Still way down:

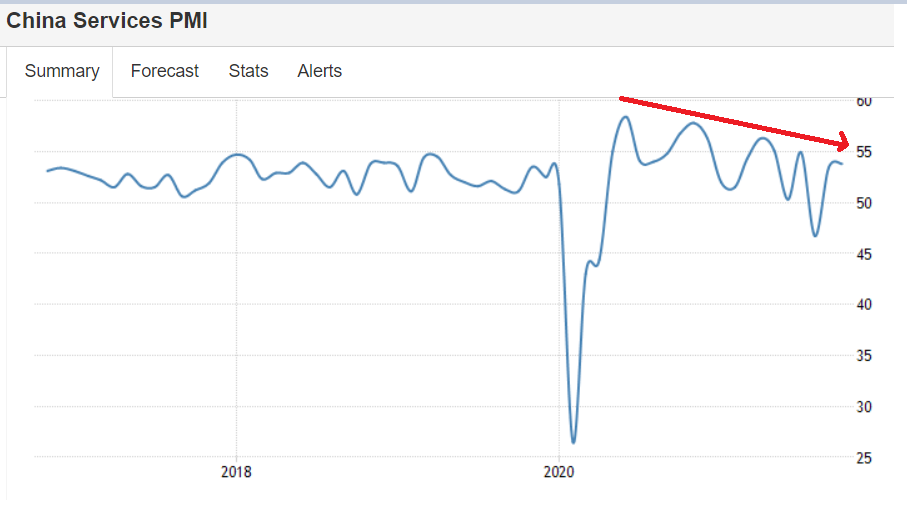

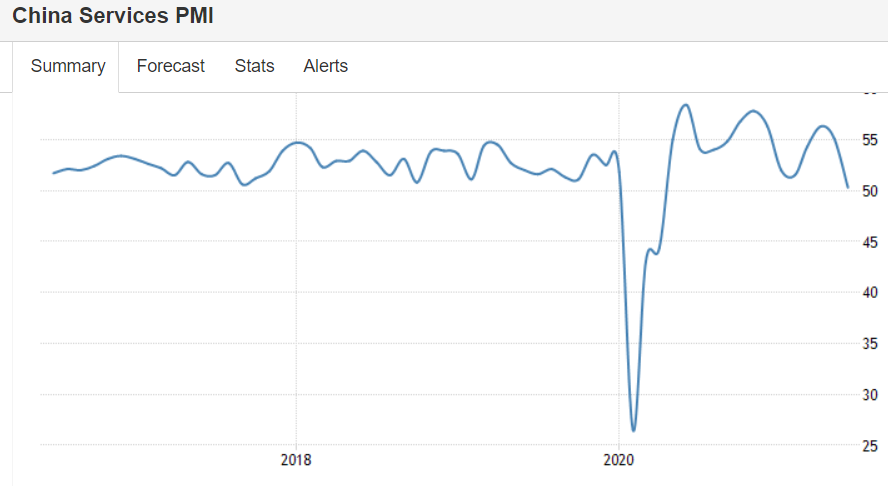

I like the headline but the chart not so much:

China Services PMI Rises to 3-Month High

The Caixin China General Services PMI increased to 53.8 in October 2021 from 53.4 in the prior month, pointing to the second straight month of expansion in the service sector and the steepest pace since July as COVID-19 outbreaks eased. New orders expanded the most in three months, export sales returned to growth, and employment rose for the second month in a row. Meantime, backlogs of work were unchanged following a three-month sequence of accumulation. On the cost front, input prices rose for the 16th straight month and increased at the fastest pace in three months on rising labor, and raw material costs; while output cost inflation accelerated to the quickest since July. Looking forward, sentiment weakened to a four-month low, due to concerns over rising costs and supply chain disruption.

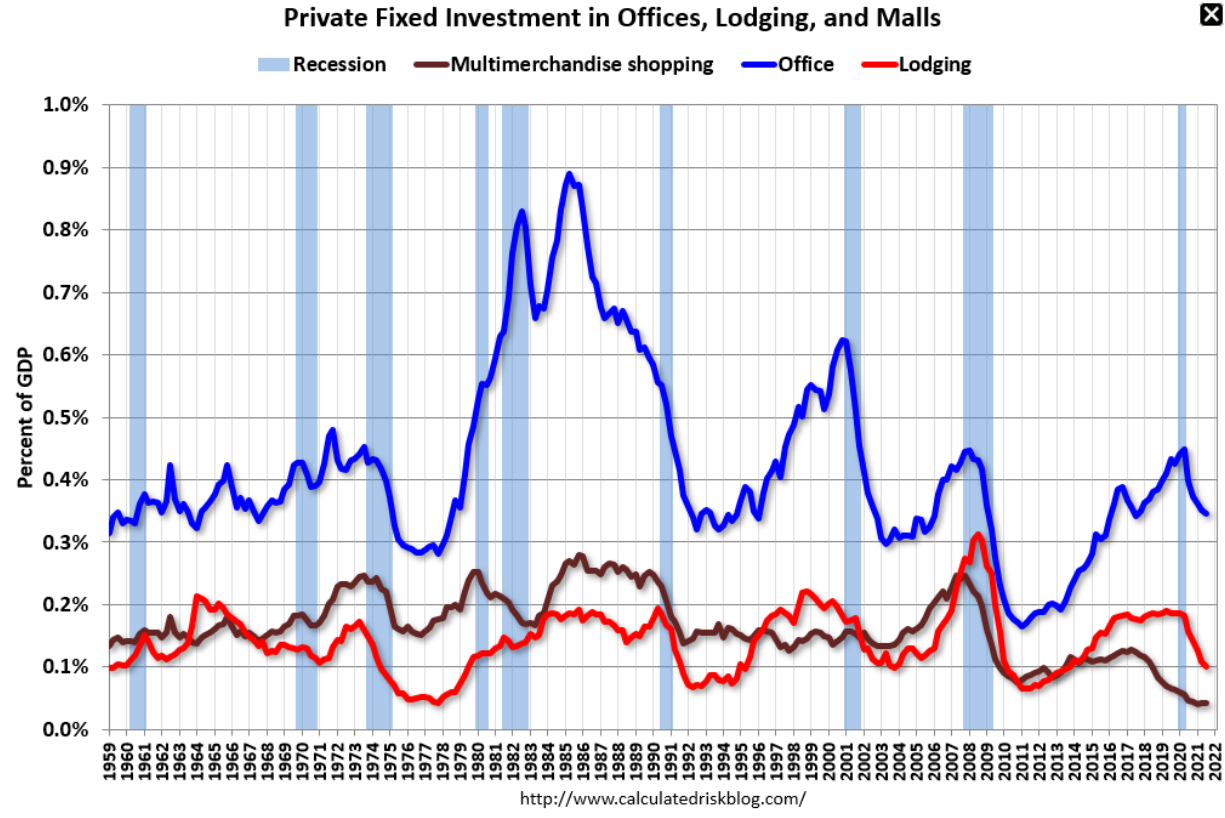

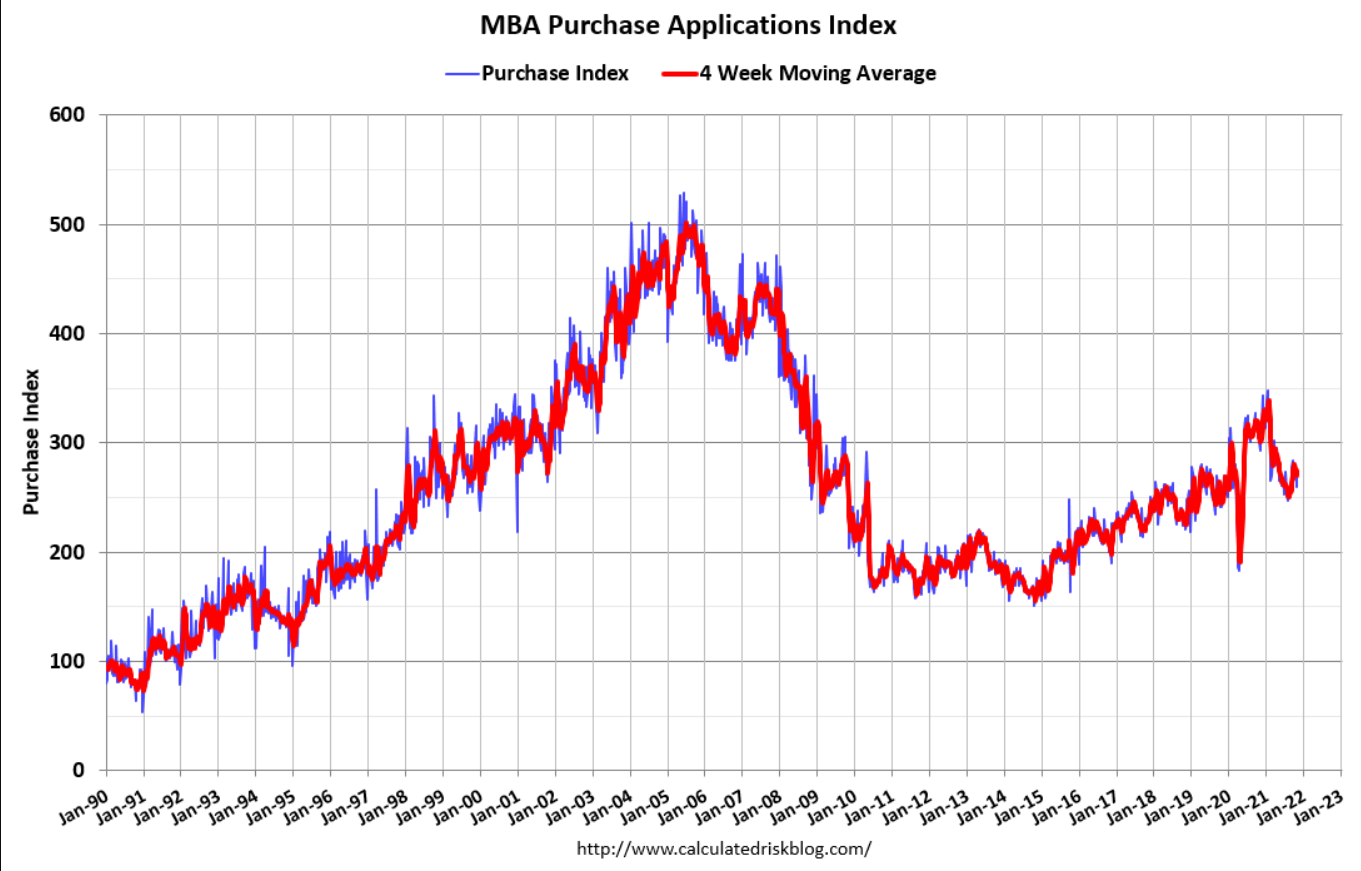

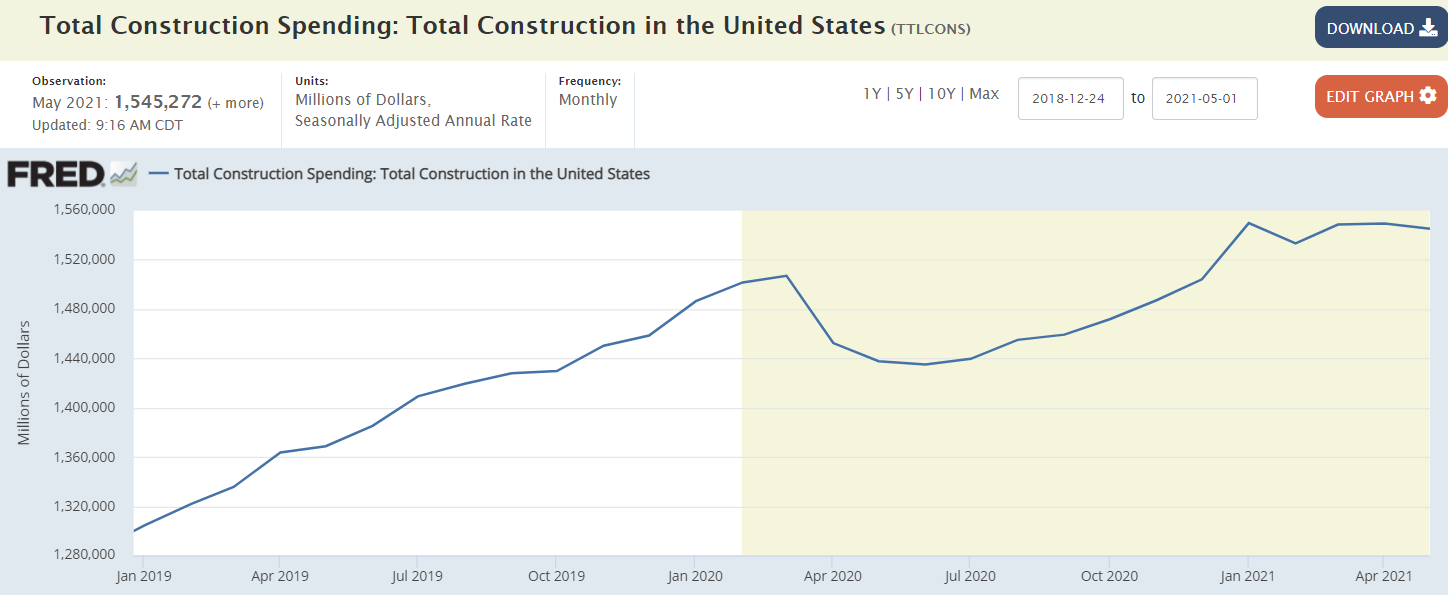

In case you thought the housing market is about interest rates:

“Mortgage applications to purchase a home fell 2% for the week and were 9% lower than the same week one year ago.”

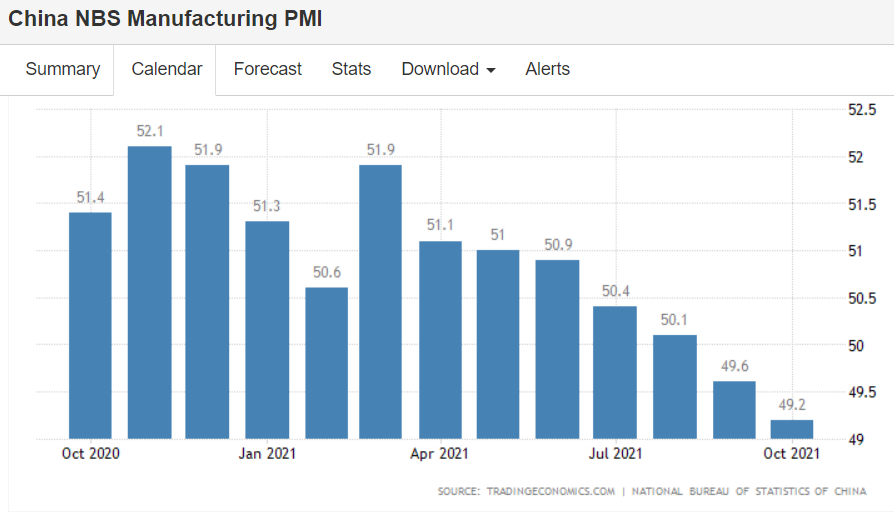

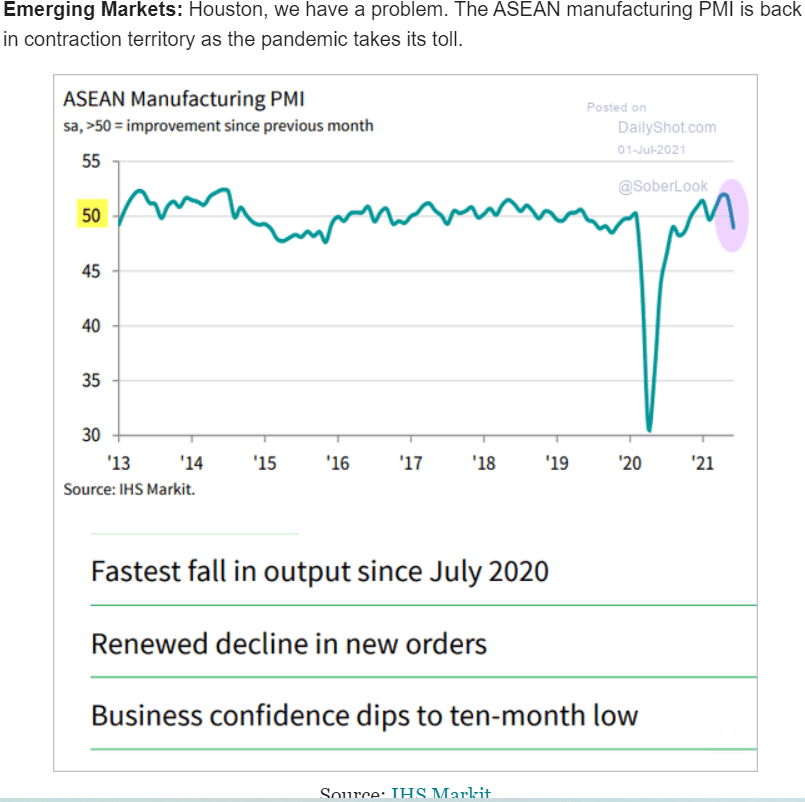

Seems a global thing:

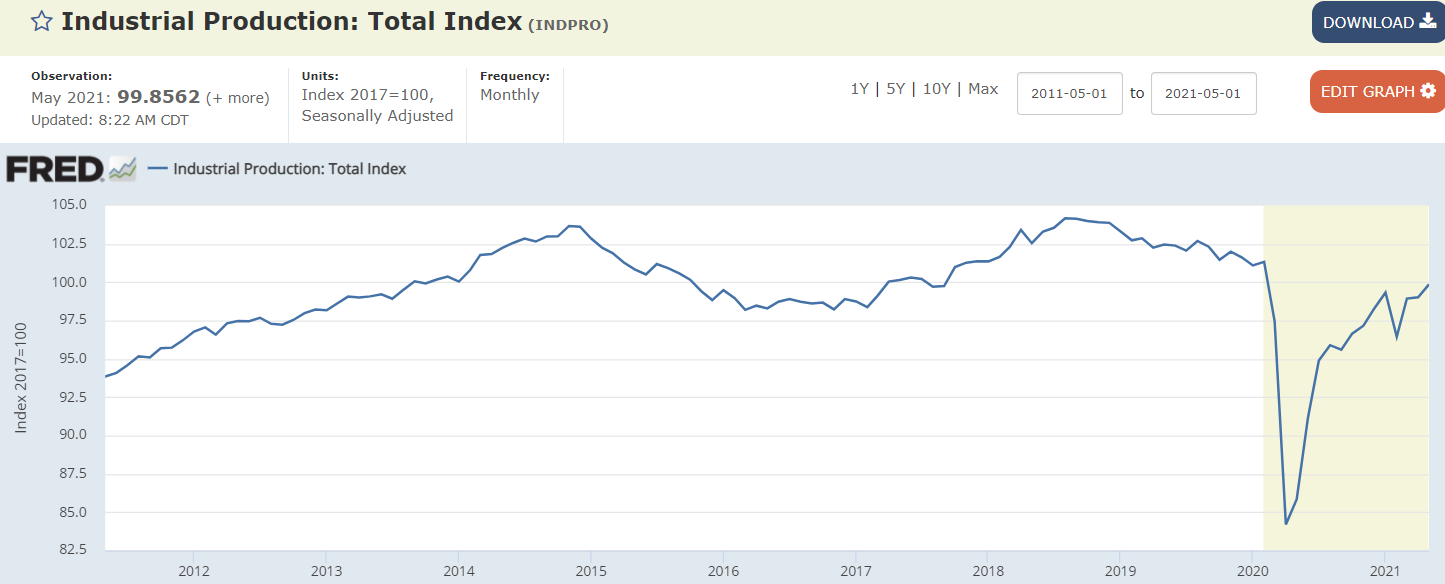

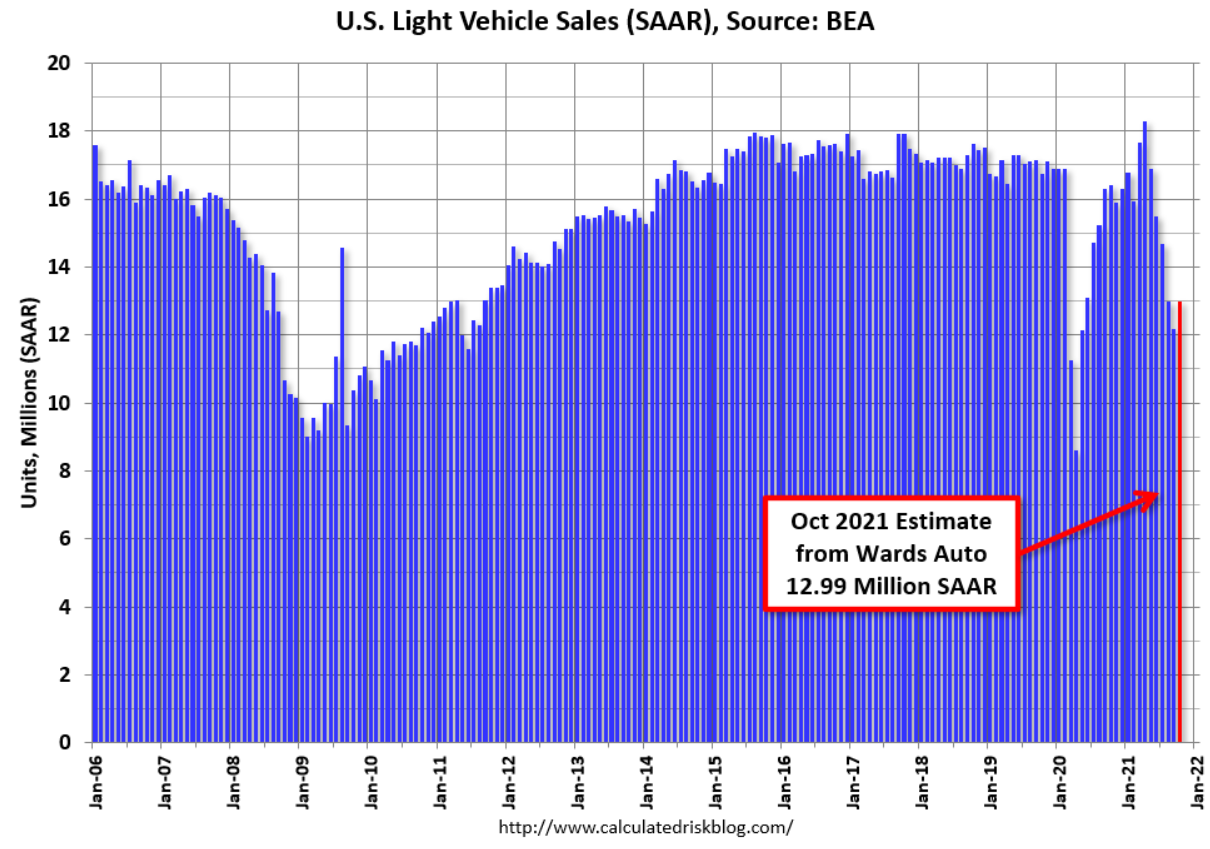

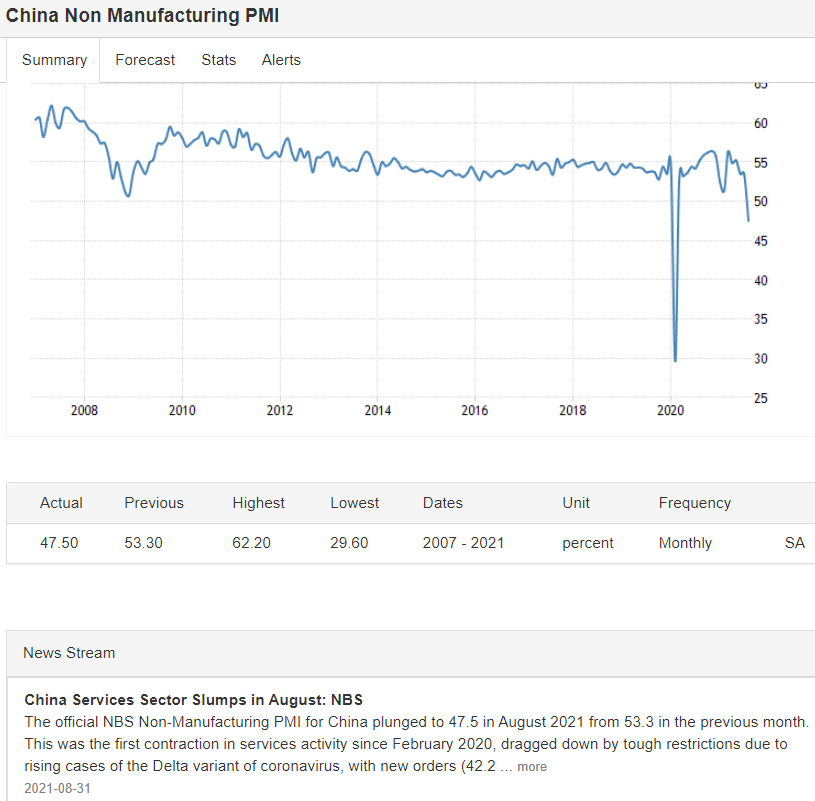

No recovery here:

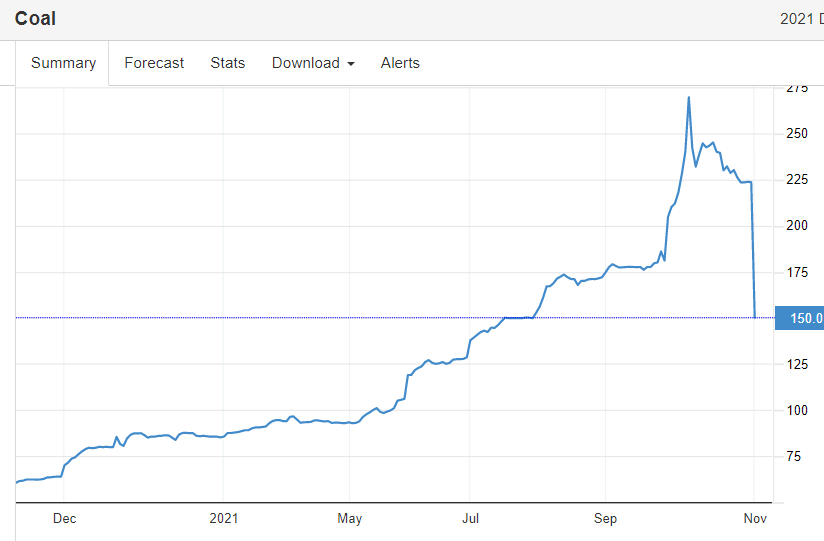

Another price reversal:

GC Newcastle coal futures tumbled by over 30% to $150 per metric ton, the lowest in three months, and are more than 40% below a record high of $269.5 hit on October 5th, as China stepped up policies to boost output ahead of the winter season. China’s average daily output increased by over 1.2 million tonnes to a record at above 11.6 million tonnes on October 18th. As a result, Chinese power plants now have stocks to produce power for 16 days from less than two days’ inventories at the start of October.

Deficit spending as a % of GDP heading south fast:

The American economy expanded an annualized 2% on quarter in Q3 2021, well below market forecasts of 2.7% and slowing sharply from 6.7% in Q2. It is the weakest growth of pandemic recovery as an infusion of government stimulus continued to fade and a surge in COVID-19 cases and global supply constraints weighted on consumption and production.

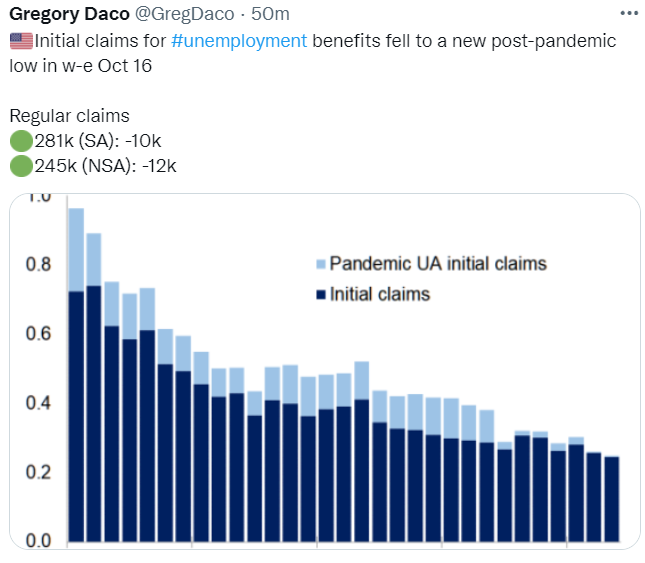

Gov’s saving money as claims fall:

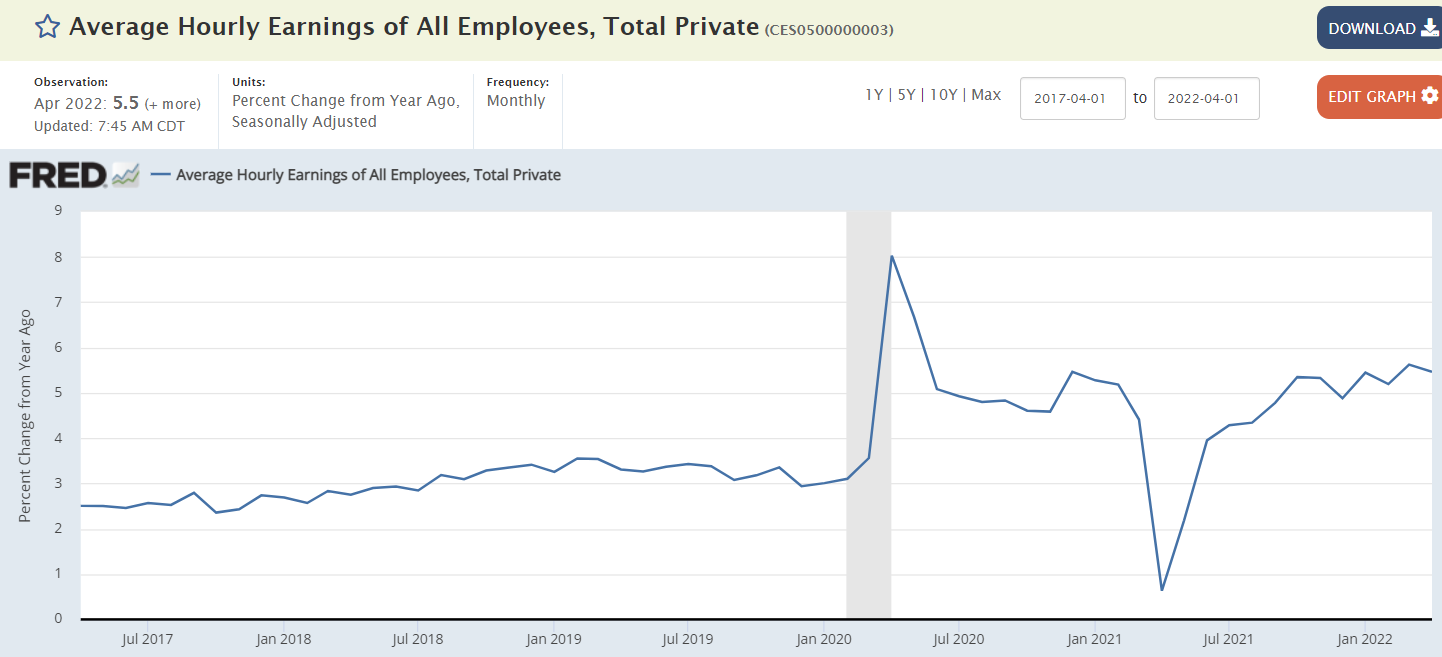

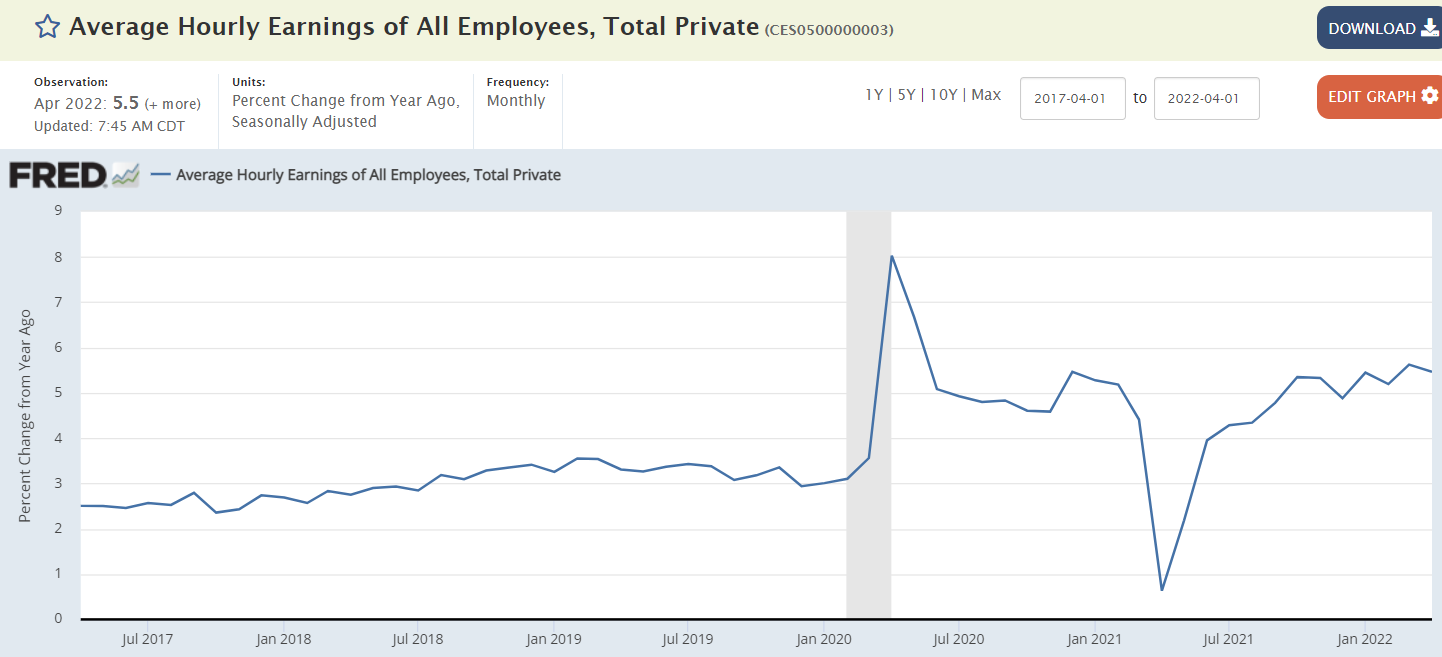

Transitory?

Big slump here:

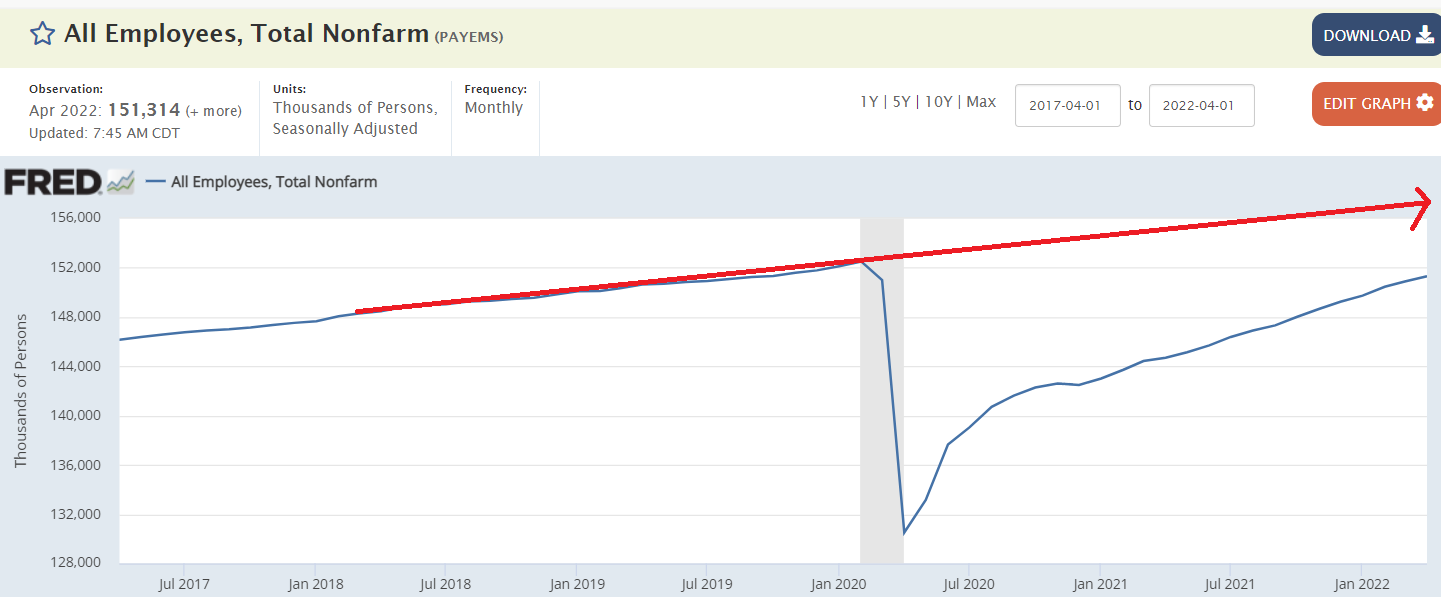

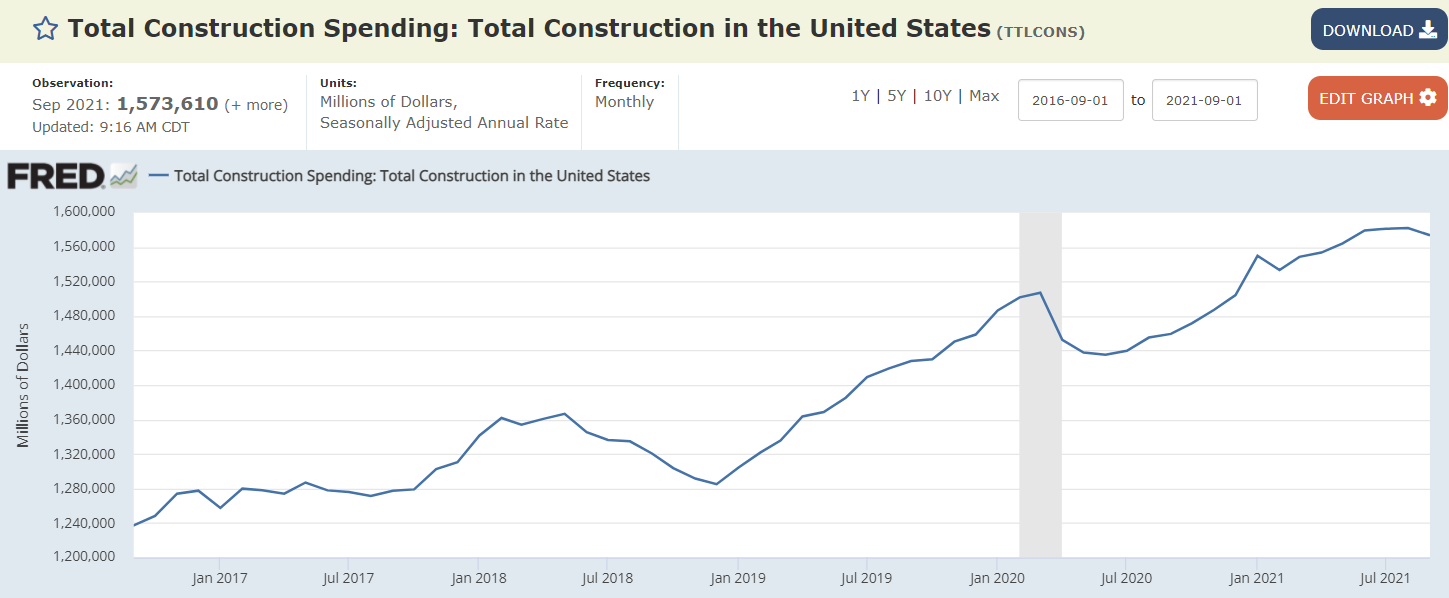

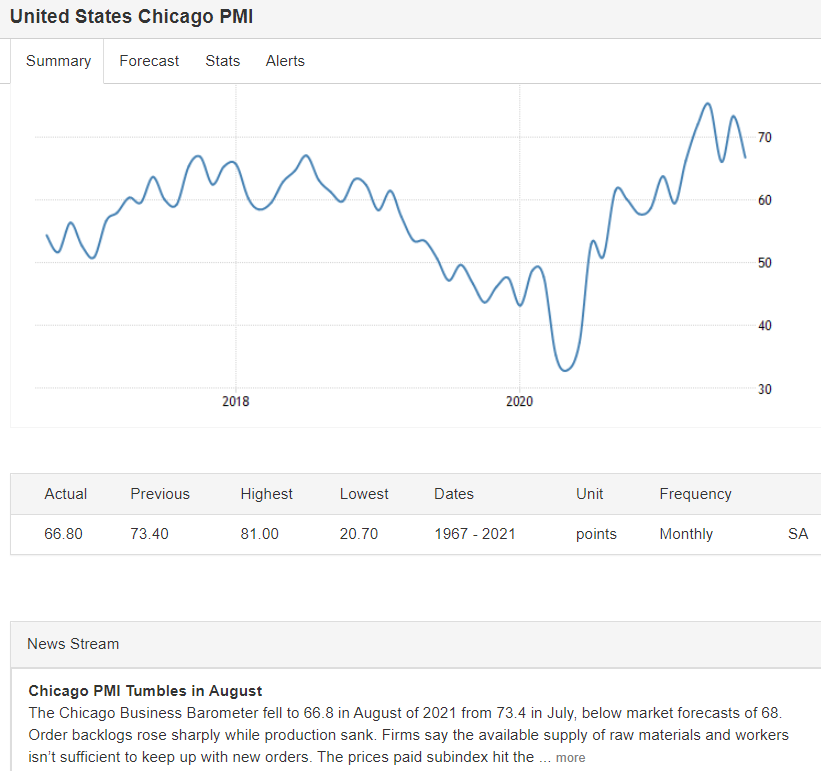

Weakness here as well:

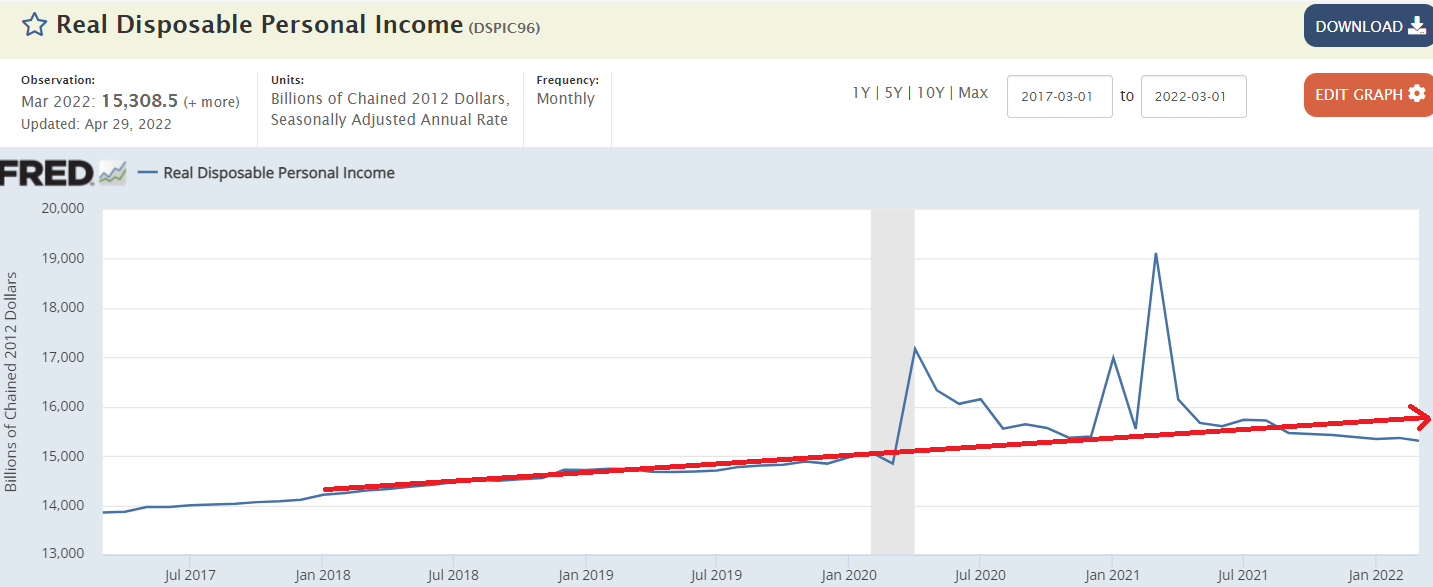

Collapse in front of expiring federal unemployment benefits:

Same pattern only more so:

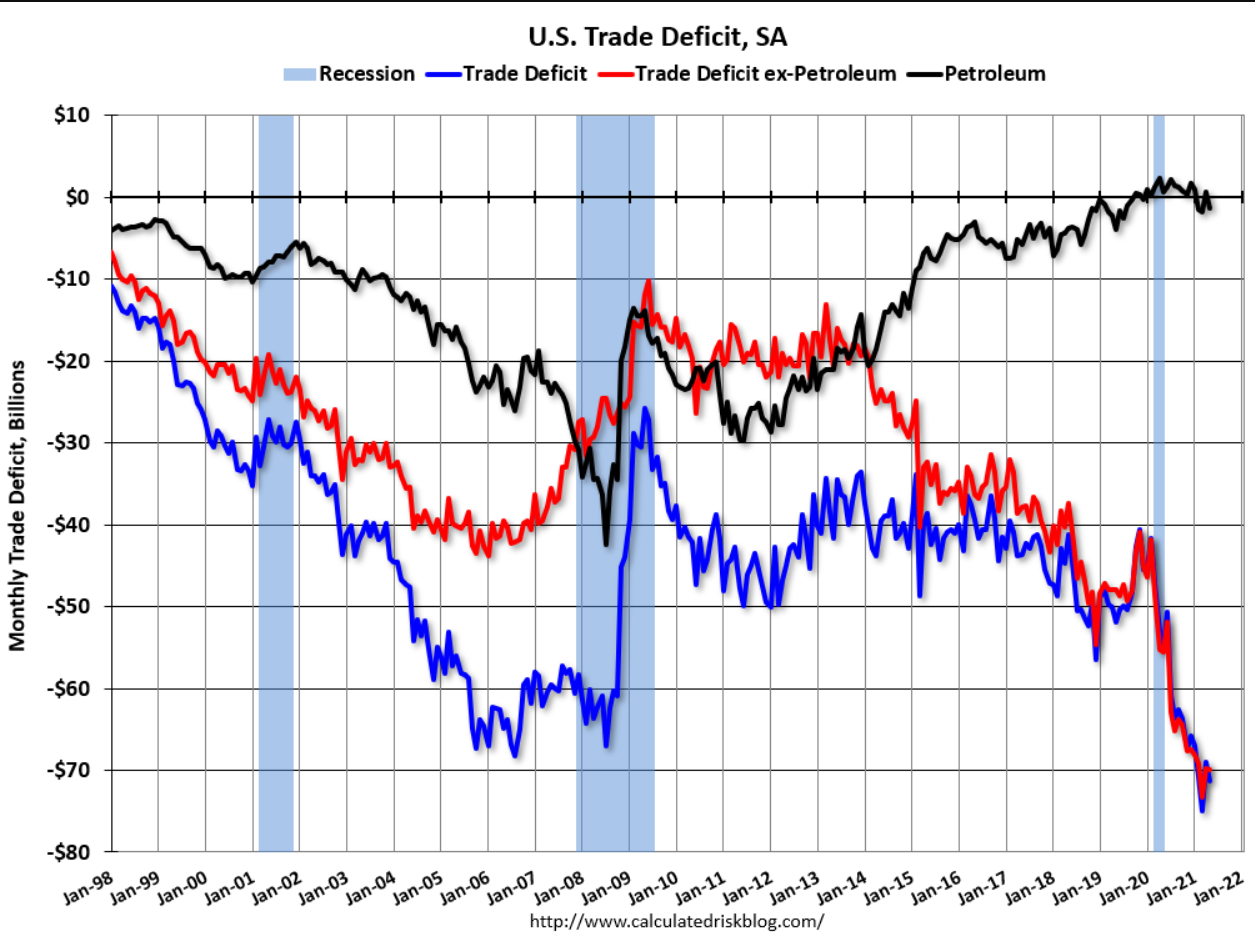

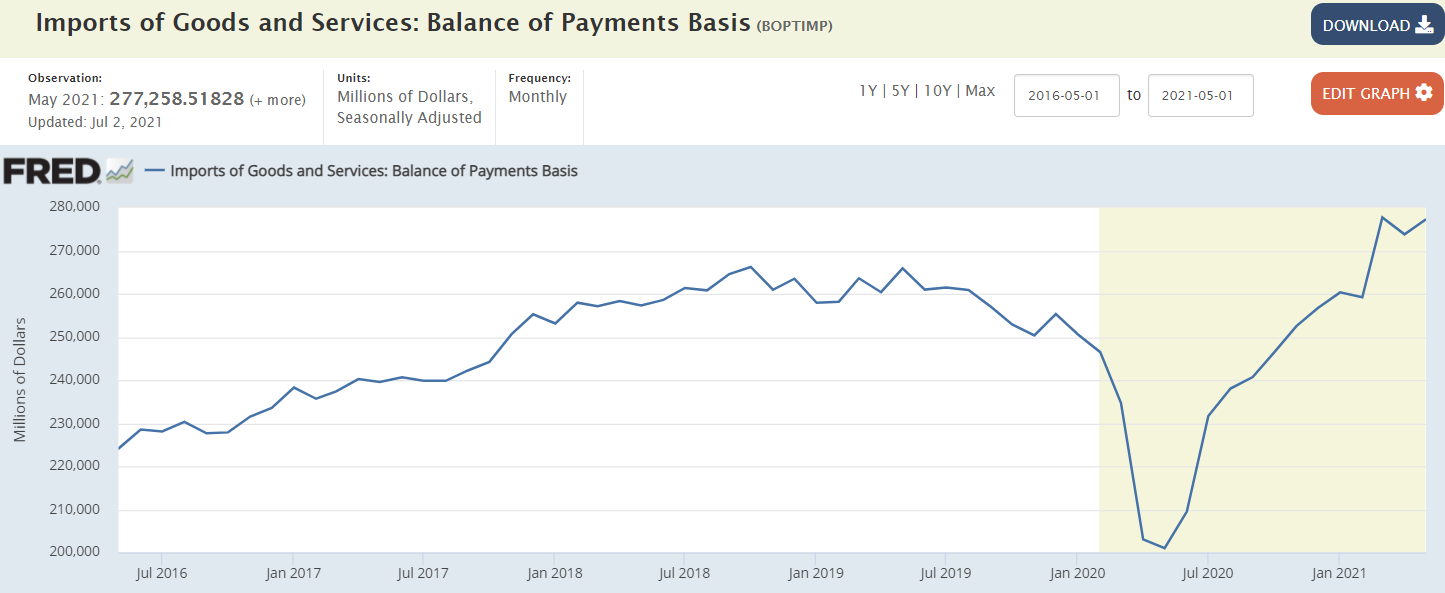

Americans spending more on imports= federal deficit spending that much less inflationary:

May exports were $206.0 billion, $1.3 billion more than April exports. May imports were $277.3 billion, $3.5 billion more than April imports.

Similar pattern:

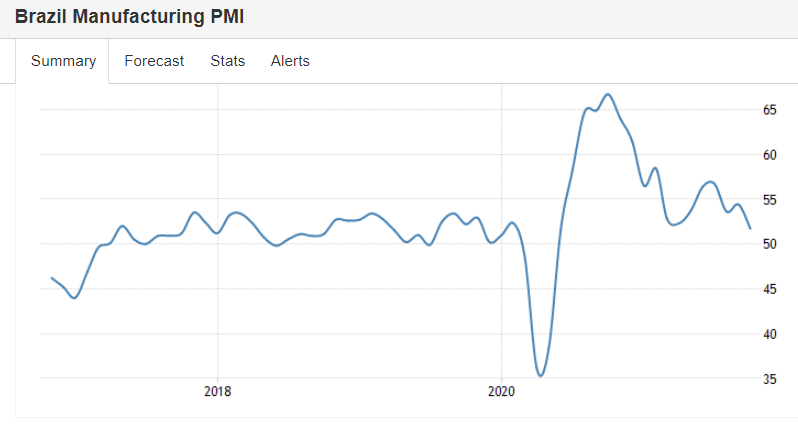

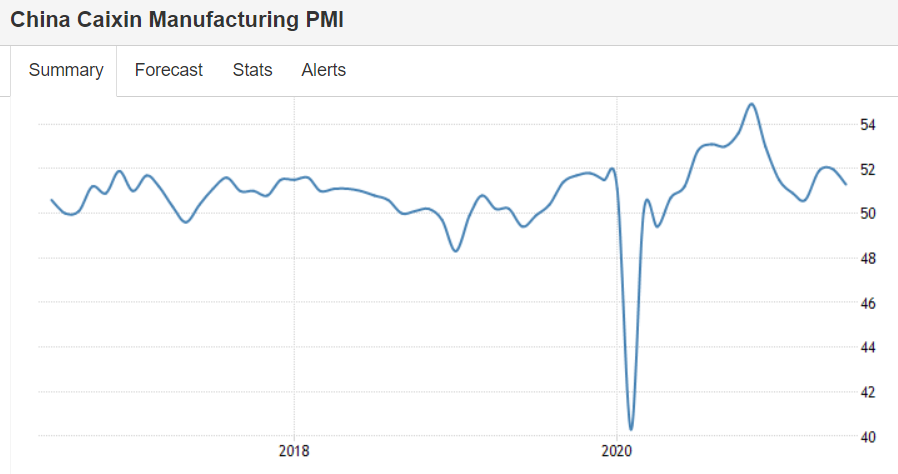

Seems to showing the same pattern as the US- covid dip, recovery, fade:

Same pattern here too:

Higher prices bringing out supply?

Epic housing shortage may finally be starting to lift (cnbc.com)

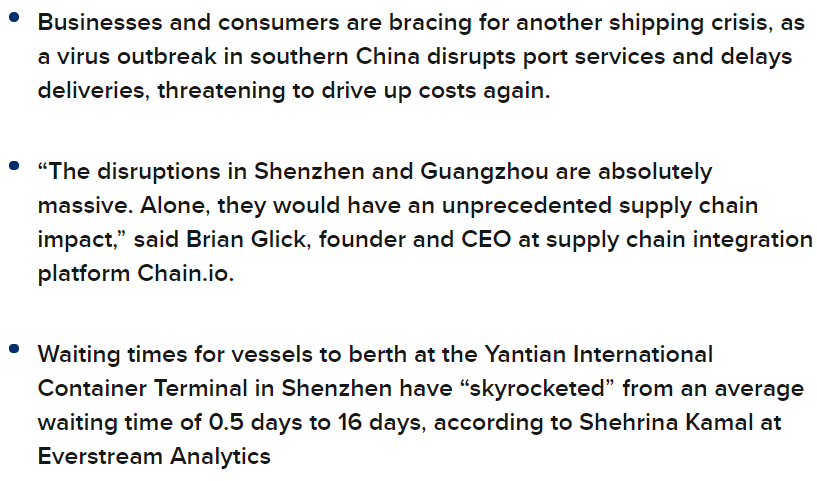

Another shipping crisis looms on Covid fears in southern China

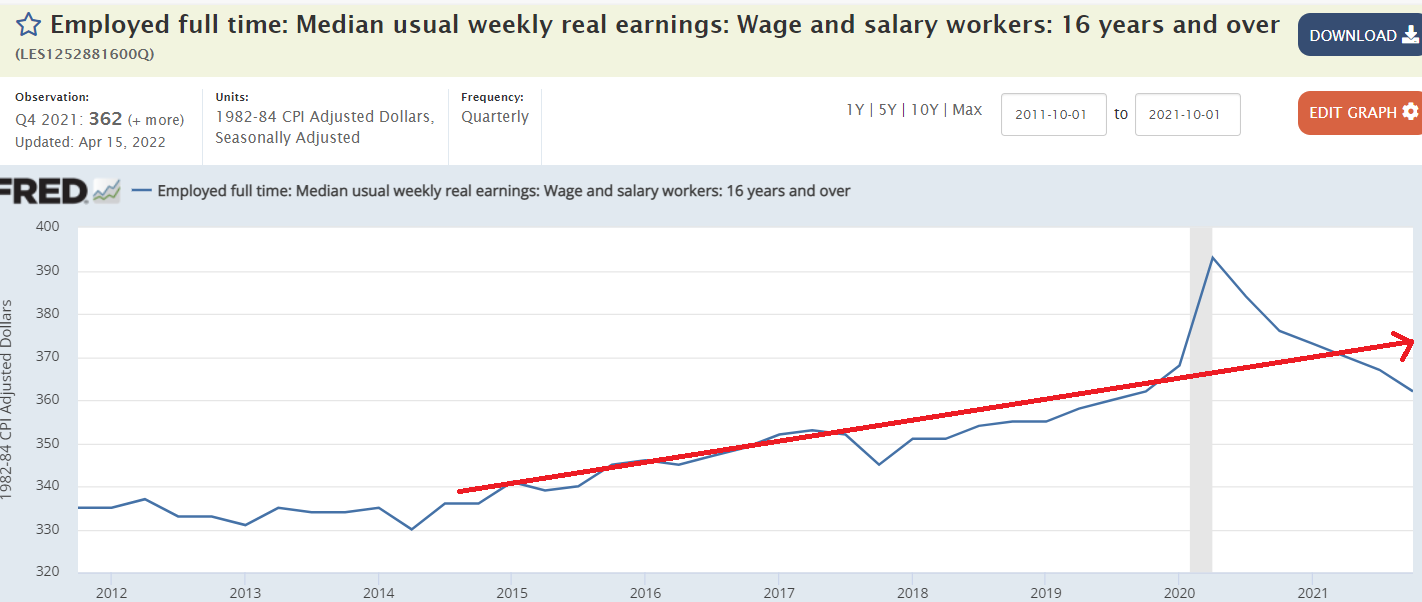

Still elevated though may be returning to trend?

Still struggling: