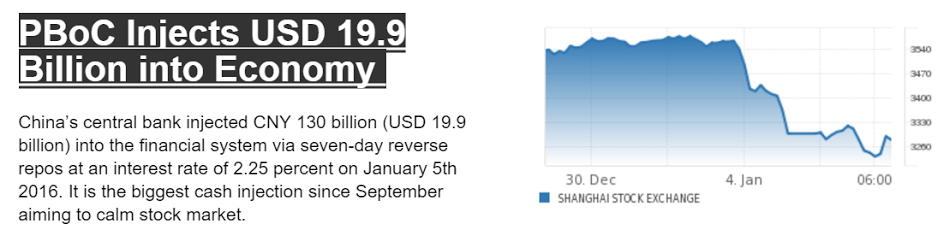

This does nothing apart from supporting their policy rate:

Port Traffic Grew at Slowest Rate Since Recession in 2015

Container traffic rose only 0.8% last year at the 30 busiest ports worldwide, the smallest increase since 2009, according to an estimate by Alphaliner

By Robbie Whelan

Jan 4 (WSJ) — Container traffic at the world’s busiest ports grew last year at its slowest rate since the recession, according to an estimate by Alphaliner, a shipping industry data provider.

Demand was held back by a lack of “peak season,” the months heading into the holidays when manufacturers normally ship large quantities of goods to retailers globally. This year, traffic in the top 30 ports sank 0.9% in the third quarter, the first decline over those months since 2009, Alphaliner said.

For the full year, Alphaliner projects container traffic rose 0.8%, the smallest increase since 2009. Weak demand has left carriers struggling to find customers to fill their ships, even as new vessels hit the seas at a record pace. Last year, ships with a combined capacity of 1.7 million twenty-foot containers entered the global fleet. To combat the lower ocean freight rates resulting from excess capacity, ship owners and operators have idled more than 1.3 million TEUs of capacity.

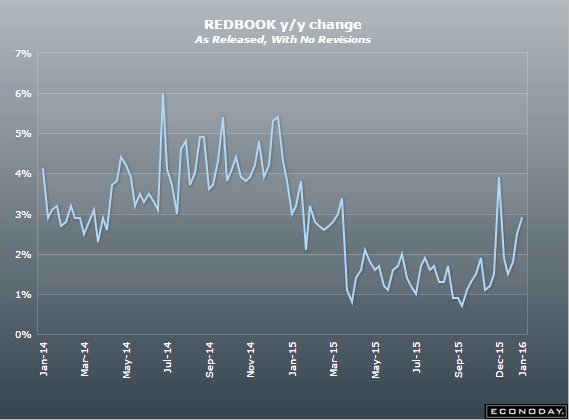

Doing better as year over year comps get easier:

The Big Three are in and December sales are running below expectations down about 5 percent from November vs expectations for a 1 to 2 percent decline. Car sales are especially weak with sales of light trucks down only slightly. The Big Three account for roughly half of all sales. Foreign brands will be posting their results through the session.