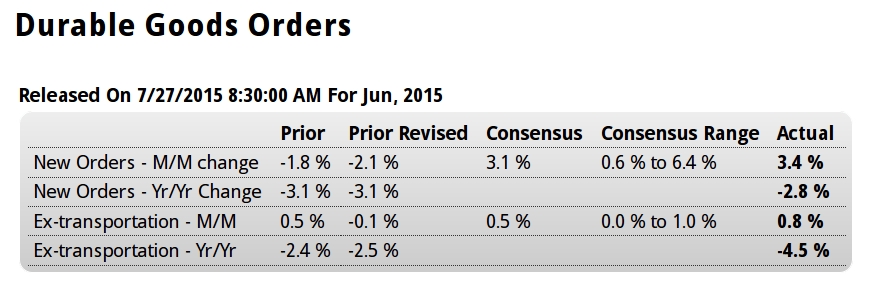

Note how they blame the dollar for the drop in exports rather than the oil price drop

which removed $ income from foreign producers, thereby reducing their ability to buy US goods and services.

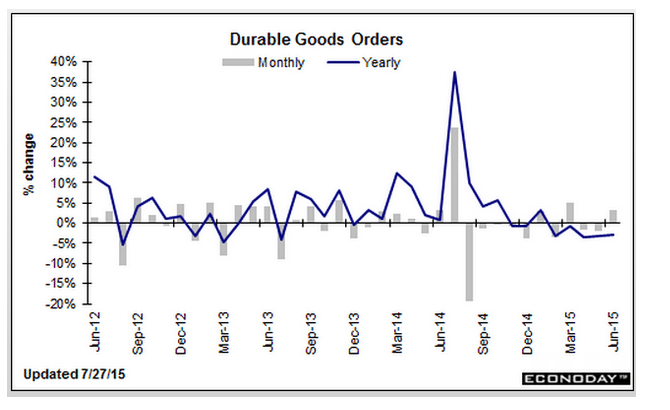

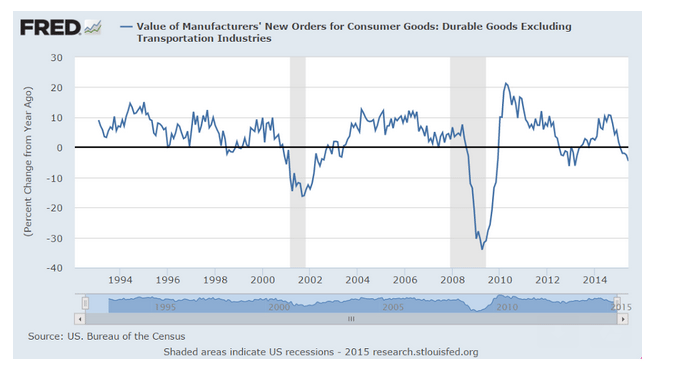

And notice the year over year chart remains negative.

source: Econoday.com

Highlights

June was a strong month for durable goods orders which rose a slightly higher-than-expected 3.4 percent. Excluding transportation, which is where aircraft orders are tracked, new orders rose 0.8 percent which is near top-end expectations. Core capital goods orders, which also exclude aircraft, rose a very solid 0.9 percent. These readings are some of the highest of the last year and offer welcome evidence of a long awaited pop higher for what is, however, a still depressed factory sector.

Turning briefly to civilian aircraft, orders surged 103 percent after falling 46 percent in May. Swings in aircraft are common in this report and reflect monthly swings in Boeing orders. Other industries include a small gain for motor vehicles and for computers & electronics as well as large gains for machinery and fabricated metals. In a hint of strength for the construction sector, electrical equipment jumped an especially sharp 2.8 percent in the month.

Turning back to totals, shipments inched 0.1 percent higher with shipments of core capital goods edging 0.1 percent lower and including downward revisions to both May and April. The shipment readings for capital goods will not be lifting second-quarter GDP estimates for business investment. Unfilled orders ended two months of contraction with a 0.1 percent gain while inventories rose 0.4 percent, a modest build that keeps the stock-to-sales ratio unchanged at 1.68.

This is only the third monthly gain for durable goods orders going all the way back to July, which was before of course the drop in oil prices and rise in the value of the dollar, the former having torpedoed the energy sector and the second having flattened the nation’s exports. Today’s report will confirm for many expectations that the negative effects of the strong dollar on exports are beginning to ease.

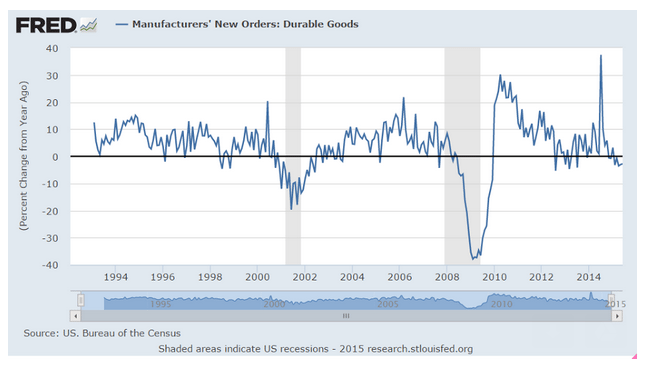

The longer term chart shows how this type of decline is most often associated with recessions:

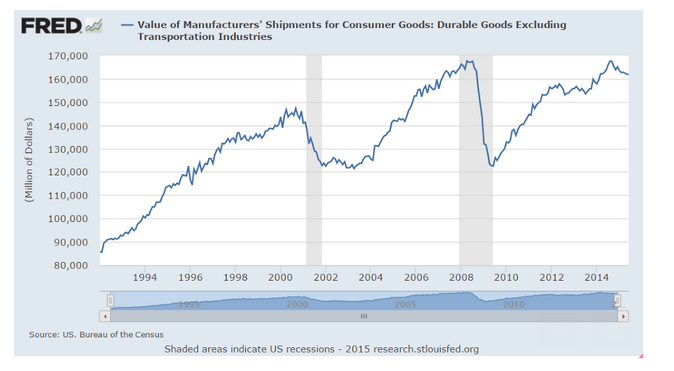

You can also see the last run up was caused by the last burst of oil exploration chasing $100 oil, and now we are back in the soup:

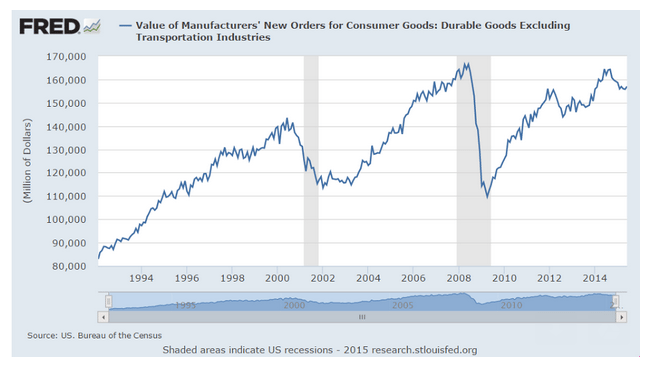

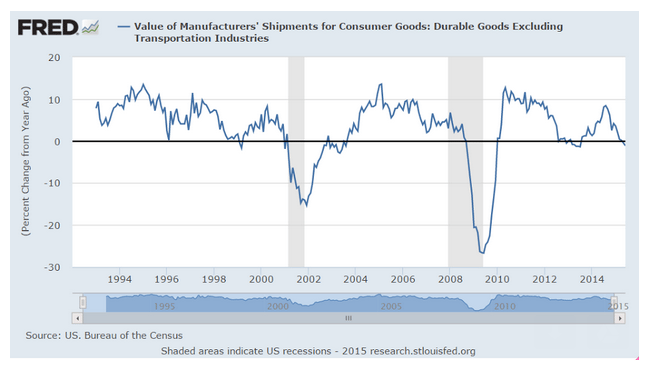

Actual shipments of consumer goods negative year over year:

Nothing good here, and note the attempt at cheer leading:

source: Econoday.com

Highlights

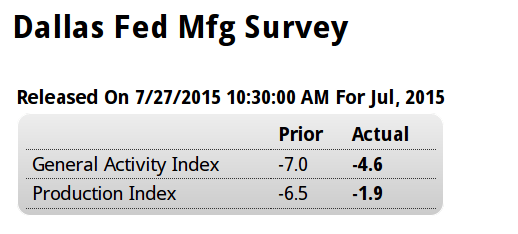

Contraction in the Texas manufacturing sector continues to ease, to minus 4.6 in July vs minus 7.0 in June and minus 20.8 May. For the first time this year, new orders actually rose in the month but only slightly, up 0.7. Unfilled orders, however, remain in contraction for an eighth straight month at minus 6.5. Lack of unfilled orders is not good for employment which is in the negative column for a third straight month at minus 3.3.

Among other readings, production, at minus 1.9, is in contraction for a fifth straight month while shipments, at minus 4.3, are in contraction for a sixth straight month. Inventories are up and price readings are mute. In a positive, the company outlook, at plus 1.2, is in the positive column for the first time this year.

Nowhere has the crunch in the energy sector been more evident than in this report. Hopefully, however, the negative effects from the prior plunge in oil prices are, as the Federal Reserve expects, beginning to ease.