More bad housing news:

MBA Purchase Applications

Highlights

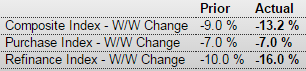

The purchase index is down for a 5th straight week, 7.0 percent lower for the 2nd consecutive week. Rates have been rising in recent weeks including the latest week which is especially depressing refinancing activity where the index fell a very sharp 16.0 percent following the prior week’s 10 percent fall. The report notes that demand for larger refinancing loans is especially down.

The average mortgage for conforming loans ($417,000 or less) rose 9 basis points in the week to 3.93 percent. The decline in the purchase index is a negative signal for underlying home sales.

More bad housing news:

Housing Starts

Highlights

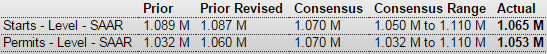

Housing is not adding to economic momentum. Housing starts slipped in January on weakness in single-family starts. Housing starts declined 2.0 percent in January after a 7.1 percent jump the month before. The 1.065 million unit pace was up 18.7 percent on a year-ago basis. Expectations were for a 1.070 million pace for January.

Single-family permits dropped 6.7 percent after a 7.9 percent boost in December. Multifamily starts gained 7.5 percent, following a 5.6 percent rise in December.

Again, permits suggest that housing activity is muted. Housing permits dipped 0.7 percent, following no change in December. The 1.053 million unit pace was up 8.1 percent on a year-ago basis. The market consensus was for a 1.070 million unit pace.

The bottom line is that housing is not adding to economic activity. This means the Fed likely will continue to reinvest mortgage-backed securities to keep rates low. But the long-term trend appears to be that single-family housing is not viewed as strong an investment as in the past.

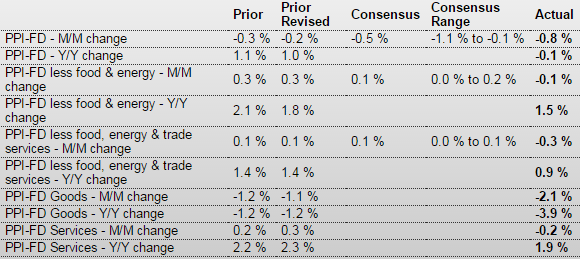

PPI-FD

Highlights

The PPI for total final demand decreased 0.8 percent after falling 0.2 percent in December. The consensus forecast a 0.5 percent drop. A sharp drop in energy pulled the headline number down. Excluding food and energy, producer price inflation slipped 0.1 percent after firming 0.3 percent the month before. Expectations were for a 0.1 percent rise.

The index for final demand goods fell 2.1 percent after dropping 1.1 percent in December. The January decrease was led by prices for final demand energy, which fell a monthly 10.3 percent. The decline in prices for final demand goods was led by the index for gasoline, which dropped 24.0 percent. Prices for diesel fuel, jet fuel, basic organic chemicals, dairy products, and home heating oil also moved lower. Conversely, the index for residential electric power moved up 1.2 percent. Prices for pharmaceutical preparations and for fresh and dry vegetables also advanced. Prices for final demand foods decreased 1.1 percent after slipping 0.1 percent in December.

The index for final demand services eased 0.2 percent after advancing 0.3 percent in December. In January, prices for final demand services less trade declined 0.3 percent after rising 0.1 percent the month before. This was the first decline since falling 0.3 percent in September 2014. In January, a major contributor to the decline in the index for final demand services was prices for outpatient care (partial), which fell 0.7 percent.

On a seasonally adjusted year-ago basis, PPI final demand was down 0.1 percent, compared to up 1.0 percent in December. Excluding food & energy, PPI final demand was up 1.5 percent versus 1.8 percent the month before.

Overall, inflation at the manufacturers’ level is muted even after discounting energy declines. The Fed is likely to see the numbers as allowing delayed rate increases.

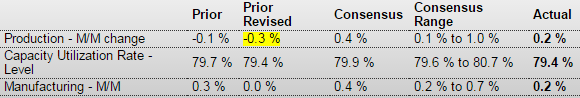

And yet another disappointing report:

Highlights

The industrial sector turned modestly positive in January-including for the manufacturing component. Industrial production for January rebounded 0.2 percent after a December decrease of 0.3 percent. Market expectations were for a 0.4 percent boost for January.

Manufacturing rose 0.2 percent in January after no change the month before. But the negative is that December manufacturing was revised down from a 0.3 percent gain. The manufacturing increase fell short of the 0.4 percent market forecast.

Manufacturing output rose 0.2 percent in January, as the production of durable goods advanced 0.4 percent and the production of nondurable goods was unchanged. Gains were posted by all major durable goods industries except motor vehicles and parts, aerospace and miscellaneous transportation equipment, and furniture and related products. Increases of more than 1.0 percent were recorded in the production of primary metals and of computer and electronic products. Among the major nondurable goods industries, gains in the indexes for apparel and leather, for chemicals, and for plastics and rubber products offset losses elsewhere. The production of other manufacturing industries (publishing and logging) moved down 0.4 percent.

Mining dropped 1.0 percent in January after a 2.1 percent jump the prior month. Utilities made a partial rebound of 2.3 percent after plunging 6.9 percent in December.

Overall capacity utilization was unchanged at 79.4 percent.

The biggest news from this report was the downward revision to December. Manufacturing is still sluggish although on a barely positive uptrend.