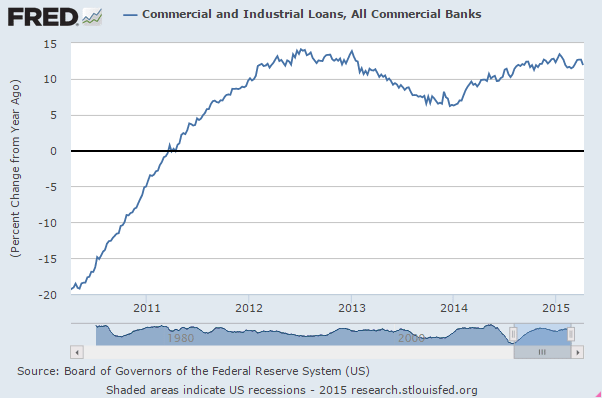

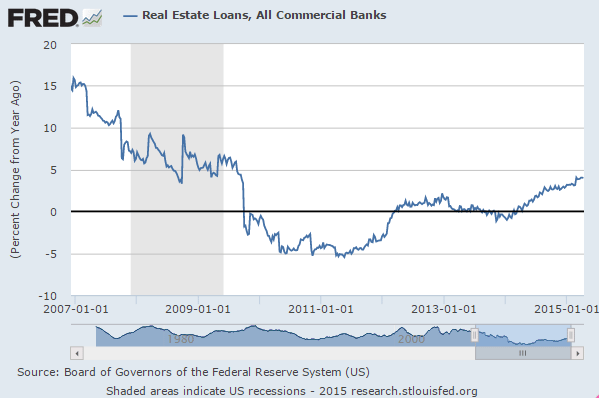

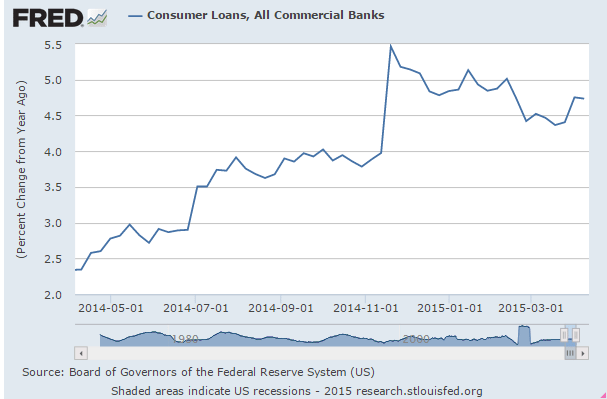

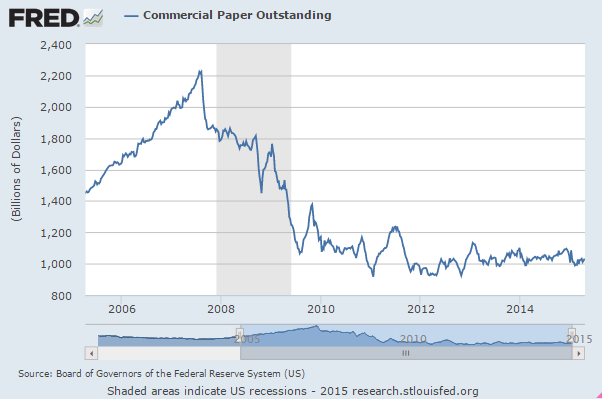

About this time last year I was looking to find signs of the credit expansion needed to ‘replace’ the cuts in Federal deficit spending and couldn’t find anything. Turns out it was the expanded investment chasing high priced oil that supported GDP growth of a bit over 2%. With that now behind us, and most every indicator in decline and with many GDP estimates now below 1%, I’m again looking for signs of a credit expansion capable of supporting positive growth, and so far, if anything, it looks to be going the other way.

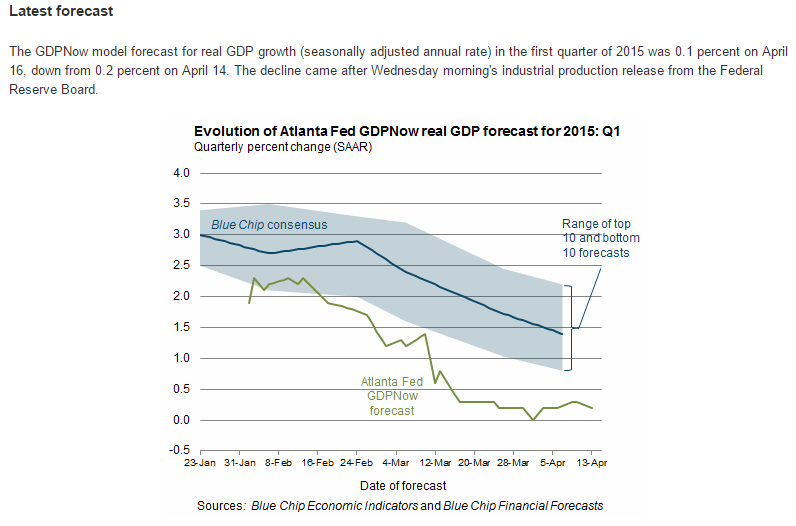

And the latest from the Atlanta Fed isn’t encouraging

Mosler Economics / Modern Monetary Theory

The Site of Economist Warren Mosler