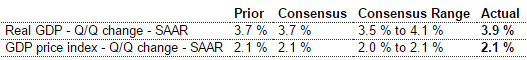

Revised up, but same story as previously discussed, with several volatile series moving up and likely to revert at least that much in Q3 when reported late October:

GDP

Highlights

Personal spending was stronger than thought in the second quarter, helping to drive real GDP to a very solid 3.9 percent annualized rate. Boosted by the consumer, final sales also rose 3.9 percent for a 4 tenths upward revision.

Personal consumption expenditures were revised 5 tenths higher to 3.6 percent as the service spending component, reflecting strength in travel, was revised 7 tenths higher to 2.7 percent. Revisions to goods spending were mixed with durables down 2 tenths to a vehicle-led surge of 8.0 percent with nondurables up 2 tenths to 4.3 percent. Consumer strength is also evident in a 1.5 percentage point upward revision to residential fixed investment, now at 9.3 percent.

But businesses also contributed to the quarter’s growth as nonresidential fixed investment, driven by structures, is revised 9 tenths higher to 4.1 percent. Another plus in the report is a downward revision to inventory growth.

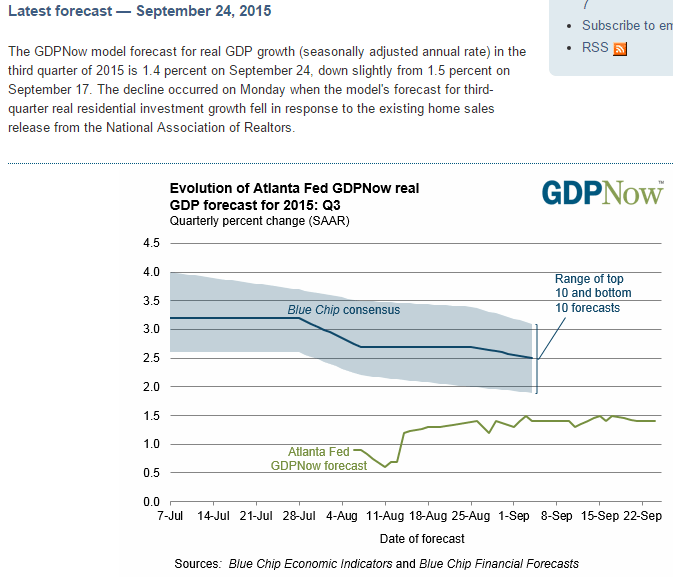

The second quarter managed in the end to meet what were tough expectations for a big bounce from the transitory factors of the first quarter when growth came in at only 0.6 percent. The outlook for the third quarter, however, is so far subdued, at roughly the 2 percent area.

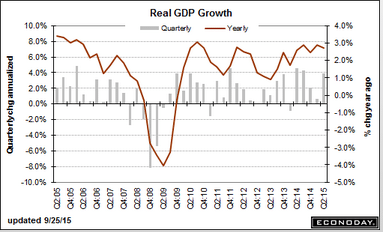

Q3 forecast revised down a tenth:

Atlanta Fed revises its Q3 forecast down a tenth:

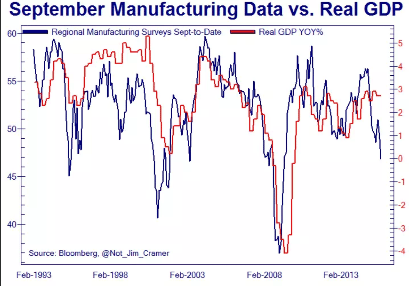

Interesting chart:

Corps are borrowing to buy each other’s debt, not to invest, seems, so net credit expansion for sector not as high as some suggest?

Big Buyers of Corporate Debt Are Other Corporations

(WSJ) — Companies reaching for better returns on their cash have found a new favorite investment—other companies’ bonds—and they are loading up. More than half of corporate cash held by U.S. companies this August was invested in investment-grade corporate bonds, a record, according to investment-software company Clearwater Analytics. Meanwhile, treasurers have reduced their companies’ holdings of more traditional investments such as U.S. Treasurys, commercial paper and bank certificates of deposit.

Rail Week Ending 19 September 2015: Year-over-Year Trends Continue to Degrade

Week 37 of 2015 shows same week total rail traffic (from same week one year ago) declined according to the Association of American Railroads (AAR) traffic data. Intermodal traffic insignificantly expanded year-over-year, which accounts for approximately half of movements. but weekly railcar counts continued in contraction. This cannot be a positive data point for the USA economically.