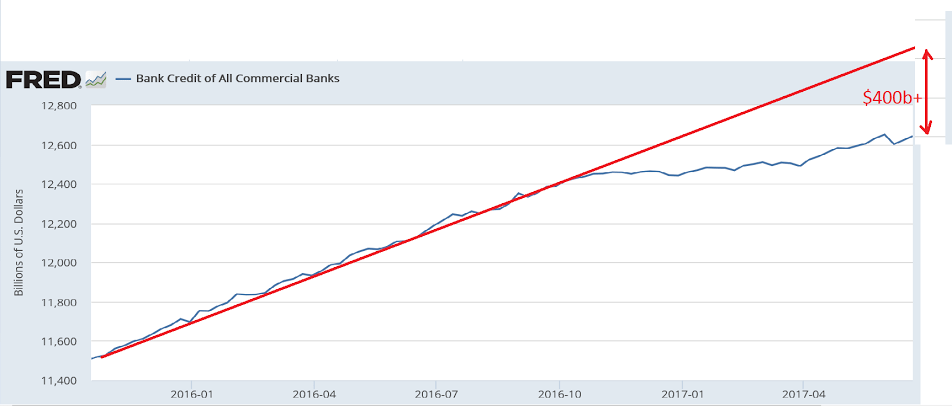

First, let’s look at total bank credit. On this chart you can see that the cumulative growth of bank credit is more than $400 billion less than it would have been if it hadn’t slowed down.

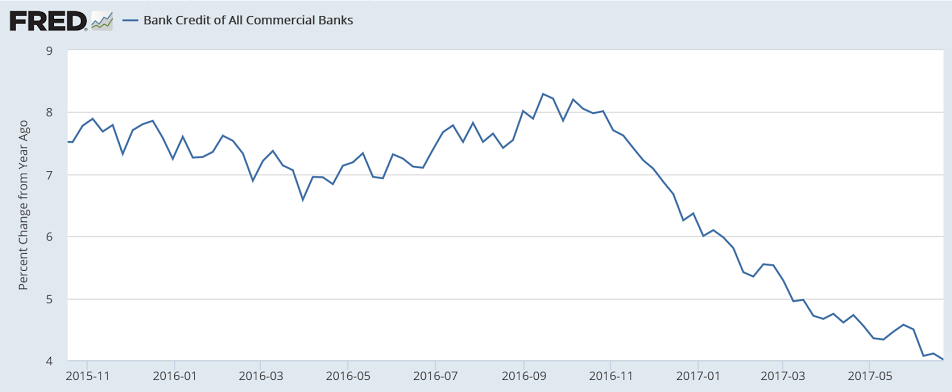

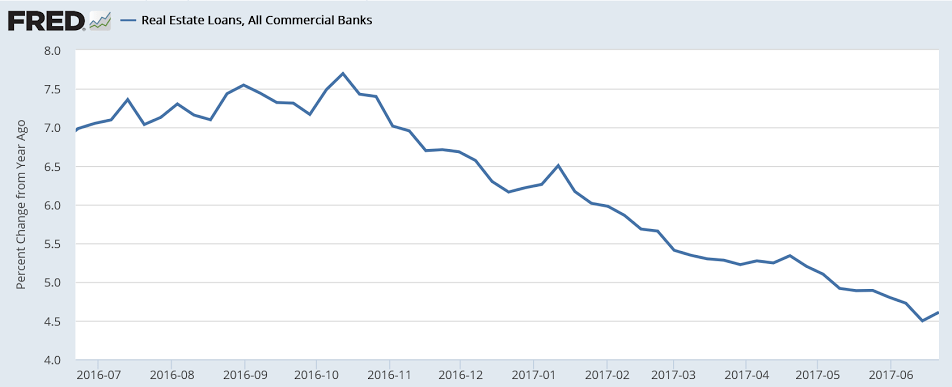

That is, last year’s economy was supported by that much more growth of bank credit than this year’s economy as the annual rate of growth has slowed from over 8% to about 4%:

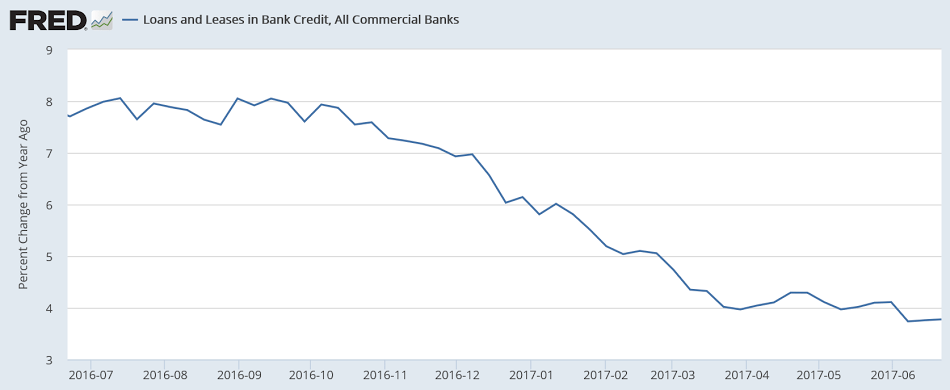

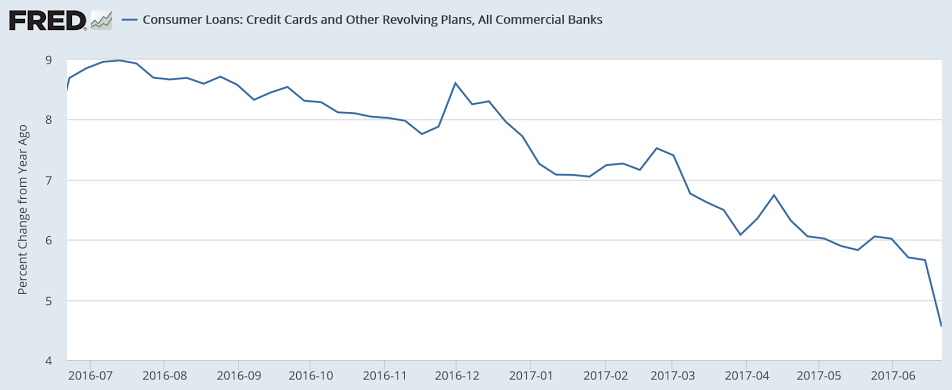

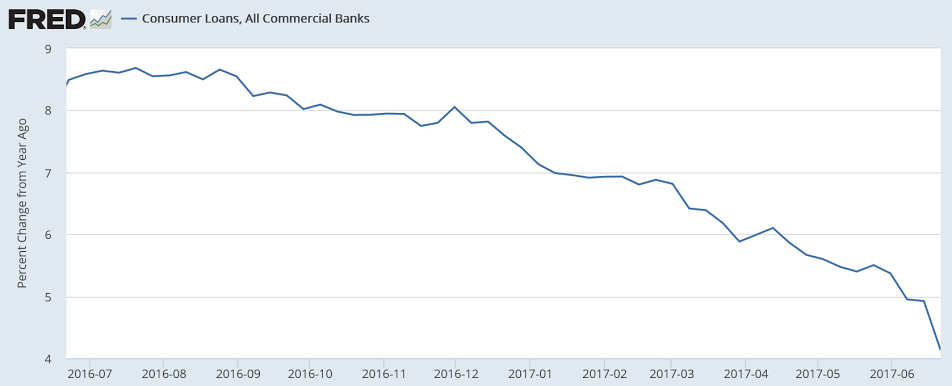

We’ve most recently had a few weeks of increase. A hopeful sign but the annual growth rate is still way down from last year:

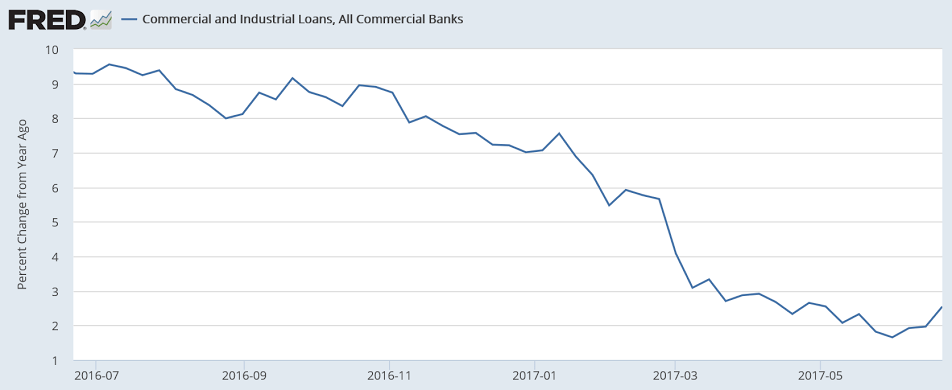

In line with the recent drop in consumer spending:

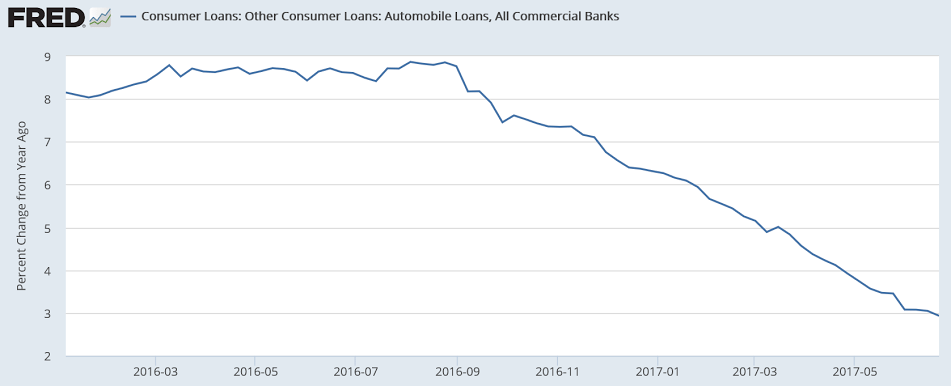

In line with the drop in new automobile sales:

Vehicle Sales Forecast: “Sixth Consecutive Decline in June”

The automakers will report June vehicle sales on Monday, July 3rd.

From Reuters: U.S. auto sales seen down 2 percent in June: JD Power and LMC

The seasonally adjusted annualized rate for the month will be 16.5 million vehicles, down nearly 2 percent from 16.8 million units in the same month in 2016.

On q1 GDP revisions:

Healthcare is Boosting GDP Growth

Summary and Commentary

This revision boosts the headline growth about a quarter percent to +1.42% — better but still tepid. The notable takeaways from this report are:

The largest upward revision was in consumer spending for healthcare and insurance.

The growth rate for consumer spending on goods remains anemic.

The inventory contraction worsened, possibly in anticipation of softer future consumer spending.

Foreign trade remained a bright spot and is not a drag on the headline number.

The US consumer may be spending more, but that increased spending is not on discretionary “life-style” goods.And as per usual, the Fed is once again projecting a return to “normalcy” in the form of 3% growth in future quarters — with consumer spending leading the way. But if this past quarter’s pattern persists those consumers may continue to face a toxic mix of stagnant disposable income, rising insurance costs and shrinking savings — not exactly a formula for happy campers.

Slowing revenues indicates economic weakness:

CBO Update to the Budget and Economic Outlook: 2017 to 2027

“The deficit estimated for 2017 is $693 billion, $134 billion more than CBO projected in January. Surprisingly weak tax collections since then have led the agency to lower its projection of revenues by $89 billion. At the same time, CBO raised its estimate of outlays by $45 billion, mainly because agencies have increased the estimated subsidy costs of past loans and loan guarantees, particularly for education and housing.”

“One reason for the sharp rise in the deficit in 2017 is the slow growth in revenue collections through May and the slow growth expected for the rest of the year: Revenues in 2017 are projected to rise only by about 1 percent as a result. That modest rate is below CBO’s estimate of growth in the economy, and thus revenues are expected to fall relative to GDP, from 17.8 percent in fiscal year 2016 to 17.3 percent this year”

‘It has to be something, but it could be infinity’: Trump ponders space in strange ceremony

“This is going to launch a whole new chapter for our great country,” Trump said near the end of his speech.

Then he sat down at a table and opened the executive order.

“I know what this is,” he said. “Space!”

Beside him, Aldrin chimed in with a quote from the astronaut character Buzz Lightyear from the movie “Toy Story.”

“Infinity and beyond!” Aldrin said.

Everyone laughed.

Then Trump added some lines of his own.

“This is infinity here,” he said. “It could be infinity. We don’t really don’t know. But it could be. It has to be something — but it could be infinity, right?”

Trump then signed the order and revived the National Space Council, leaving his final words on the subject a mystery.