This is persistent, strong euro medicine that ‘absorbs’ the portfolio selling that’s been going on for over 2 years. And the lack of inflation and tight fiscal policy tell me it will persist until currencies adjust sufficiently to shift the balance:

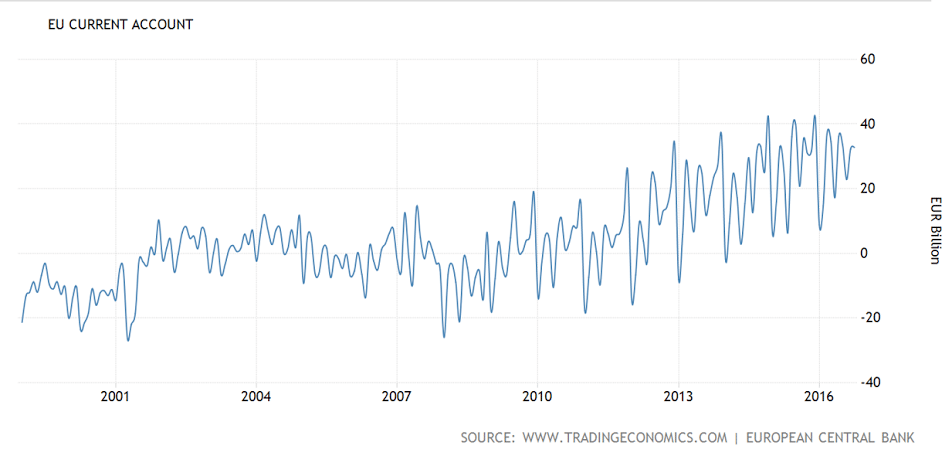

Euro Area Current Account

Eurozone’s current account surplus rose to €32.8 billion in October 2016 from €30.9 billion in the same month a year earlier. The services surplus widened to €8.2 billion (from €2.4 billion a year earlier) and the primary income surplus increased to €8.8 billion (from €4.6 billion). Meanwhile, the goods surplus narrowed to €27.0 billion (from €33.7 billion in the previous year) and the secondary income deficit went up to €11.2 billion (from €9.8 billion). If adjusted for seasonal factors, the current account surplus rose to €28.4 billion compared to €24 billion in October 2015.

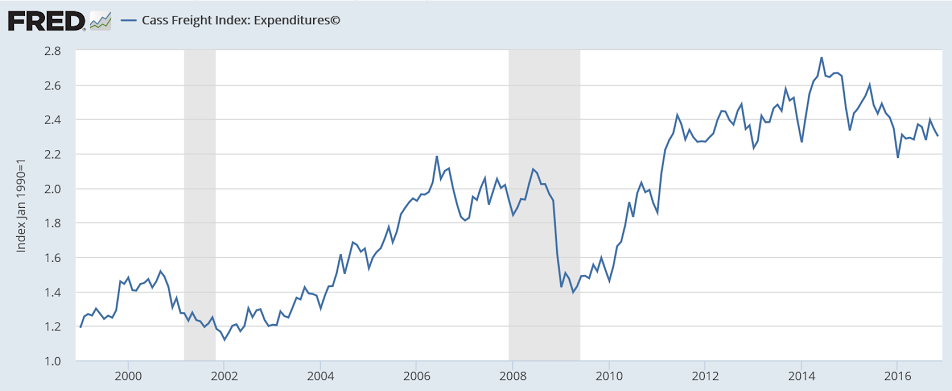

Another indicator that shows the US could have already gone into recession:

GDP forecast revised lower:

December 16, 2016: Highlights

The FRBNY Staff Nowcast stands at 1.8% for 2016:Q4 and 1.7% for 2017:Q1. This week’s news had a negative effect on the nowcast, pushing down the Q4 and Q1 measures by about 0.7 percentage point each. The largest negative contributions came from capacity utilization and industrial production data as well as housing data, which were only partly offset by a positive contribution from survey data. Border Adjustability: The House Republican Blueprint proposes to convert the corporate income tax into a destination-based cash flow taxation system that would ‘border adjust’ by not taxing revenues from exports and disallowing deductions for the cost of imports. The economic effects of such a policy are similar to an export subsidy combined with an import tariff of equal size.