From Art Patten, Symmetry Capital Management, LLC

A brief overview of our current thinking on the financial market and economic outlook—please see important disclosures at the bottom of this email:

Yesterday’s rally provided a reprieve from strong selling pressures, but was low-conviction judging by trading volumes and bond market behavior. I suspect it will prove temporary and that the current trend will remain negative. Normally we could ascribe that to seasonal dynamics—for example, the old “sell in May and go away” adage—but there are some really strange forces at work, and almost all of them are bearish. They may not cause much damage in the coming quarters, but at some point they will. Our current guess is 2012, but it could start earlier.

- Recent commodity market volatility indicates to us that the trade is highly levered on the bullish side, and thus increasingly fragile. As long as there’s real demand, the investment (speculative!?) demand from developed world investors can do OK (and then some, in recent quarters). But there are now rumors of commodity supplies being used in China in much the same way that houses were used in some western countries 2005-2007, tech stocks 1998-2000, and so on here), and monetary and credit indicators from China do not bode well for commodity prices right now.

- There are similarly fragile dynamics in Europe, where continental banks levered up on the debt of countries that now can’t pay their bills, as they surrendered monetary autonomy to join a union with no fiscal authority (and a real anti-fiscal fetish, as embodied in the Maastricht Treaty). Money and credit indicators out of Europe look absolutely horrific at the moment.

- Either of those fragile equilibria could break hard in 2011, with the usual contagion to financial markets and asset prices. If they are not managed proactively (a serious possibility given (1) the zero-bound on central banks’ interest rate targets and (2) the prevailing deficit and debt phobias around the world) it will spread to the global economy yet again, against a backdrop of already-high unemployment and painful relative price shocks from food and fuel.

- On a relative basis, the U.S. looks attractive. However, in 2011-2012, the proportion of young adults in the U.S. economy turns negative here), something that is strongly associated with recessions.

- Fiscal austerity will only worsen things. In fact, we’re not surprised by the softness in U.S. leading indicators, given announcements that federal tax receipts were better than expected. Remember—today, the federal budget deficit is what gold mines were in the 19th century. In an over-levered economy slowly recovering from recession, it would have been very hard to produce too much new gold (money) back then, and the last thing you would have done is re-bury whatever gold was produced. But ‘fiscal discipline’ today amounts to the very same thing! Granted, it’s rational to worry that larger deficits will mean higher tax rates, as few politicians—and far too few economists!—grasp the reality of our monetary system and how it interacts with fiscal policy.

- The current trajectory of the debt ceiling negotiations is depressing. The GOP believes that government spending crowds out private investment, as though money comes from somewhere ‘out there’ or is still dug out of the ground. The Dems can’t get over their beloved ‘Clinton surpluses,’ ignoring the fact that they, like every other significant federal budget surplus, were followed by a recession. For the last few weeks, a few members of the GOP have been pointing out (correctly) that the U.S. will not default. It will direct revenues to Treasury debt holders first, and be forced to make severe spending cuts elsewhere. This will further undermine an already anemic level of overall demand. In fact, fiscal authorities in most parts of the world are doing all they can to undermine global aggregate demand. The U.S. Congress is just now joining the party.

- U.S. equity markets aren’t indicating an imminent recession, but keep in mind that they were more of a coincident than a leading indicator when the last one started in December 2007. I expect a similar dynamic this time around, with a sideways trend eventually giving way to one or more financial shocks and the eventual realization that we’ve driven ourselves into the ditch yet again.

- Longer-term, we’re heading into an environment in which the relative impotence of monetary policy will become a new meme, a 180-degree turn from the last four or five decades. And it will probably take at least a decade for macro policy to adjust (Japan’s policymakers still haven’t, over 20 years later). More lost decades ahead? We’re starting to think it’s a wise bet.

- The only factors that look benign at the moment are in U.S. credit markets. They imply that the employment picture should continue to improve and that the U.S. economy is not nearing recession. If we had to guess, we’d predict one or two financial market shocks ahead, but depending on their timing, there could be something of an equity market rally after the usual summer doldrums. But it might involve significant sector rotation, and our outlook for 2012 is rather pessimistic at the moment.

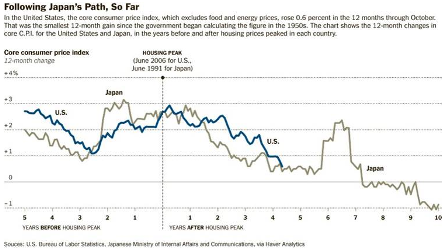

Finally, here’s a chart that the NYT ran in January that makes a compelling case that a 1970s-style inflation is off the table. If time allows, I’ll pen an Idle Speculator piece this summer on why that is. In the meantime:

Symmetry Capital Management, LLC (SCM) is a Pennsylvania-registered investment advisor that offers discretionary investment management to individuals and institutions. This publication is for informational, educational, and entertainment purposes only. It is not an offer to sell or a solicitation to buy securities, nor is it a recommendation to engage in any investment strategy. This material does not take into account your personal investment objectives, financial situation and needs, or personal tolerance for risk. Thus, any investment strategies or securities discussed herein may not be suitable for you. You should be aware of the real risk of loss that accompanies any investment activity, and it is strongly recommended that you consider seeking advice from your own investment advisor(s) when considering any investment strategy or security. SCM does not guarantee any specific outcome from any strategy or security discussed herein. The opinions expressed are based on information believed to be reliable, but SCM does not warrant its completeness or accuracy, and you should not rely on it as such.