Interesting how these two reports relate to each other.

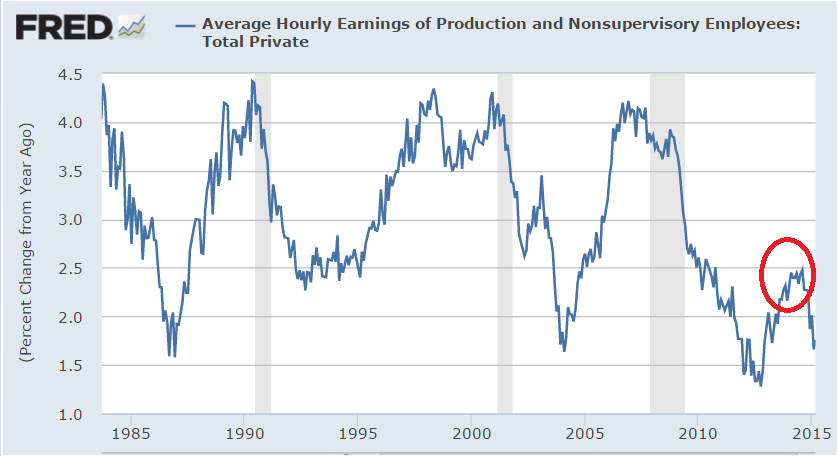

And the circled section is the last time the street was screaming about ‘wage inflation’ saying that every time in the past it went up as it had to that point it kept going up for the next 4 years. But it does track somewhat with investment, below:

Wage Growth Is Poised to Accelerate

By Gene Epstein

April 24 (Barrons) — Jason Benderly of Applied Global Macro Research has built an explanatory model that accounts for fluctuations in labor compensation with a far closer fit than a single-variable model that consists solely of the change in the unemployment rate. These four key variables (the change in the jobless rate, the jobless rate, the change in labor productivity, and after-tax profit margins), along with two other, minor ones relating to prices, explain real hourly compensation, which includes all benefits, going back to 1960. With no trouble explaining the recent period, the model predicts an acceleration in wage growth.

Weak U.S. business spending data hints at sluggish growth rebound

By Lucia Mutikani

April 24 (Reuters) — U.S. business investment spending plans fell for a seventh straight month in March. Non-defense capital goods orders excluding aircraft declined 0.5 percent last month after a revised 2.2 percent drop in February, which was the biggest decline since July 2013. In March, shipments of core capital goods fell 0.4 percent after a downwardly revised 0.1 percent gain in February.Shipments in February were previously reported to have risen 0.3 percent. That downward revision together with March’s weak reading could see economists trim their first-quarter GDP growth estimates.

Looks like this is coincident to recession, unless rescued by another fracking boom…

Sure looks to me like there’s a high probability this cycle is over. And could have been over last year if not rescued by the fracking boom.

Fracksional reserve banking???

:( sorry!!!