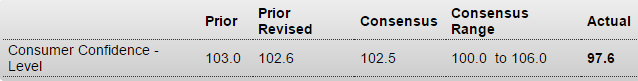

A lot less than expected based on jobs assessment, and note the drop in car buying plans:

United States : Consumer Confidence

Highlights

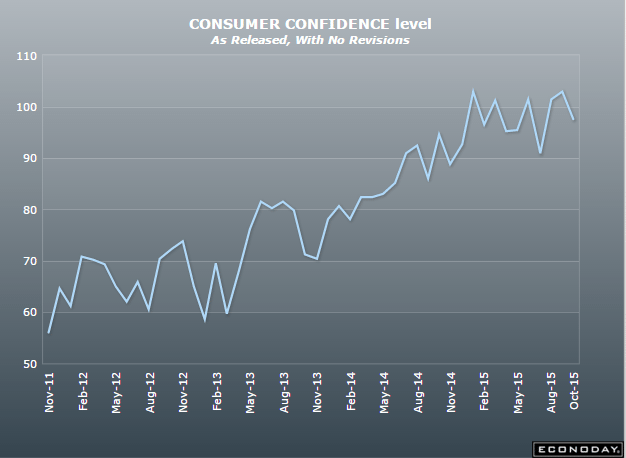

A decline in the assessment of the current jobs market pulled down the consumer confidence index to a lower-than-expected 97.6 in October. This is about 2.4 points below Econoday’s low-end forecast and 5.0 points below a revised September.

Consumers are saying there are fewer jobs available then there were in September and more say jobs are hard to get. But the latter reading, at 25.8 percent, is still low and consistent with low rates of unemployment. Still, these readings are weaker than September and helped pull down the present situation component by a sizable 8.2 points to 112.1.

The six-month outlook shows much less monthly weakness compared to September with the component down 2.8 points to 88.0. Buying plans are mixed with cars down but both houses and appliances up. Inflation expectations are steady at 5.1 percent which is moderate for this reading.

Jobs are at the heart of consumer confidence and today’s report will limit expectations for strength in the October employment report. This report may also limit expectations for retail sales in October including, based on buying plans, sales of vehicles.

United States : Richmond Fed Manufacturing Index

Highlights

The Richmond Fed makes it five for five, that is five regional Fed reports all showing negative headlines for October. The Richmond Fed index did improve, however, to minus 1 from September’s minus 5. New orders came in at zero following the prior month’s steep contraction of minus 12. But backlog orders, at minus 7, are down for a third month which is not a plus for future shipments or employment. Shipments in October fell to minus 4 from minus 3 which is also a third month of contraction. Hiring is still positive, unchanged at plus 3, but continued growth here is uncertain. Price data are mute with prices received showing slight contraction as they are in other reports. This morning’s report on durable goods orders showed another month of broad weakness in September and this report, together with the other regional reports, point to another weak month for the factory sector in October.

United States : PMI Services Flash

Highlights

Growth in the nation’s service sector is solid but a little slower this month than in September. The services PMI flash for October came in at 54.4 for the slowest rate of growth since the severe weather of January. The report cites a third straight slowdown in new business which is also at its weakest point since January. Though the service sector is insulated to a degree from foreign effects, the report does note that less favorable global conditions are making customers less willing to spend.

Backlogs are down for a third month which is the worst run in two years and hiring has slowed to the weakest level since February. The outlook, though still favorable, is near a three-year low. Price data show little change for inputs and only a fractional gain for prices charged. This report fits in with the general soft tone of economic data, softness that will perhaps be a key focus of tomorrow’s FOMC statement.