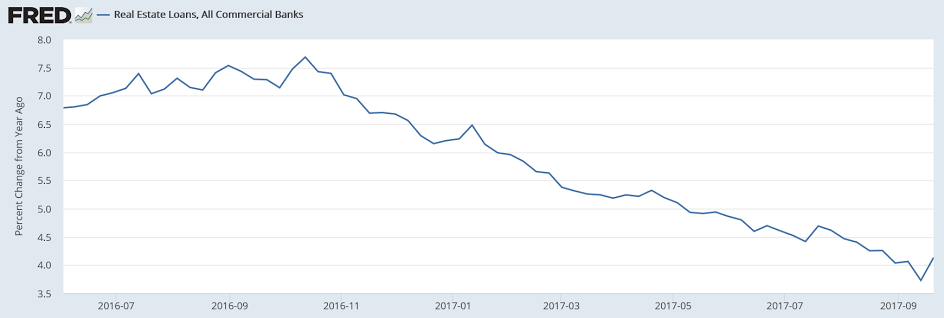

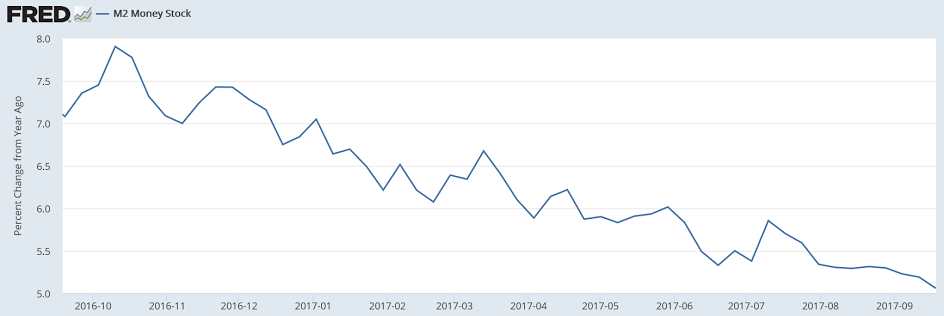

Loans create deposits, with M2 a partial measure of deposits, which can be altered by QE and other operating factors like cash in circulation. But those types of things have been largely quiet recently so M2 growth is currently a not terrible look at overall deposit growth:

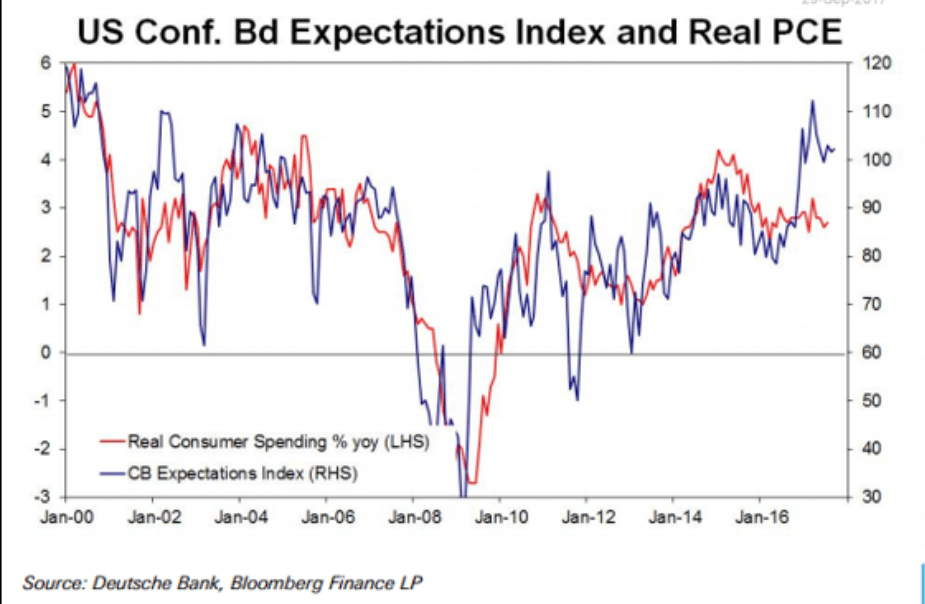

Trumped up expectations and surveys vs real spending, which has been weak:

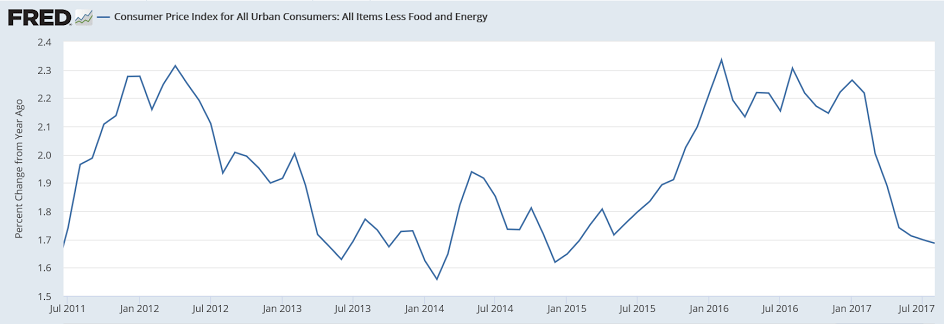

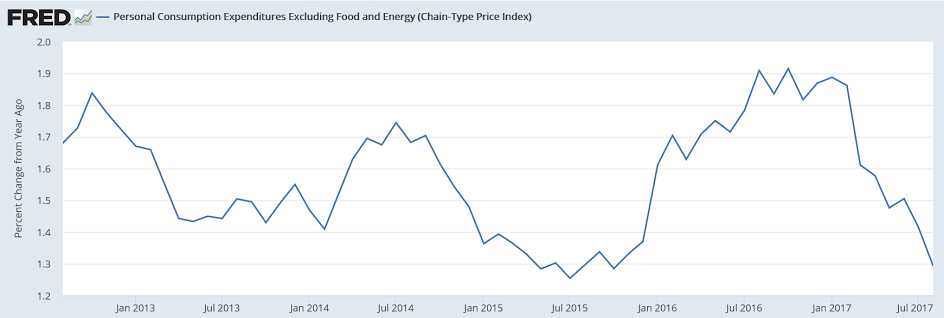

And what is called ‘inflation’ is also looking weak:

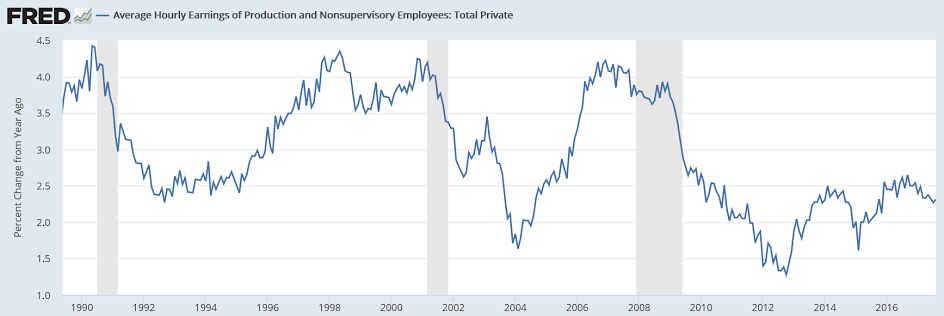

And wage growth remains at what are generally historic lows:

So the Fed sees all this, and indicates that they are leaning to another rate hike in December, as they continue to forecast increases in inflation that, after many years of similar forecasts, have yet to materialize. And they list every reason for the low inflation indicators, except for a lack of aggregate demand (low spending), when all of the above charts support a low demand story, as does all of the other weak data released last week- personal income, housing starts and sales, etc.

Presumably the Fed is raising rates to ‘remove accommodation’ which means they are trying to keep things that aren’t growing all that fast now from growing too fast in the future do to all

the ‘accommodation’ they believe they have embedded in the economy with low rates and qe.

The channel for Fed interest rate policy is credit- lower rates are presumed to encourage borrowing, while higher rates are presumed to discourage borrowing. And so to me the Fed looking at the deceleration of the growth of lending and of M2 as evidence the economy needs more rate hikes and the unwinding of QE doesn’t make sense?

Note how this Fed President is worried about the risk of the emergence of too much demand:

Boston Fed President Eric Rosengren on Wednesday came down on the side of further interest-rate hikes, saying they would be a form of insurance against the possibility of an overheated economy.

Current economic trends suggest an economy “that risks pushing past what is sustainable,” Rosengren said in a speech to The Money Marketeers of New York University. This could result in higher asset prices, or inflation well above the Fed’s 2% target, he warned.

“Steps lowering the probability of such an outcome seem advisable — in other words, seem like insurance worth taking out at this time,” he said.

“As a result, it is my view that regular and gradual removal of monetary accommodation seems appropriate,” he added.