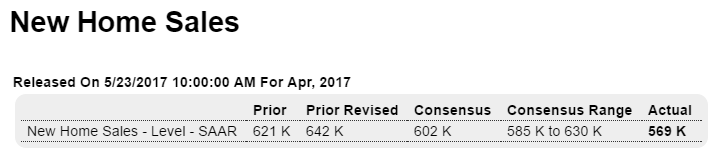

Seems to be slowing in line with the deceleration in mortgage lending previously discussed:

Highlights

In a mixed report that confirms a reputation for unusual volatility, new home sales swung 11.4 percent lower in April to a much lower-than-expected annualized rate of 569,000. The offset is a 40,000 upward revision to March and February, now at 642,000 and 607,000. Averages are essential to evaluate this report and here the news is clearly good, at a 3-month average of 606,000 and just down from March’s expansion high at 611,000.

But the most recent news for April isn’t so good. Sales slowed even as builders cut prices where the median fell 3.0 percent in the month to $309,200. Year-on-year, the median is down 3.8 percent and is roughly in line with sales which are up only 0.5 percent on the year.

New supply came into the market but not very much, at 268,000 units for a 4,000 increase. On a monthly sales basis, supply jumped to 5.7 months from 4.9 months to reflect April’s sharp sales decline.

April was a bad month for all regions especially the West which at a 126,000 sales rate fell 26 percent in the month. Year-on-year, the Midwest is at 73,000 and is far out in front with a 20 percent gain followed by the South at 4.1 percent. The Northeast is down 5.1 percent on the year with the West, in an ominous reading perhaps given the region’s importance to builders, down 13.7 percent.

One month is never enough to judge new home sales which eases the negative signals from April. But the report does follow last week’s housing starts which also showed significant April weakness. Watch for existing home sales on tomorrow’s calendar for an additional and very important indication on April for a housing sector that opened the year strongly but may be seeing unwanted slowing during the Spring selling season.

Gets stupider by the day, as the confusion over how the currency works continues to undermine

underlying public purpose, including national security:

U.S. plan to sell oil reserve shows declining import needs

By Henning Gloystein and Dmitry Zhdannikov

May 23 (Reuters) — U.S. President Donald Trump’s proposal to sell half of the United States’ strategic oil reserve surprised energy markets on Tuesday since it counters OPEC’s efforts to control supply in order to boost prices.

The White House requested in its budget released late on Monday gradually selling off the nation’s Strategic Petroleum Reserve (SPR) starting in October 2018 to raise $16.5 billion. The U.S. SPR SPR-STK-T-EIA holds 688 million barrels, making it the world’s largest reserve, and a release of half over 10 years averages about 95,000 barrels per day (bpd), or 1 percent of current U.S. output.

Others taking notice now:

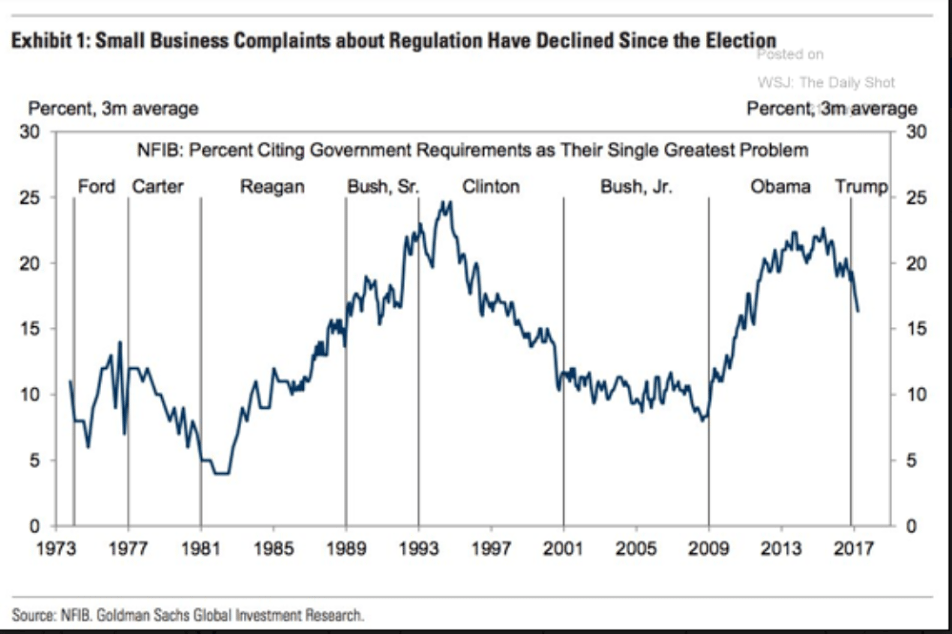

Tells me how seriously you can take some of these surveys: