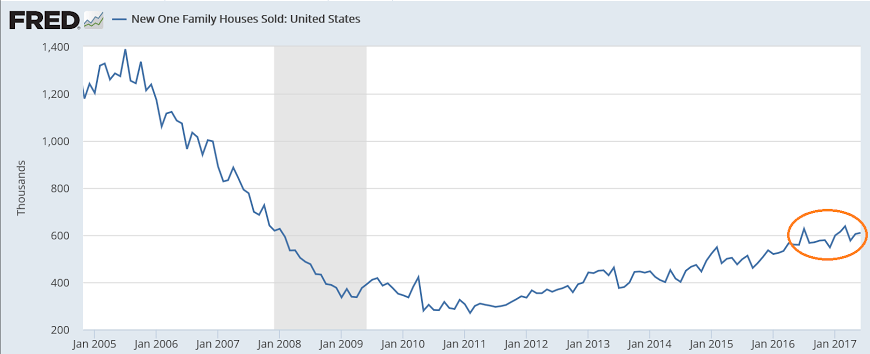

New homes aren’t built without permits, which have flattened as well, and are therefore not adding as much to growth:

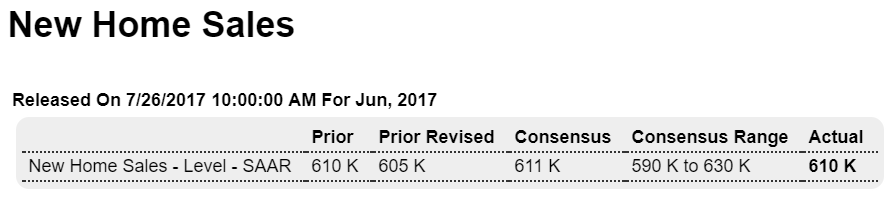

Highlights

New home sales are steady near the best levels of the expansion, at a 610,000 annualized rate in June. The 3-month average is 597,000 which is, however, noticeably below the first-quarter cycle peak of 617,000. This is a negative for second-quarter residential investment in Friday’s GDP report.

But the upshot of today’s report is mostly positive. Sales are very strong in the West which is a key region for new homes. Sales in the region rose 12.5 percent in the month to a 180,000 pace and are up 33 percent year-on-year. But sales in the South, another key region and the largest one, fell in June, down 6.1 percent to a 323,000 pace. June sales were up in the Midwest, at a 66,000 rate, and flat in the Northeast at 41,000.

Sales got a lift from lower prices in the month, down 4.2 percent for the median to a still imposing $310,800. Year-on-year, the median is down 3.4 percent and looks low compared to the 9.1 percent gain for on-year sales.

Supply offers limited good news, rising but only slightly at a 1.1 percent monthly gain to 272,000 units. Relative to sales, supply is steady at 5.4 months vs 5.3 and 5.5 in the prior two months.

New home sales at least didn’t move backwards as did Monday’s existing home sales data. Low mortgage rates and high levels of employment are important positives for the sector which, despite up-and-down readings since the Spring, is still a positive force for the economy.

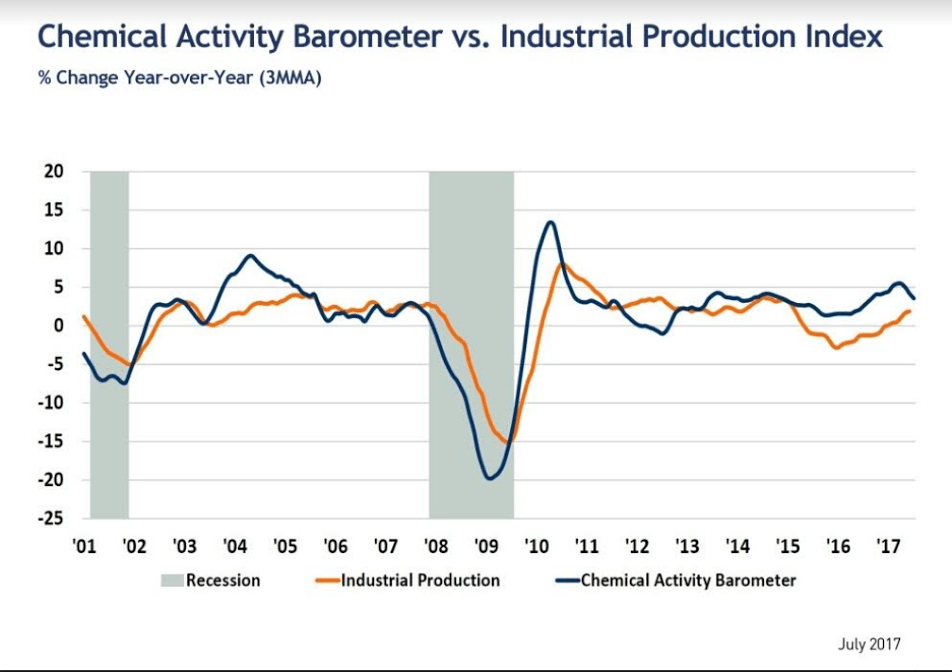

This tends to lead industrial production:

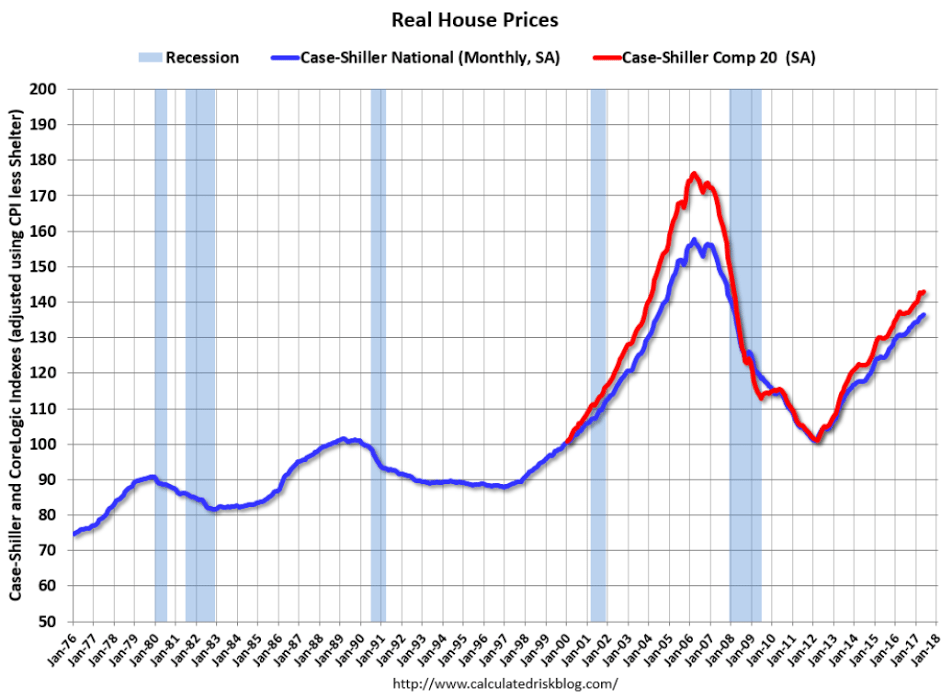

These house prices are inflation adjusted, and you can see they are still well below the prior peak: