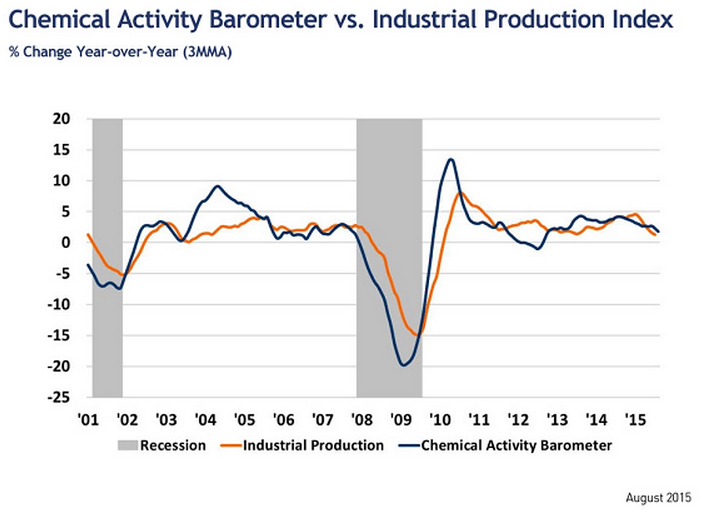

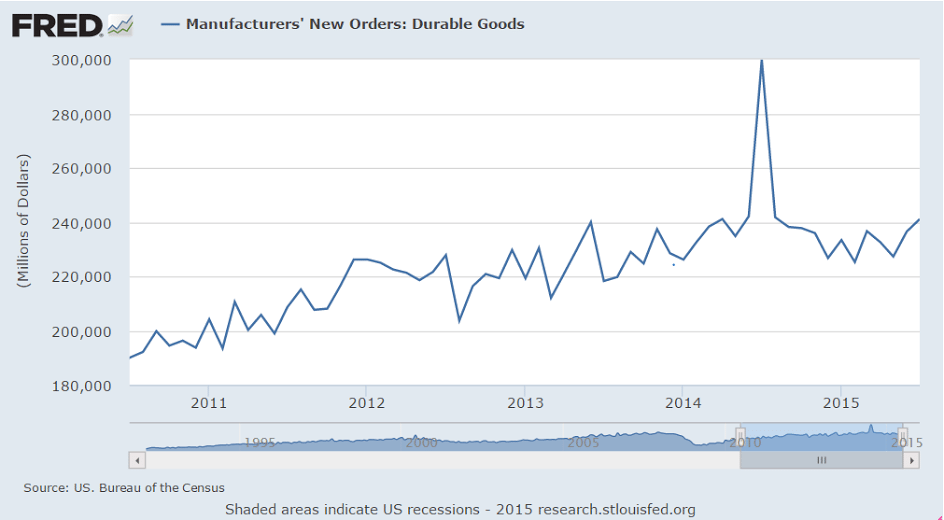

Sagging along with industrial production:

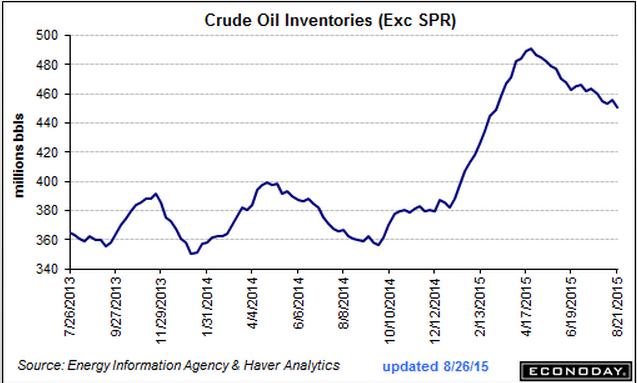

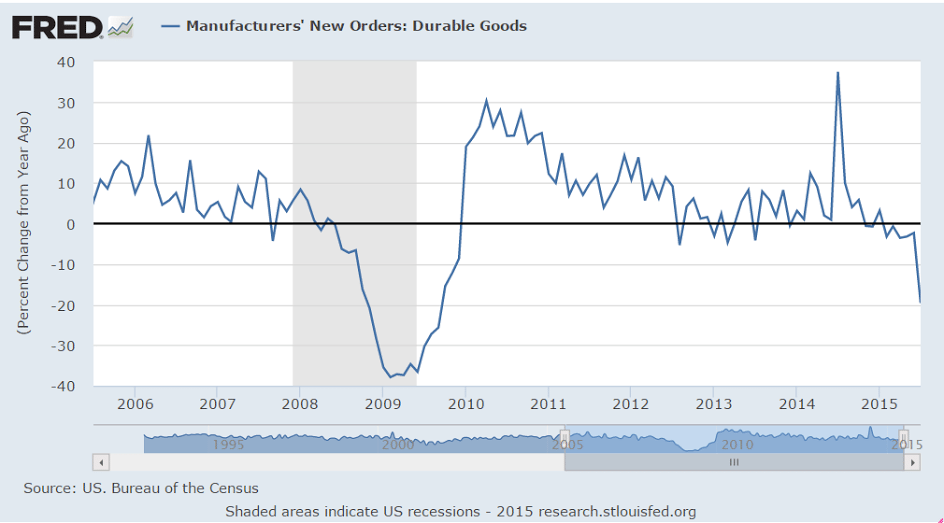

Better than expected which is nice, but nothing to get excited about. Durable goods tend to chug along at 3 or 4% pretty much regardless of what else happens. But this time they’ve been disrupted to the downside by the oil capex collapse. And note the large year over year drop is due to the comp with last year’s spike from aircraft orders and should reverse next month, but the trend remains weak:

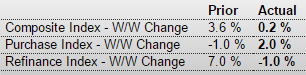

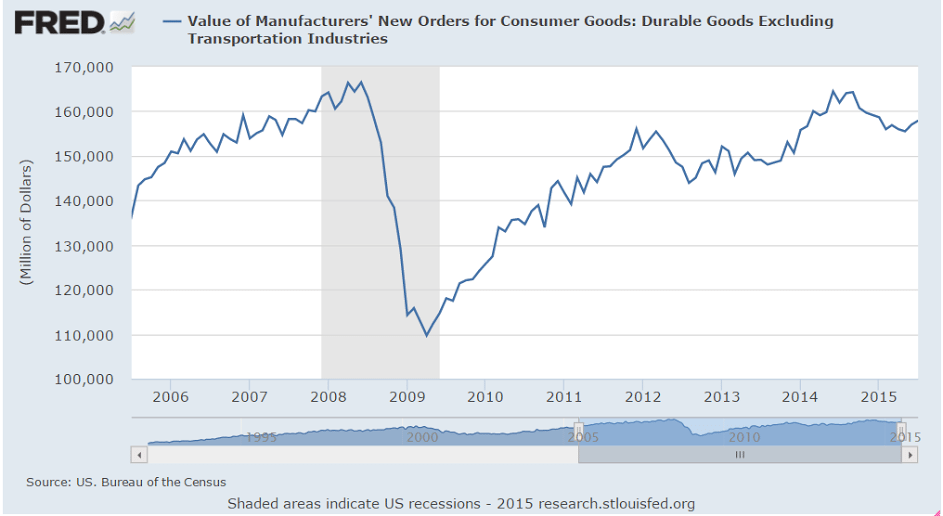

Still up from last year, but more recently this year it’s been going sideways at best, and remains severely depressed:

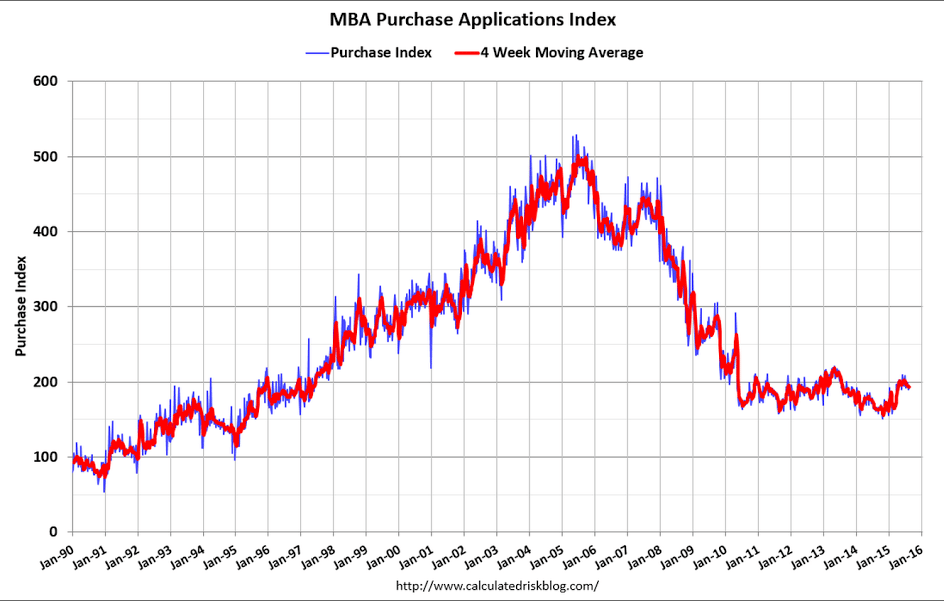

Looks to me like increased demand and falling domestic production are doing their thing to cause WTI to converge with Brent as well as increase US imports over time:

United States : EIA Petroleum Status Report

Highlights

A dip in imports made for a 5.5 million barrel draw in weekly oil inventories to 450.8 million. Gasoline and distillate inventories both rose, up 1.7 million and 1.4 million respectively. Demand indications for gasoline are very strong, up a year-on-year 5.8 percent. WTI bounced 50 cents higher to $39.75 in immediate reaction to the headline draw in oil before quickly easing back to $39.25.