Note the year over year rate of growth:

As previously discussed, in order for GDP to grow at last year’s pace all the pieces, ‘on average’ have to do same.

And so far, housing and cars are well below last year’s growth rates.

And the contribution of net govt spending is well below last year’s contribution.

And so far net export growth isn’t coming to the rescue.

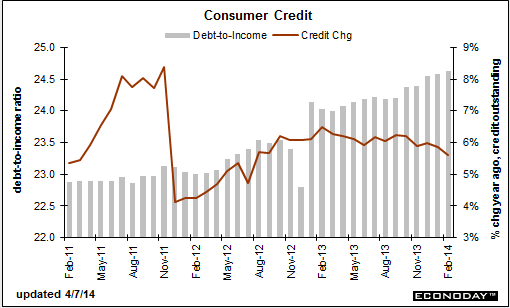

Nor is consumer credit driving spending.

Even capex just took a hit.

And the personal income growth rate isn’t looking like it’s ‘bounced’ any.

Employment growth, a lagging indicator that’s largely a function of sales, if anything looks a tad less as well.

The ‘surveys’ are still showing positive growth, and maybe they’ll turn out to be correct. But I have noticed a tendency for their responses to be influenced by the stock market.

Hopefully we’ve just had a weather pause, and the consumer and business celebrate spring with a material surge of spending that exceeds their incomes to off set the ongoing ‘demand leakages’.

But if not, growth slips into reverse until the federal deficit again gets large enough to stop the slide.