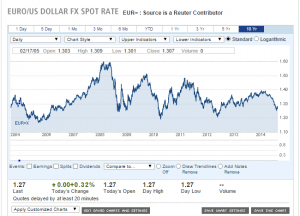

The euro is up vs the $US today in spite of near universal positioning for it to fall,

including technical indicators pointing to further declines.

I see lots of positives for the euro and one negative.

Positives:

1. $US went up/euro down due to portfolios buying/selling for the ‘wrong’ reasons (for example- Turkey sold 12 billion euro of reserves)

a. end of Fed QE- this entirely psychological, as QE in the first instance functions as a tax that removes interest income from the economy

b. potential for Fed rate hikes- this is backwards as well- 0 rates are a deflationary/contractionary bias

c. negative ECB rates function as a tax removing net euro financial assets from the economy

d. proposed ECB asset purchases would remove additional euro interest income from the economy

2. The EU overall is running a trade surplus, which in the first instance reduces the rest of worlds net euro financial assets

3. The deflationary forces have depressed wages for exporters, tipping wage ppp in their favor.

4. EU proactive deficit reduction, assisted by the lower rates on govt. securities, continues (albeit at a slower pace) to reduce the supply of net euro financial assets in the non govt. sectors of the economy.

5. Lower energy prices help EU more than the US due to higher US domestic energy output.

The major negative is the possibility that the ECB is selling euro through it’s Belgium branch, which has been reporting large increases in $US Tsy holdings.

If the ECB is selling euro it can keep it down to any level it desires. It’s a political choice. Market forces are not applicable.

Best I can tell, however, the selling has not been from the ECB, but I have no first hand knowledge.

Therefore I see the ‘fundamentals’ aligned for a strong euro that can potentially go back through the highs, with any proposed further action by the ECB further strengthening it, whether they know it or not.

However, those forces strengthening the euro are also further damaging the economy, which puts more political stress on the EU overall.

And this political stress that will intensify as the euro rises has the potential to end the current institutional arrangements and cause the euro to cease to exist.

That is, I can see the euro going up in value until it becomes worthless.

Reminds me of the saying:

“A man chases a woman until she catches him”

;)

And what I don’t know is whether the portfolio shifting that has driven the euro down for the ‘wrong’ reasons has run its course. If there is more to come it could sell off further until the underlying fiscal and trade flows cause it to reverse.