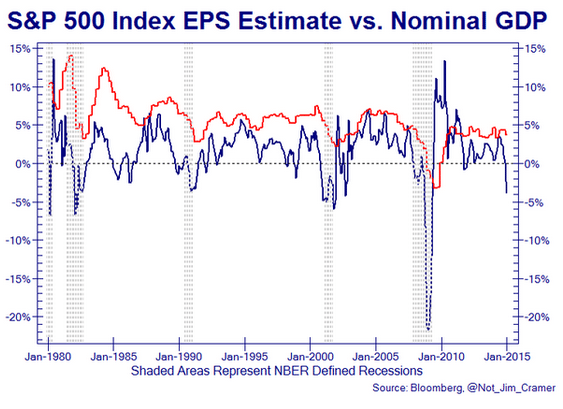

The mainstream assert that the drop in oil prices is an unambiguous positive for the US economy, as it’s like maybe a $200 billion tax cut for consumers. The idea is that the $ saved on oil products get spent elsewhere, increasing real spending. On the negative side they see the fall in capital expenditures as under $100 billion and hurting only a few consumers but not nearly as many as get helped.

So far the data isn’t showing this happening, at least not in a meaningful way.

What they’ve left out is that falling oil prices only shift income from sellers of oil to buyers of oil, and even nominal spending due to that shift increases only to the extent that buyers of oil spend more of they savings than sellers of oil cut back due to loss of income. Additionally, capex reductions are from lack of potential profits, and not from shifting incomes. Putting all this together there is the reasonable possibility that the drop in oil prices turns out to be an unambiguous negative.

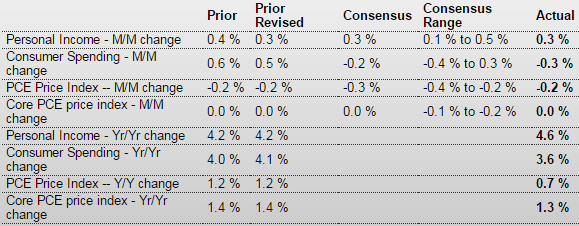

Personal Income and Outlays

Highlights

The consumer sector has been volatile on a monthly basis for spending while income growth has been steadier. Meanwhile, inflation has been weak. Personal income grew 0.3 percent in December after advancing 0.3 percent in November. Market expectations were for a 0.3 percent rise. December matched expectations. The wages & salaries component increased a modest 0.1 percent, but followed a jump of 0.6 percent the prior month.

Personal spending decreased 0.3 percent, following a boost of 0.5 percent in November. Analysts projected a dip of 0.2 percent for December.

Durables fell 1.2 percent on a swing in auto sales, following a rise of 1.8 percent in November. Nondurables, tugged down by gasoline prices, decreased 1.3 percent after decreasing 0.3 percent the prior month. Services edged up 0.1 percent, following a 0.5 percent spike in November.

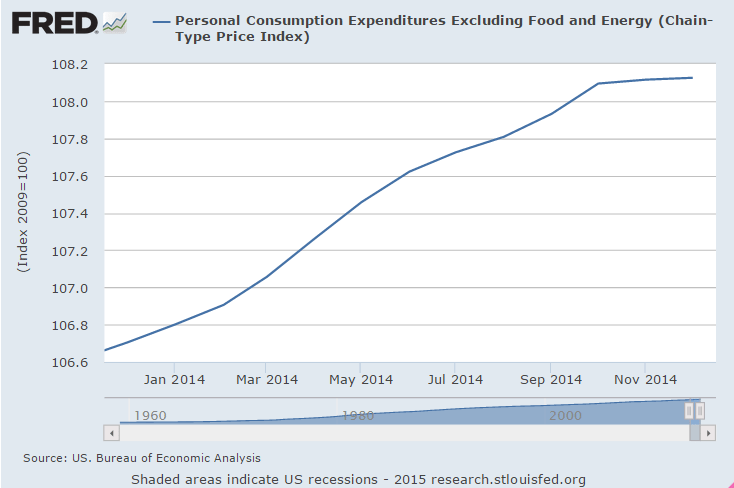

PCE inflation remained weak-largely due to lower energy costs. Headline inflation decreased 0.2 percent on a monthly basis, following a drop of 0.2 percent in November. Forecasts were for a 0.3 percent drop. Core PCE inflation was flat in both December and November. December matched expectations.

On a year-ago basis, headline PCE inflation decelerated to 0.7 percent in December from 1.2 percent the prior month. Year-ago core inflation posted at 1.3 percent in December compared to 1.4 percent in November. Both series remain below the Fed goal of 2 percent year-ago inflation.

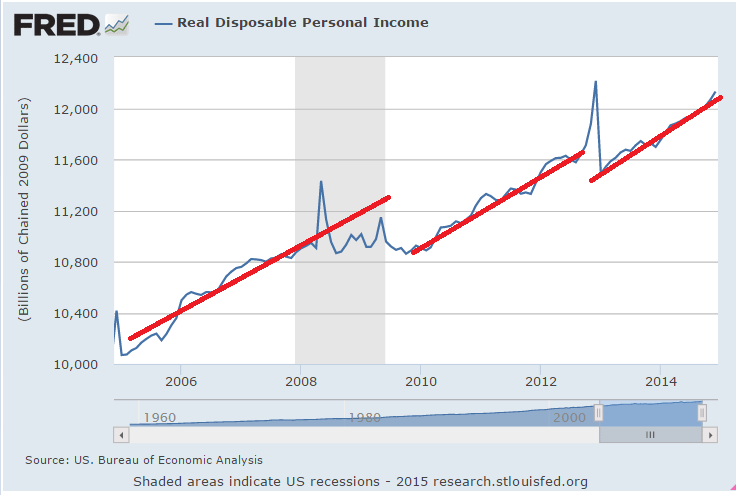

Note how after tax real income has had two shifts lower and isn’t growing fast enough to ‘catch up.’

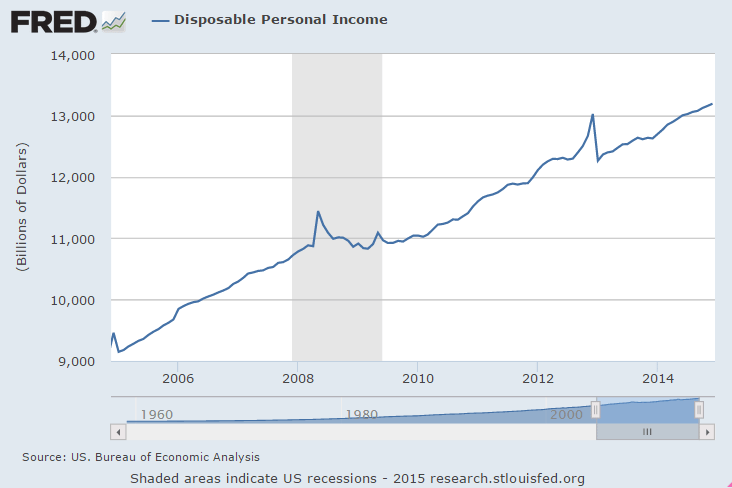

And nominal after tax income growth has actually slowed recently:

Interesting that this slowed!

This may also show business has been ‘over hiring’?

New export orders collapse- who would have thought???

;)

And import orders rose bit, also as expected from the shift in oil income.

ISM Mfg Index

Highlights

ISM growth had been running hot compared to other manufacturing reports but has slowed down noticeably the last two readings. January’s composite score of 53.5 compares with a revised 55.1 in December and 57.6 in November. October was the fourth quarter’s peak at 57.9.

New orders slowed substantially in January, to 52.9 from 57.8. In contrast, November and October growth in orders was in the low 60s. Weakness in foreign demand is a key factor here as new export orders fell 2.5 points to a sub-50 49.5. This is the lowest export reading since November 2012. Total backlog orders also moved into contraction, to 46.0 for a 6.5 point loss.

Production remained strong in part because of the working down of backlogs. A big headline is prices paid which fell 3.5 points to 35.0 which is very low, the lowest reading since April 2009.

This report is a concern, reflecting weak foreign markets and also troubles in the oil patch. The ISM wasn’t the first to signal slowing but it now heavily underscore prior indications.

The chart says it all:

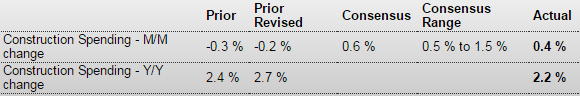

Construction Spending

Highlights

Construction outlays rebounded 0.4 percent in December after dipping 0.2 percent the month before. December was below market expectations were for a 0.6 percent gain.

December’s increase was led by public outlays which rebounded 1.1 percent after dropping 1.8 percent jump in November. Private residential spending rose 0.3 percent after edging up 0.1 percent in November. Private nonresidential construction spending eased 0.2 percent in December after a 0.8 percent rise the month before.

On a year-ago basis, total outlays were up 2.2 percent in December compared to 2.7 percent in November.