Karim writes:

Very poor job data with a gain of only 96k and a net revision of -41k. Somewhat offsetting is the 0.2% drop in the unemployment rate from 8.3 to 8.1% (which along with April 2012 is the lowest since January 2009). The biggest swing (and miss) was manufacturing employment, which shifted from a gain of 23k to a fall of 15k, indicating that global economic weakness is affecting U.S. exporters. Indicators of domestic demand fared better as trade swung from a gain of 11k to 29k jobs, finance from -2k to +7k, and leisure/hospitality from 28k to 34k.

Though August payroll data is typically revised higher, the data affirms the notion the economy is hovering around or just below trend growth of 2-2.5%.

The data increases the chances of QE3, unsterilized and possibly open-ended purchases of Agency MBS and USTs, but I still think later in the year. An open-ended program likely requires a consensus Fed economic forecast, which is still a work-in-progress. Next week’s FOMC meeting will be contentious, and a close call, however.

Other data highlights:

- The drop in the unemployment rate came as a result of a drop in the participation rate from 63.7% to 63.5% (labor force fell by 368k).

- The U6 measure improved from 15% to 14.7%, but the median duration of unemployment rose from 16.7 weeks to 18 weeks.

- Average hourly earnings were unchanged and aggregate hours gained 0.1%, a weakish combination for personal income.

- The diffusion index dropped from 54.3 to 50.2

Some interesting charts from SMR:

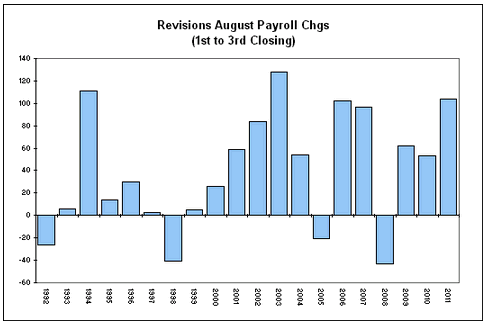

Over the past 20 years August payrolls have been revised upward between the 1st and 3rd release on 16 occasions.

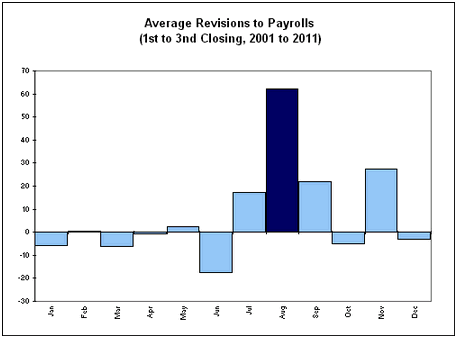

The magnitude of the August payroll revisions over the past 10 years has far exceeded any other month of the year. Over this period the August reading has been revised upward by an average of 62,000, in contrast to the next largest month (November) at +27,600.