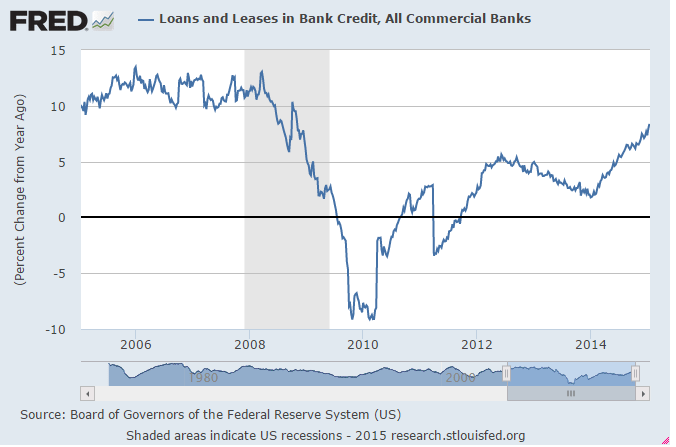

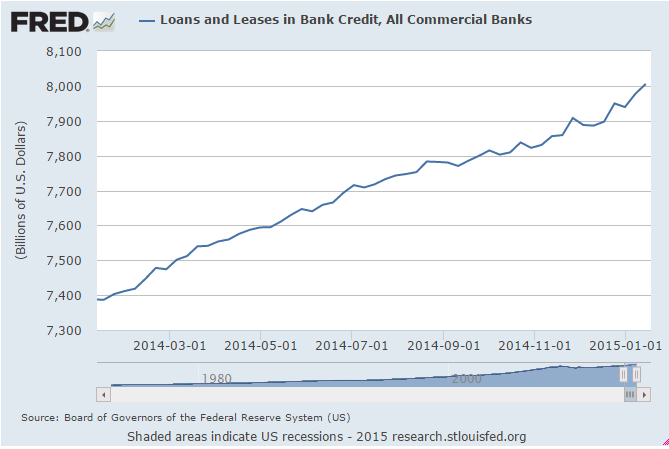

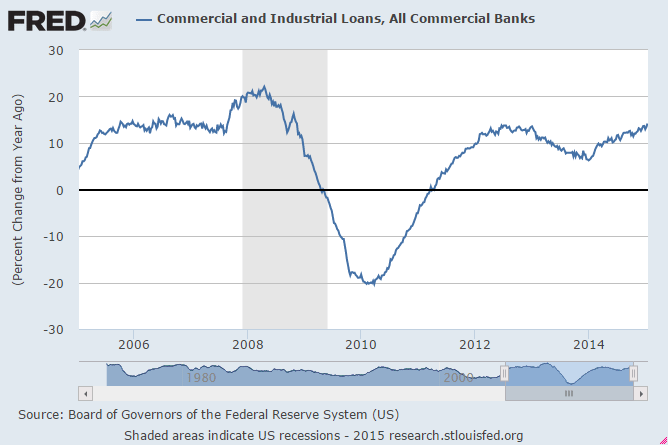

Yes, bank lending is growing some, but it’s just back to where it was a couple of years back when it took a step back, and below the prior cycle’s growth rate:

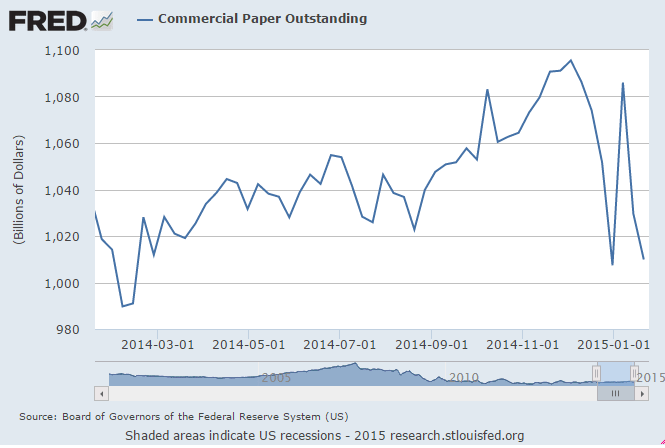

And commercial paper is down about $85 billion since Dec 3, which means the rise in bank lending has been at the expense of shadow bank lending, and total lending is going nowhere:

Meanwhile, the euro has fallen a bit further vs the dollar after the Greek election results. I still don’t see this leading to any kind of fiscal expansion, and the proposed debt restructuring is functionally just a tax on bondholders that if anything further removes aggregate demand.

Additionally, the ECB’s latest moves, while actually contractionary/deflationary, are perceived as the reverse and Greece and others will likely give them time ‘kick in’ and spur growth. And while lower oil costs are a plus for most euro consumers, the lower cost of imports adds to the trade surplus, which is a force for a stronger euro.