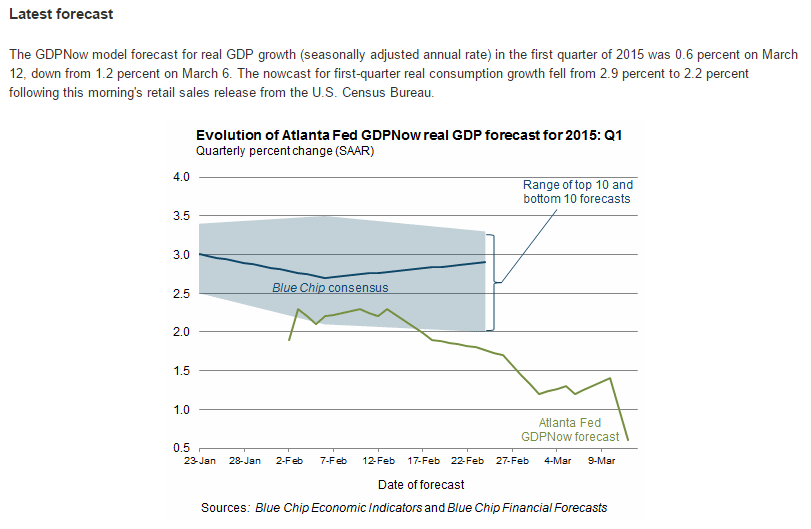

First, the economic releases have continued to lower the Atlanta Fed’s Q1 GDP estimate now down to only .6%:

My narrative seems to be holding- the drop in oil prices has lowered total spending below ‘stall speed’, after energy related spending chasing $90 oil was what kept it positive for the last couple of years:

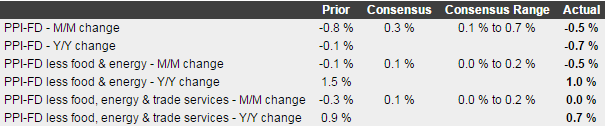

Prices down and it’s not just energy:

PPI-FD

Highlights

The PPI for total final demand fell 0.5 percent in February after decreasing 0.8 percent in January. Expectations were for a 0.3 percent rebound. Energy was flat, following a 10.3 percent drop while foods decreased 1.6 percent, following a 1.1 percent dip in January. Excluding food and energy, producer price inflation posted a minus monthly 0.5 percent after slipping 0.1 percent the month before. Analysts called for a 0.1 percent gain. Total excluding food, energy and trade services were unchanged after dipping 0.3 percent in January. Expectations were for a 0.1 percent rise in February.The index for final demand goods decreased 0.4 percent after falling 2.1 percent in January. Leading the decrease, margins for final demand trade services dropped 1.5 percent. (Trade indexes measure changes in margins received by wholesalers and retailers.)

The index for final demand services fell 0.5 percent after easing 0.2 percent the month before.On a seasonally adjusted year-ago basis, PPI final demand was down 0.7 percent, compared to down 0.1 percent in January. Excluding food & energy, the PPI final demand was up 1.0 percent versus 1.7 percent the month before. Excluding food, energy, and trade services PPI inflation slowed to 0.7 percent on a year-ago basis, compared to 0.9 percent in January.

Consumer Sentiment

Highlights

There appears to have been a bubble in consumer spirits late into last year and early into this one, that is a brief surge that came and went and never materialized into a rise for consumer spending. The first read on consumer sentiment this month fell very sharply to 91.2, down 4.2 points from final February for the lowest reading since November. Sentiment peaked at 98.2 in mid-month January which was the highest reading in 8 years.

The two components of the headline index both show weakness, at 103.0 for a 3.9 point decline for current conditions and at 83.7 for a 4.3 point decline for expectations. The decline in current conditions points to weakness for consumer spending this month relative to February while the decline in expectations points to a falling off in confidence for the jobs outlook.

Gasoline prices, though low, have been edging up in recent weeks and are now lifting inflation expectations which are up 2 tenths for the 1-year outlook to 3.0 percent and up 1 tenth for the 5-year outlook to 2.8 percent.