Tough to give this a positive spin…

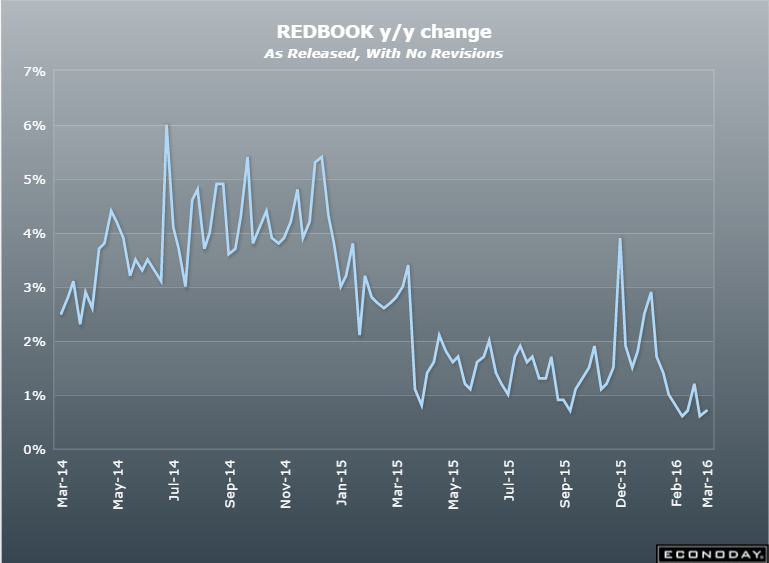

And note the downward slope of the chart, as weakness continues to spread from oil capex to the rest of the economy:

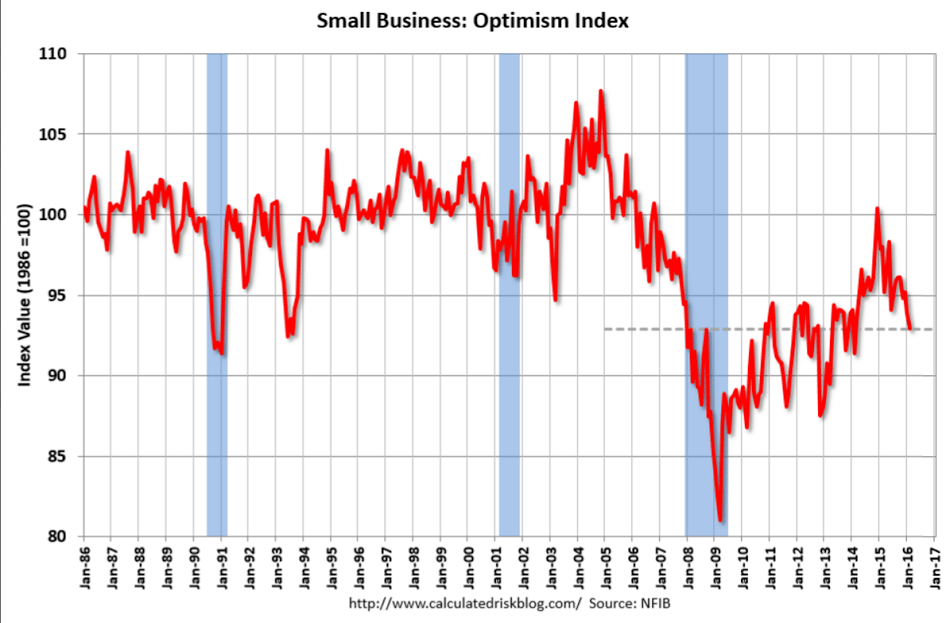

NFIB Small Business Optimism Index

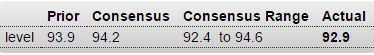

Highlights

The small business optimism index slipped 1 point in February to 92.9, a 2-year low that reflects incremental declines across six of 10 components. The report’s two employment components both inched 1 point lower with plans to increase employment still at a positive reading of 10 and job openings hard to fill still at a very strong 28 which leads all components. Earnings trends, however, are very weak, down 3 points to minus 21 and reflecting what the report cites as higher labor costs that are not being passed through to selling prices. Sales expectations also fell 3 points but are doing better than earnings which are at the zero level. Weak earnings and sales are negatives for business investment with plans for capital outlays and expansion intentions both down 2 points but with both readings still strongly positive at 23 and 8 respectively. Underlying strength for business investment and employment, however, is not likely to hold up for very long given weakness in earnings and sales.

Below levels of the prior recession: