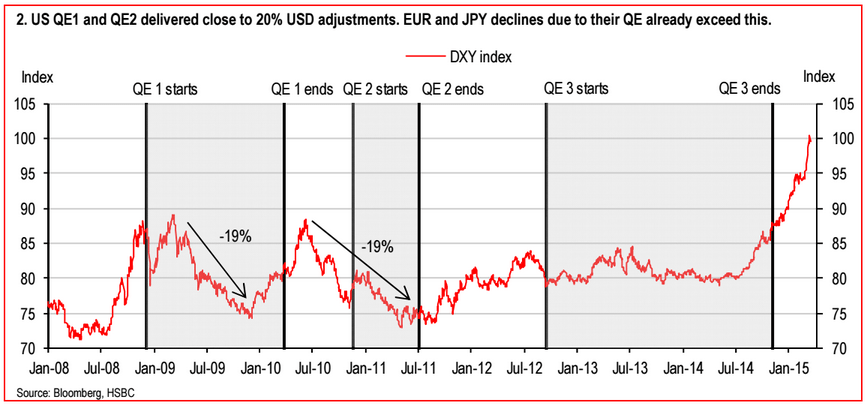

So my story is that traders and portfolio managers worried about inflation and currency depreciation from QE caused the depreciation during those periods, covering shorts and restoring dollar weightings after QE ended, returning the dollar to where it was. And now the latest spike is largely from the ECB’s QE announcement which caused strong desires to shift out of euro and into dollars. And this too should reverse at some point as, like everywhere else it’s been tried, QE will not reverse their deflationary forces or add to aggregate demand, and the euro shorts and underweight portfolios will be scrambling to get their euro back, while at the same time the current account surplus that resulted from the weak euro works to make those needed euro that much harder to get.

This should take q4 GDP down a bit more for the next published revision.

And it’s also consistent with my oil price narrative as well:

Current Account

Highlights

The nation’s current account gap widened sharply in the fourth quarter, to $113.5 billion vs a slightly revised $98.9 billion in the third quarter and driving the gap, relative to GDP, up 4 tenths to 2.6 percent. The gap on income is the main culprit, up $11.4 billion in the quarter and reflecting declining equity in foreign affiliates as well as transfers for fines and penalties. On trade, the goods gap rose $4.1 billion but was offset in part by a $1.0 billion increase in the services surplus.

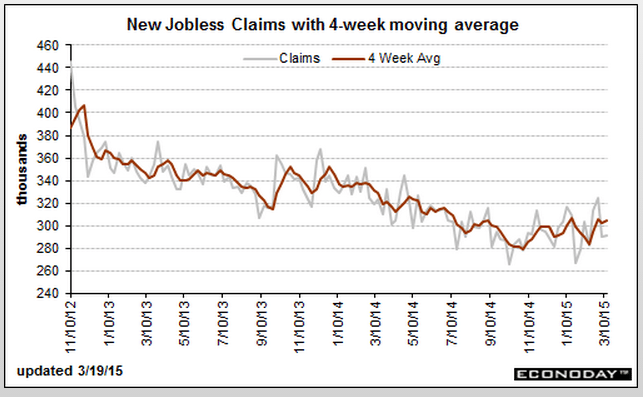

Down from last month and a bit worse than expected: