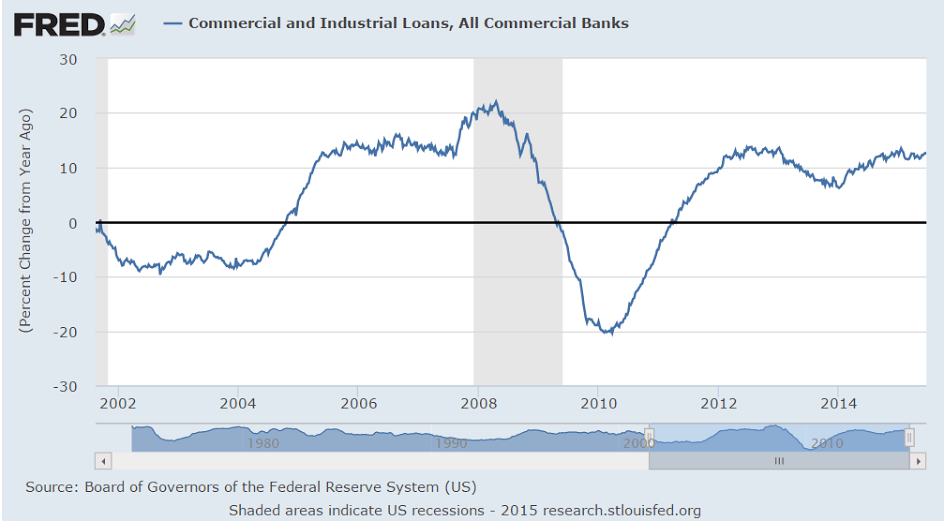

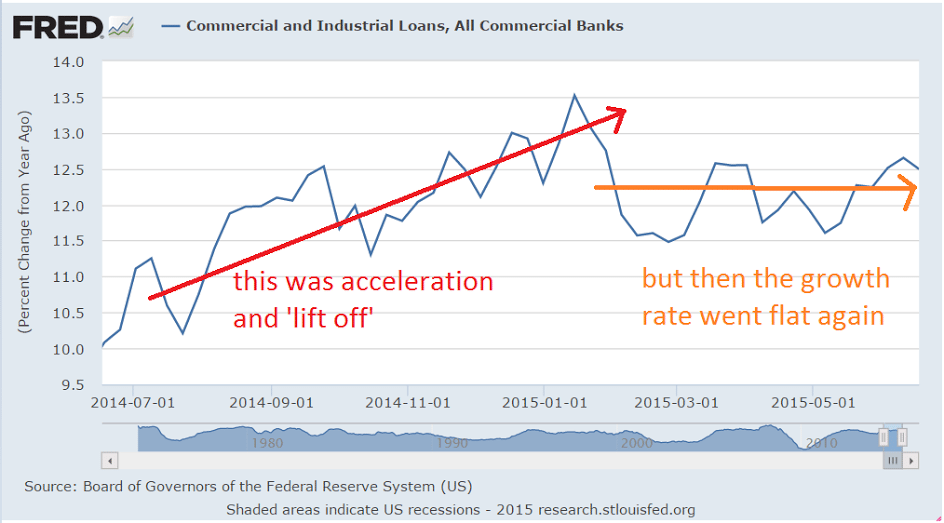

Yes, and the rate of growth is lower than the last cycle, and steady to lower, not ‘accelerating’, and in any case note that it jumped up going into the last recession.

And commercial paper isn’t growing as was the case in the last cycle, so that element of total credit remains flat and depressed.

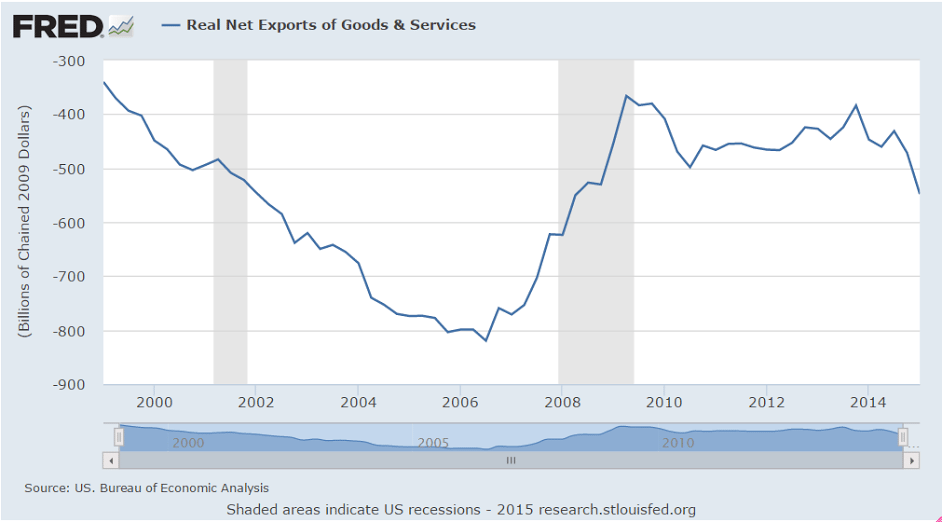

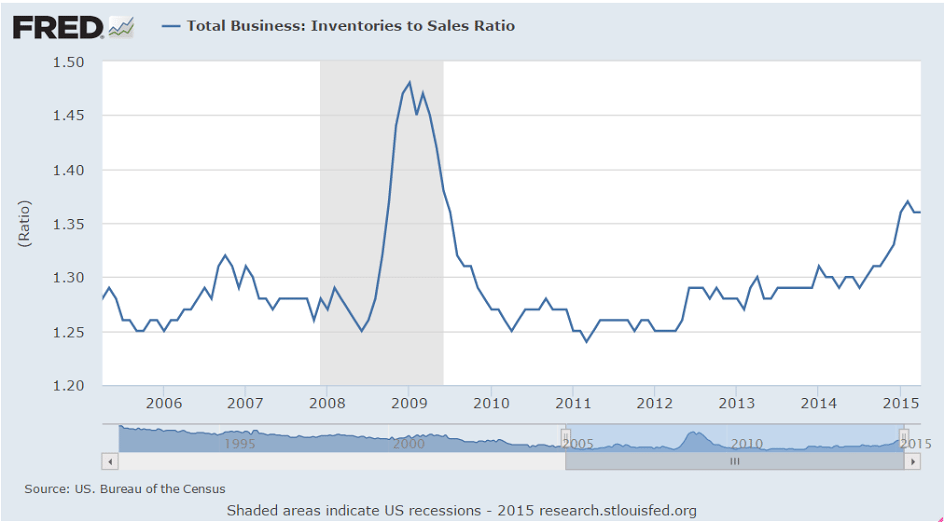

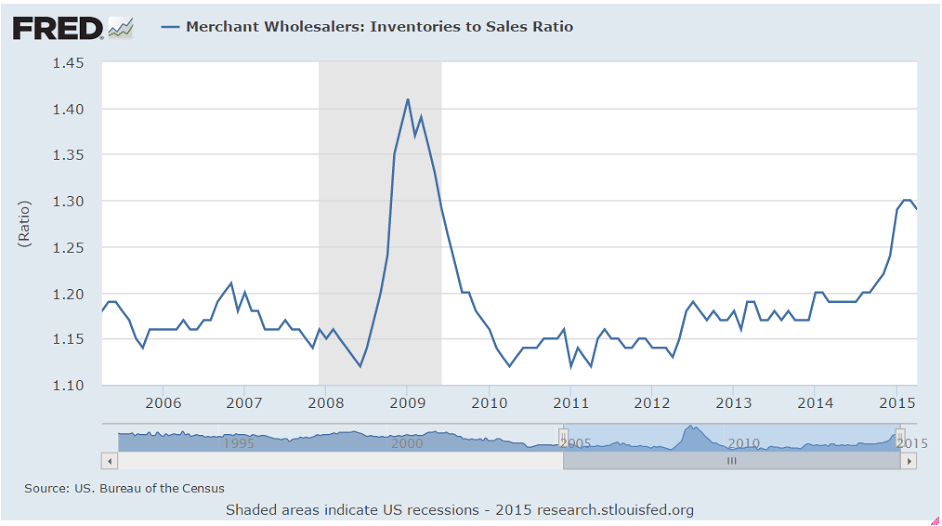

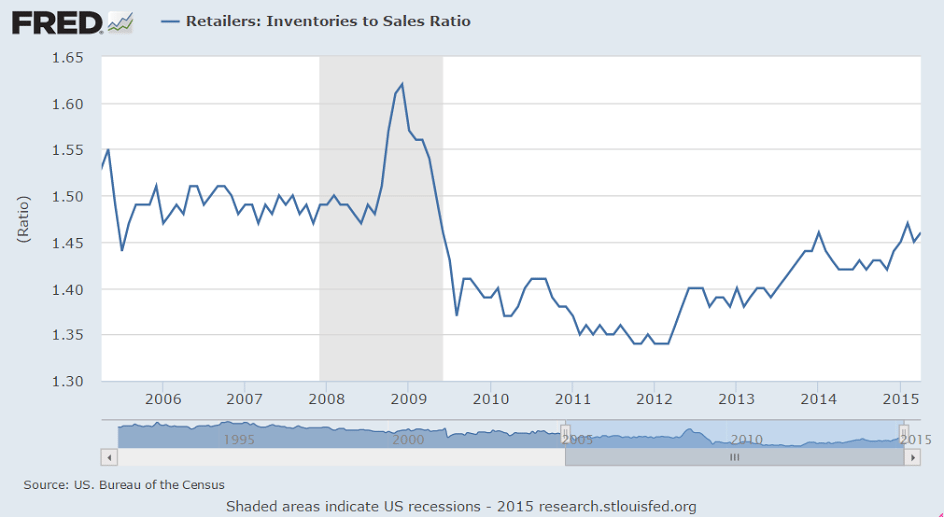

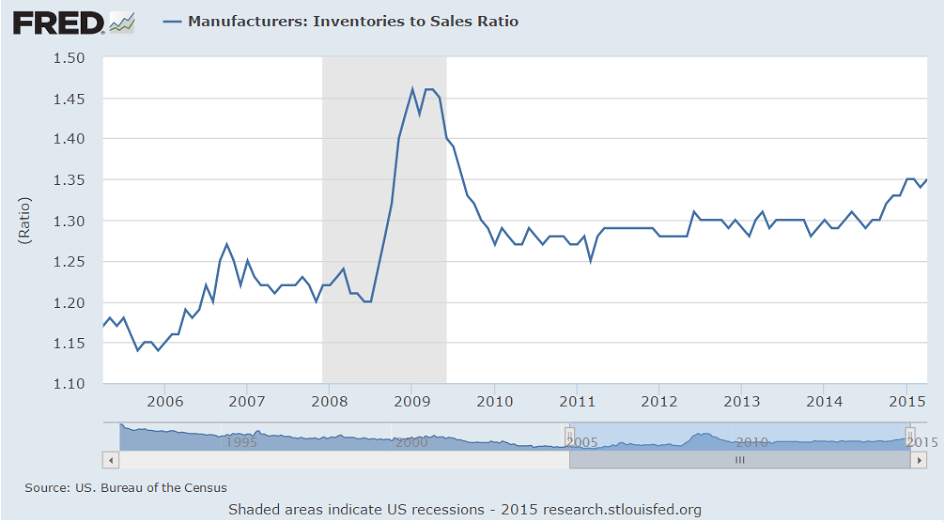

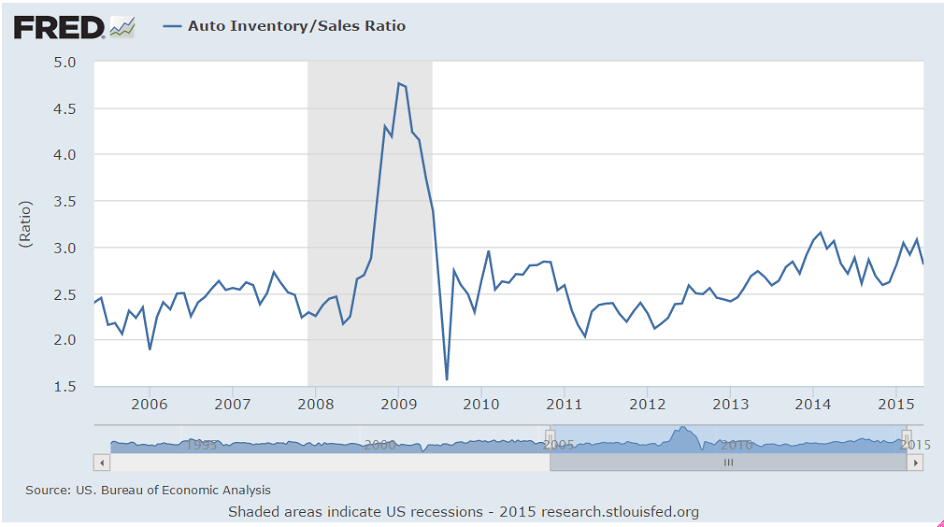

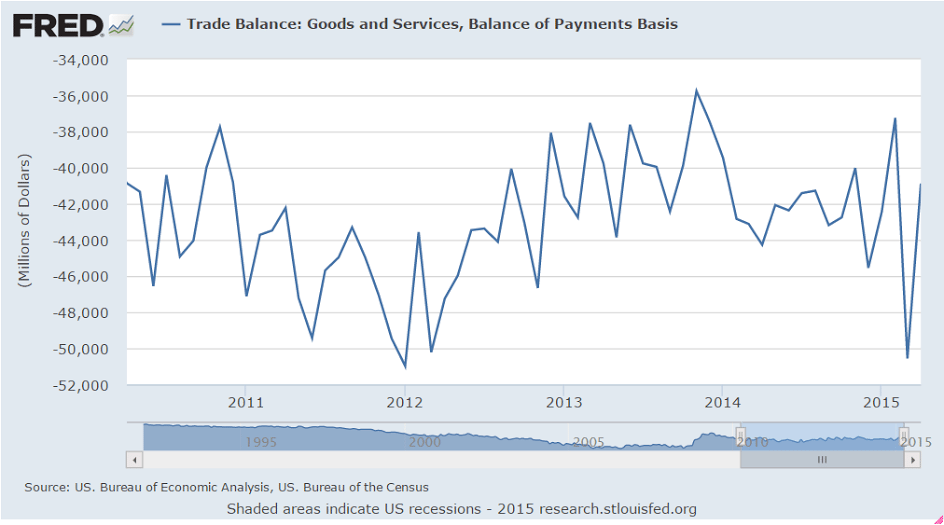

I see no evidence yet of ‘lift off’ from Q1 to Q2, only a very modest bounce of a few indicators and a strong possibility of Q2 being 0 should inventory/sales continue to revert and net imports be larger than expected as the last report looked like a zig that’s always followed by a zag:

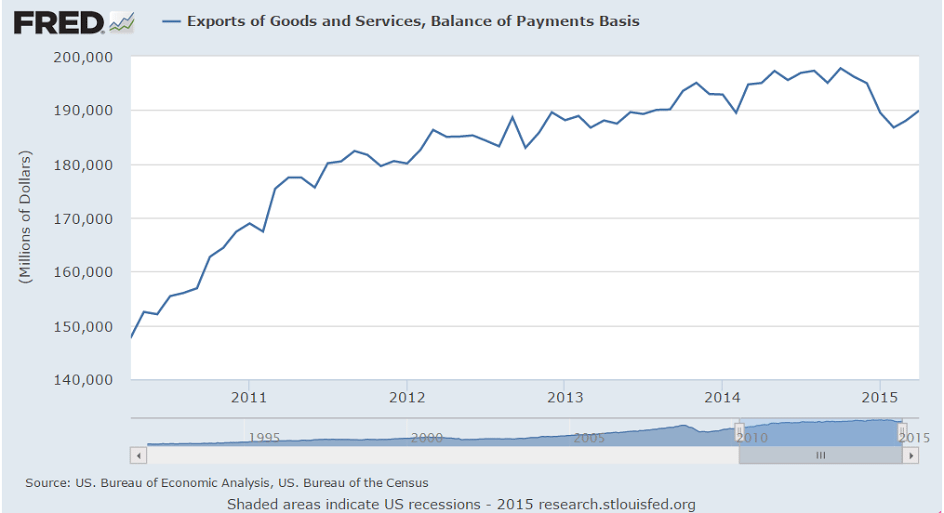

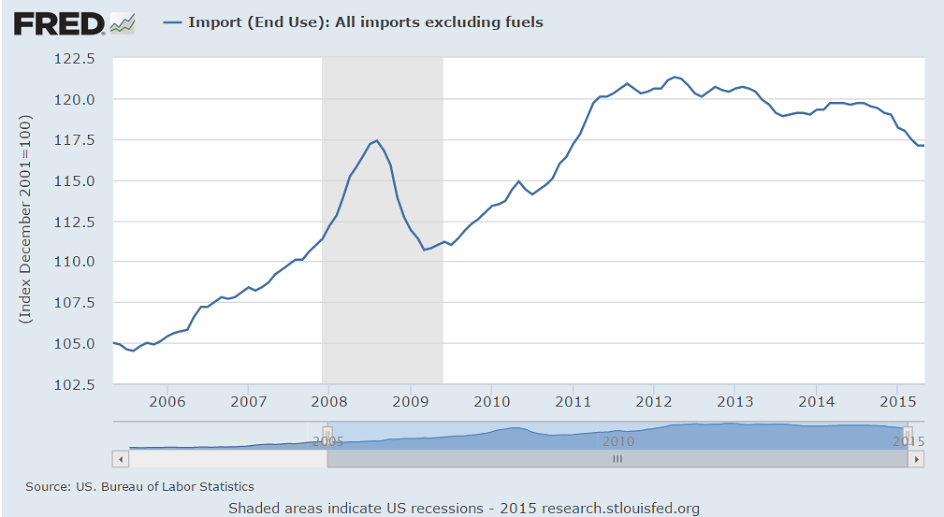

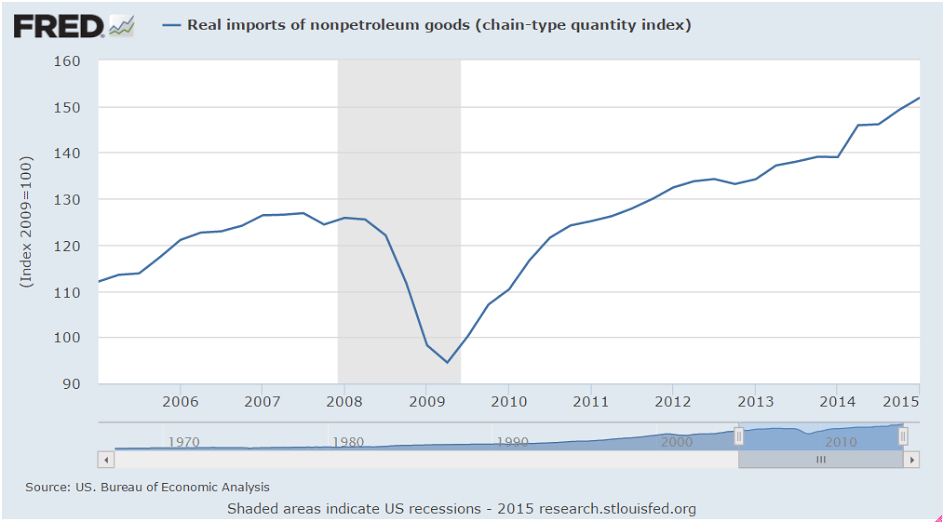

Port strike and price influence:

zigs up followed by zags down:

Net exports decreasing again, and now oil is a bit higher and US production growth has slowed and likely turned negative in June, with oil consumption up a bit, adding to oil imports. And non oil imports have been rising with the strong dollar, which has also dampened US export growth. Furthermore, the global drop in capex due to lower oil prices looks to have reduced US exports as well.