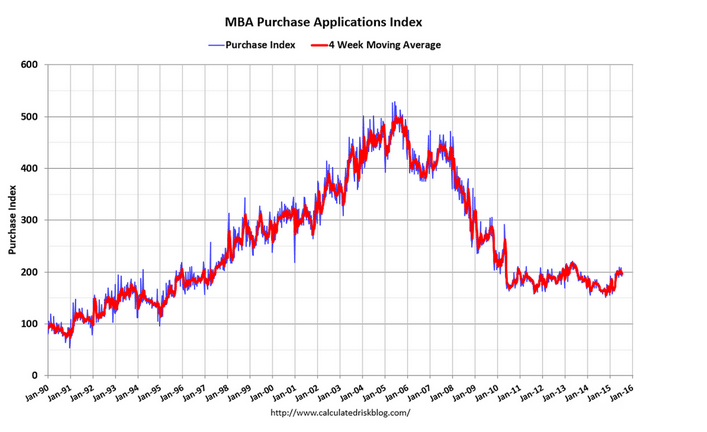

Confirms other indicators of housing a bit volatile but still depressed and going nowhere:

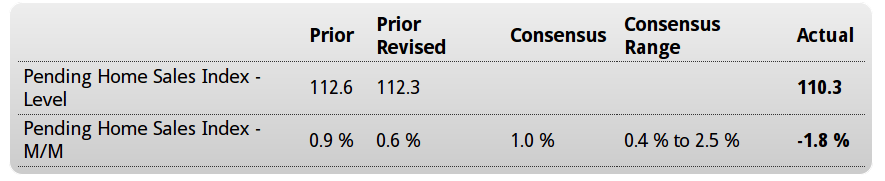

Pending Home Sales Index

Highlights

In a negative for the summer home-sale outlook, pending sales of existing homes fell a sharp 1.8 percent in June. The low-end Econoday forecast was for a gain of 0.4 percent. The year-on-year rate slowed from the low double digits to plus 8.2 percent, which is very respectable but slightly lower than the trend for final sales of existing homes.

Weakness was centered in the South and the Midwest where year-on-year pending sales are on the soft side, at plus 7.8 percent and 5.0 percent respectively. Both the West and Northeast posted small monthly gains in June with year-on-year sales rates at plus 10.4 percent and with the Northeast, the smallest region for home sales, in the top spot at 12.0 percent.

This report is the latest to take the edge off the housing outlook which had been rising sharply following weakness early in the year. Strength in housing may contribute less than expected to the second-half economy.

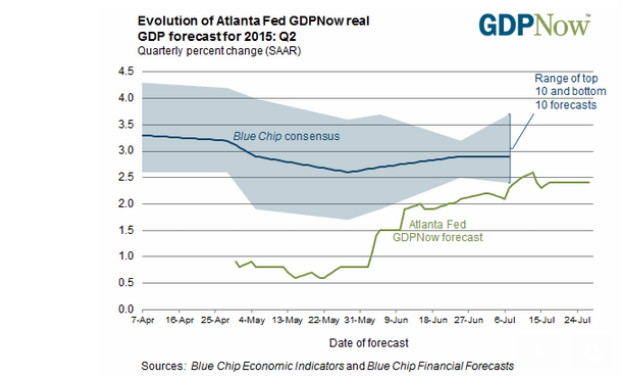

At 2.4%, the Atlanta Fed’s model is below most all mainstream forecasters of tomorrows initial govt. estimate for Q2 GDP. A weak number wouldn’t surprise me, but in any case I expect downward revisions as June trade and inventory numbers are released, and as past releases are revised lower as well. The problem is nothing has stepped up to replace the lost oil capex, both domestically which is a direct loss to US sales and output, and internationally which is cutting into US exports.

Latest forecast — July 27, 2015

Mortgage purchase apps have held relative steady and at historically depressed levels after a brief dip earlier this year. They are higher than last year, but there are also fewer all cash purchases and therefore more mortgage financed purchases for an given number of sales.

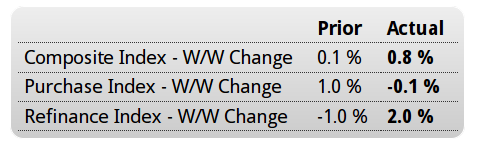

MBA Mortgage Applications

Highlights

The purchase index was little changed in the latest week, up 0.1 percent, but continues to trend much higher than a year ago, up 18 percent. The refinance index rose 2.0 percent in the week. Rates moved lower with the average 30-year mortgage for conforming loans ($417,000 or less) down 6 basis points to 4.17 percent.