Please visit https://warrenmosler.com/blog/ for new posts!

Thank you!

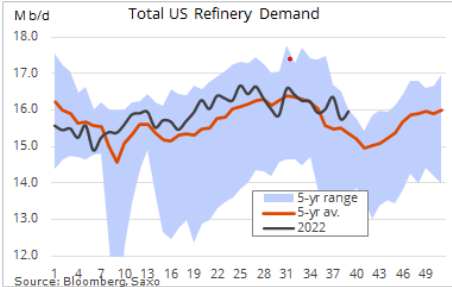

“Oil prices surged almost 2% on Wednesday, with WTI futures rising to almost $88 a barrel and Brent crude to above $93 a barrel, on expectations of tighter supply. Ministers from OPEC+ agree to cut production by 2M barrels per day today, double the volume previously flagged. The move came despite pressures from the US, with Washington arguing that economic fundamentals do not support a reduction in production. Still, output cuts could have a smaller effect on global supply because several countries are already pumping well below their quotas. Meanwhile, the EIA report showed US crude stocks unexpectedly fell by 1.356 million barrels last week, the second consecutive drop and the biggest in five weeks.”

Central Banks Are Stocking Up On Gold

Which Countries Own the Most Gold | SchiffGold

“Central banks purchase a net 270 tons of gold through the first half of the year. This fell in line with the five-year H1 average of 266 tons.”

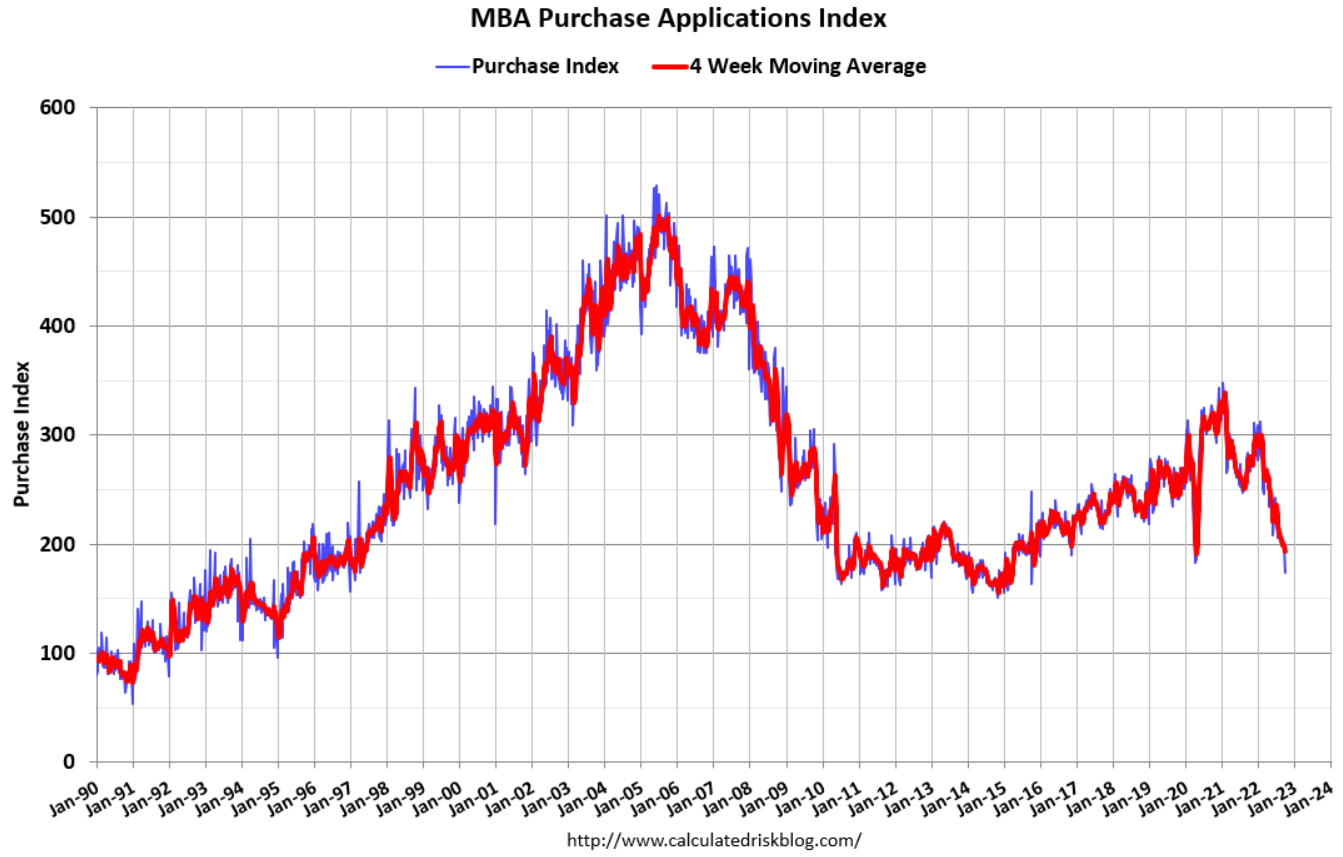

“Mortgage application in the US sank 14.2% in the last week of September, the biggest drop since April 2020, pushing the index to the 218.7, the lowest since 1997. Higher borrowing costs continue to weigh on demand but “there was also an impact from Hurricane Ian’s arrival in Florida last week, which prompted widespread closings and evacuations. Applications in Florida fell 31%, compared to 14% overall, on a non-seasonally adjusted basis“, Joel Kan, an MBA economist said.”