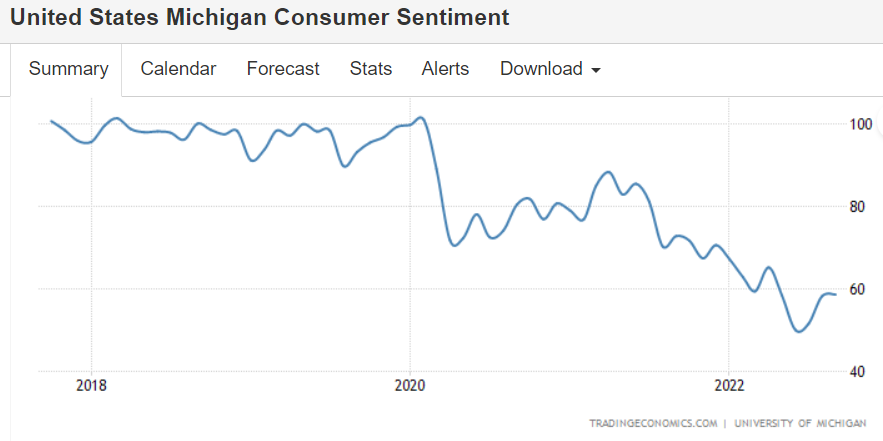

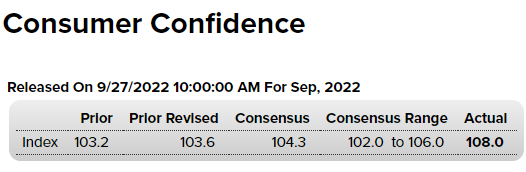

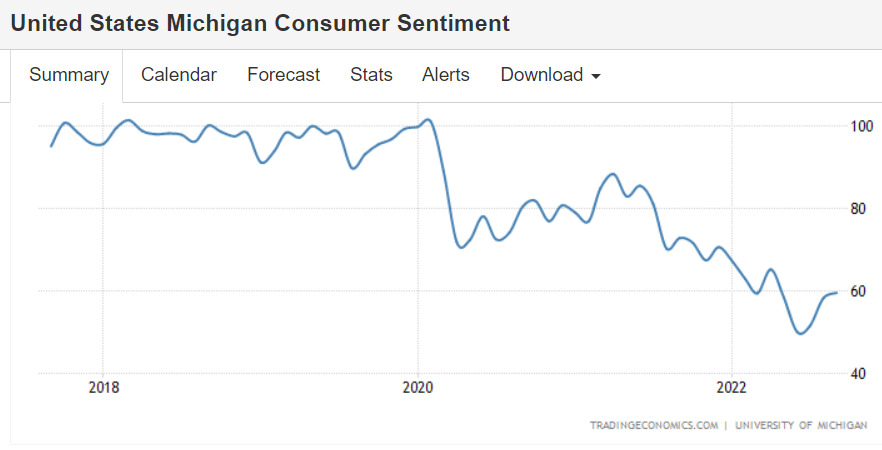

“The University of Michigan consumer sentiment for the US was revised lower to 58.6 in September of 2022 from a preliminary of 59.5, but remained above 58.2 in August and the highest in five months. Expectations were revised sharply lower (58 vs 59.9 in the preliminary estimate) while current conditions were seen better (59.7 vs58.9). Buying conditions for durables and the one-year economic outlook continued lifting from the extremely low readings earlier in the summer, but these gains were largely offset by modest declines in the long run outlook for business conditions. Meanwhile, inflation in the year ahead was seen higher (4.7% vs 4.6% in the preliminary estimate) while the five-year outlook was revised lower (2.7% vs 2.8%).” (United States Michigan Consumer Sentiment)