This looks like a large part of the ‘portfolio shifting’ that’s been going on out of a variety of ‘fears’. And it is my suspicion that those who are shifting euro assets to other currencies largely have euro liabilities to fund over time. This means they are getting themselves ‘out of balance’ which is another way to say they have gone ‘short euro’ and at some point will be back to cover:

Record Capital Outflows Push Euro Toward Parity With Dollar

By Mike Bird

Dec 21 (WSJ) — More money has left eurozone financial markets this year than at any time in the bloc’s history, helping drive the euro toward parity with the dollar for the first time in 14 years. The eurozone had its largest-ever net outflows in the 12 months to September, data from the European Central Bank showed. Eurozone investors bought €497.5 billion ($516.5 billion) of financial assets outside the bloc in that period. Global investors, meanwhile, sold or let mature €31.3 billion of eurozone assets during the year. Together, that adds up to a net outflow of €528.8 billion, the most since the single currency was introduced in 1999.

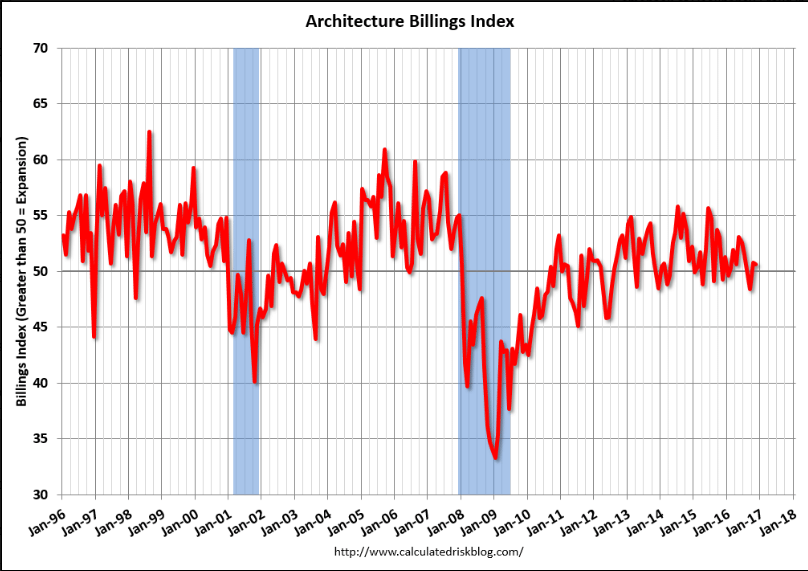

Still indicating recession type levels:

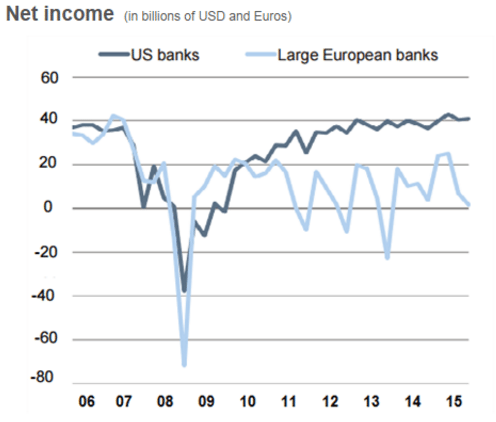

US bank income has been relatively flat, though positive and a source of at least some capital growth: