>

> (email exchange)

>

> On Oct 17, 2013 12:47 AM, wrote:

>

> ”strengthens verification measures” actually more important than it sounds

>

> 1. Another late and politically driven requirement added to an already over-stressed

> technical environment, so could add to the #FAIL;

>

> 2. I’m not sure the current Federal Change can verify income NOW (and how would we

> know they couldn’t) using whatever combination of IRS and credit reporting agency

> data they’re using;

>

> 3. It’s not clear how to add more verification without really draconian measures

> (and these guys don’t want to fund the IRS, so will they privatize it?)

>

> 4. 2014 income has to be estimated in advance. How exactly is that to be “verified”

> in some way more than checking 1040s etc?

>

> 5. Sets up a “fraud” narrative that proved so useful on say voter photo ID

> requirements.

>

> The Democrats had to give them something on ObamaCare, I suppose. But this gift will

> keep on giving.

>

> ObamaCare is such a mess. Such a BIG mess.

>

Monthly Archives: October 2013

fuzzy presidential logic

“Also, the White House supports a provision in the deal that strengthens verification measures for people getting subsidies under Obamacare, spokesman Jay Carney said.

Carney called the change “a modest adjustment,” and said it didn’t amount to “ransom” for raising the federal debt ceiling because both sides agreed to it and the White House supported it.”

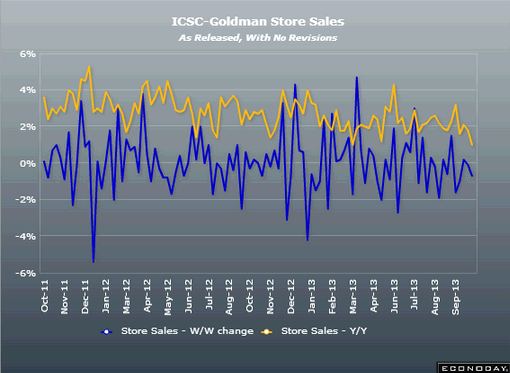

weekly mtg purchase apps drop a full 5%

Credit expansion is today’s ‘high powered money’ and, as always, the private sector is pro cyclical, and this series just fell to a 6 year low.

And when it slips into reverse it can get ugly quick.

Shutdown is having ‘notable impact’ on mortgages.

By Diana Olick

October 16 (CNBC) — Applications for government mortgage products dropped to a six-year low last week, as negotiations to end the U.S. government’s partial shutdown and avert a debt default rocked back and forth between progress and deadlock.

While total mortgage applications inched higher by 0.3 percent week-to-week, the increase was driven entirely by a 3 percent rise in refinances, according to a weekly survey by the Mortgage Bankers Association. Mortgage applications to purchase a home dropped a wider 5 percent.

Purchase Apps:

Full size image

today’s charts and opinion

Not looking good. And Congress and the President not in any rush either, seems. Still looking to me like they are getting their sense of security from:

The stock market doing ok, believing a balanced budget is a good thing, both sides trying to take credit for this year’s drop in the deficit. Recalling the ‘fear mongering’ in front of the last round of tax hikes and sequesters. Recalling markets bounced back after the Aug 2011 debacle, etc. Voters convinced govt should limit spending to what it takes in.

That is, letting the US go cold turkey to a balanced budget is consistent with their ideology and with current political dynamics.

They are maneuvering only to try to make sure that if it works they get the credit and if it fails the opposition gets the blame.

And I hope I’m wrong!!!

Bulgaria fyi

Fama’s Fallacy

Here’s how you have to think to win a Nobel prize:

Fama’s Fallacy:

There is an identity in macroeconomics… private investment [PI] must equal the sum of private savings [PS], corporate savings (retained earnings) [CS], and government savings [GS]…. (1) PI = PS + CS + GS…. Government bailouts and stimulus plans seem attractive when there are idle resources – unemployment. Unfortunately, bailouts and stimulus plans are not a cure. The problem is simple: bailouts and stimulus plans are funded by issuing more government debt…. The added debt absorbs savings that would otherwise go to private investment…. [G]overnment infrastructure investments must be financed — more government debt. The new government debt absorbs private and corporate savings, which means private investment goes down by the same amount…. Suppose the stimulus plan takes the form of lower taxes… lower tax receipts must be financed dollar for dollar by more government borrowing. The government gives with one hand but takes them back with the other, with no net effect on current incomes…

Eugene Fama

good grief!!!

:(

Meeting postponed between President Obama, Congressional leadership

What’s the rush?

Neither side has any interest in ‘compromise’ nor fears going cold turkey to a balanced budget.

In fact, they all believe we owe it to our grandchildren to do exactly that.

:(

Meeting postponed between President Obama, Congressional leadership

October 14 — A meeting between President Barack Obama and congressional leaders to discuss progress toward a deal to re-open the government and raise the U.S. debt ceiling has been postponed to give the Senate more time, the White House said on Monday.

Obama had been due to meet with Senate Majority Leader Harry Reid, Senate Republican leader Mitch McConnell, House of Representatives Speaker John Boehner, and House Democratic leader Nancy Pelosi at 3:00 p.m. The last meeting between Obama and the congressional leaders was Oct. 2.

Boehner’s Offer

Just listened to the video several times.

He offered a short term debt ceiling increase in return for discussions on how to reopen the govt.

That way govt stays closed but no default.

So, it seems they’ve decided to use only the passing of the continuing resolution as leverage, at least until the short term debt ceiling extension expires.

The slow motion train wreck continues…

Boehner’s Offer

http://www.cnbc.com/id/101093035

Rand Paul – “Cold Turkey Balanced Budget is a Good Thing”

Deep down, I suspect most of Congress believes what Rand Paul believes.

They believe balancing the budget is the right thing to do for our children and grandchildren.

And, of course, they have widespread popular support for a balanced budget and probably enough votes for a balanced budget amendment to the US constitution as well.

So maybe that’s why both sides are OK painting themselves into a corner.

There is no way out apart from one side completely losing face and credibility.

And when something can’t happen, sometimes it doesn’t happen, and we actually do go cold turkey into a balanced budget.

So what happens when the automatic fiscal stabilizers are disabled?

When the slowdown slows tax revenues, instead of the deficit going up as spending then exceeds revenues, spending is instead cut, which slows things down further, which means more spending cuts, which slows things down further, all the way to 0, as ‘balance’ combined with the fixed ‘demand leakages’ puts the system in ‘default’.

Said another way, the dollars to pay taxes and net save come from govt spending.

(You can’t do a reserve drain without a reserve add.)

With a balanced budget and automatic net savings/demand leakages, govt isn’t allowed to spend enough dollars to cover the tax bill.

And when taxes don’t get paid, spending is further constrained, so additional taxes can’t get paid, further restricting spending, etc. etc. etc.

So given our current institutional structure, the answer is yes, if we balance the budget and leave it that way, the world as we know it is definitely going to end.

(And with a bang, not a whimper.)

And given the policy of going cold turkey to balance probably does ‘sound like a pretty reasonable idea to the American public,’ it’s looking more and more like both sides are setting up to let it happen.

Massive deflationary bias in general

Sales and creditworthiness collapses

Major corps turn into Lehman and Bear Stearns

Bad for stocks

Bad for credit product

Good for the dollar (harder to get)

Good for US tsy secs (Fed low forever)

Blood in streets if allowed to persist

“It really is irresponsible of the president to try to scare the markets,” said Senator Rand Paul, Republican of Kentucky. “If you don’t raise your debt ceiling, all you’re saying is, ‘We’re going to be balancing our budget.’ So if you put it in those terms, all these scary terms of, ‘Oh my goodness, the world’s going to end’ — if we balance the budget, the world’s going to end? Why don’t we spend what comes in?”

“If you propose it that way,” he said of not raising the debt limit, “the American public will say that sounds like a pretty reasonable idea.”

Worried about the debt ceiling? Republicans aren’t.

And I’ll bet a lot of Dems aren’t either.

They all think a balanced budget is a good thing.

And they all have been led to believe the year and tax hike and sequesters didn’t hurt the economy as feared. So how can they not suspect it’s all a bluff?

Meanwhile, it’s the going cold turkey to a balanced budget that’s potentially catastrophic, not the risk of higher rates, downgrades, etc, etc.

And no one I’ve read writes about that risk as they all probably think it’s a benefit.

Both sides do agree we have a long term deficit problem and that it would be a good thing to take at least $2 trillion out of the budget over the next 10 years.

They just don’t agree on how to do it.

Good luck to us, mates.

The USS Stupidity is going down…

:(

Worried about the debt ceiling? Republicans aren’t.

By Chris Cillizza and Sean Sullivan

October 8 (The Washington Post) — Treasury Secretary Jack Lew has described Congress as “playing with fire” when it comes to the ongoing debate over whether to raise the debt ceiling. Goldman Sachs warns that not raising the debt limit could result in a “rapid downturn in economic activity if not reversed very quickly.” The vast majority of economists use words like “recession” and “catastrophe” to explain the impact of breaching the debt ceiling later this month.

And yet, a majority — yes, a majority — of self-identified Republicans in a new Pew Research Center poll agreed with the statement that “the country can go past the deadline for raising the debt limit without major economic problems.” Almost two-thirds (64 percent) of Republicans who identify with the tea party expressed that sentiment.

What explains that level of skepticism in the face of such dire warnings?

Some of the Republicans doubt about the true danger of the debt ceiling is based on the fact that, well, lots and lots of people — Republicans, Democrats and independents — don’t really know what it is or does. (Overall, 47 percent of people said that raising the debt ceiling was “essential” to avoiding an economic crisis while 39 percent said the economy would be okay if the debt limit wasn’t increased.) The reflex reaction to warnings about how terrible something you don’t really get might be is to assume people are exaggerating about the consequences.

That doubt goes double — or maybe triple — when you are a Republican who is already distrustful of what a Democratic administration tells you is fact. And, there are several Republican voices in Congress — most prominent among them Michigan Rep. Justin Amash — insisting that the Obama administration is shouting “disaster” when the economic reality is far less catastrophic.

The numbers in the Pew poll may help explain House Speaker John A. Boehner’s comments on the debt ceiling in recent days. Late last week, Boehner (R-Ohio) made news by telling Republican members that he would not let the country go into default and that political realities meant a debt deal would have to be attractive enough to win some Democratic support. Days later, however, Boehner told ABC’s George Stephanopoulos that there weren’t enough votes in the House to pass a “clean” debt-ceiling increase, meaning that Republicans would only be for such a move if it meant concessions from Democrats.

If the Pew numbers explain Boehner’s shift, they also make clear the difficulty of his bargaining position and the real possibility of a debt default.

Boehner — through his actions in the run-up to the government shutdown and his statements since the government went dark — has shown that he understands that the way he keeps his job is to placate cast-iron conservatives. And he wants to keep his job.

But, how far is he willing to go to do that? If a majority of Republicans don’t believe breaching the debt ceiling is such a big deal, how does Boehner make the case to House Republicans of the seriousness of the stakes? And, if he can’t make that case and/or wring concessions out of the White House, does he let a default happen?