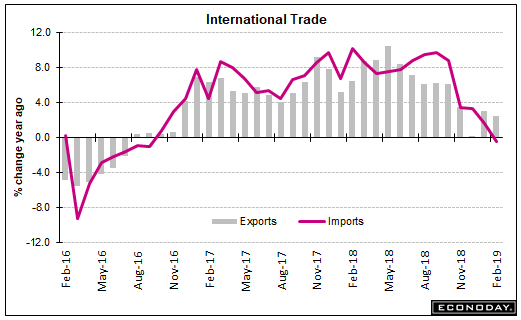

Imports and exports both decelerating indicates a weaker global economy, and weak US retail sales indicates domestic consumer spending growth is slowing:

Highlights

First-quarter GDP looks to get a major boost from improvement in the nation’s trade deficit which, for February, came in at much lower-than-expected $49.4 billion. And the positives are more than just a technical calculation as exports, driven by aircraft, jumped 1.1 percent in the month on top of January’s 1.0 percent gain.

Exports of goods rose 1.5 percent to $139.5 billion as civilian aircraft rose $2.2 billion in the month. Outside of aircraft, however, gains are less striking with auto exports up $0.6 billion and with monetary gold and consumer goods showing marginal gains. For farmers, the results are slightly in the negative column with exports down $0.2 billion. But exports of services, at $70.1 billion in the month and usually a reliable plus, rose 0.3 percent.

Imports rose only 0.2 percent in the month, totaling $259.1 billion but with consumer goods showing yet another large increase of $1.6 billion in the month. Imports of industrial supplies fell $1.2 billion despite a 0.8 billion rise in the oil subcomponent. Imports for other categories were little changed.

Bilateral country deficits show a sharp decline with China, down $24.8 billion in unadjusted monthly data that are hard to gauge given strong calendar effects during the lunar new year. But year-to-date, the deficit with China is at $59.2 billion and down sizably from $65.2 billion in the comparison with the 2018 period. February’s deficit with both the European Union and Canada narrowed while deficits with Japan and especially Mexico, at $7.4 billion vs January’s $5.8 billion, deepened.

Today’s results are certain to lift first-quarter GDP estimates which had been roughly at the 2 percent line. The average deficit for the first two months of the quarter is $50.3 billion which is well under the $55.6 billion monthly average in the fourth quarter. And the easing deficit with China may well ease immediate tensions in U.S.-Chinese trade talks.

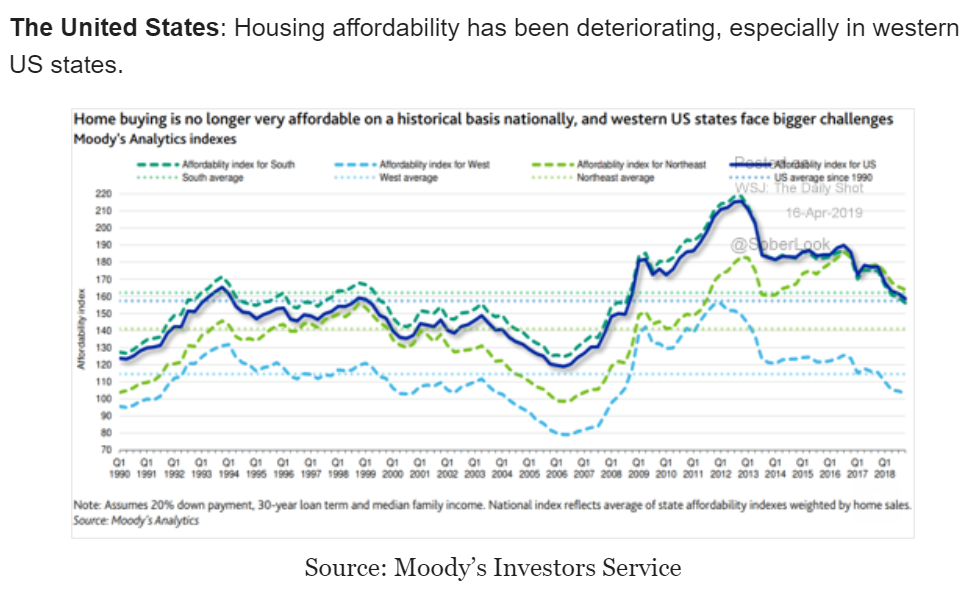

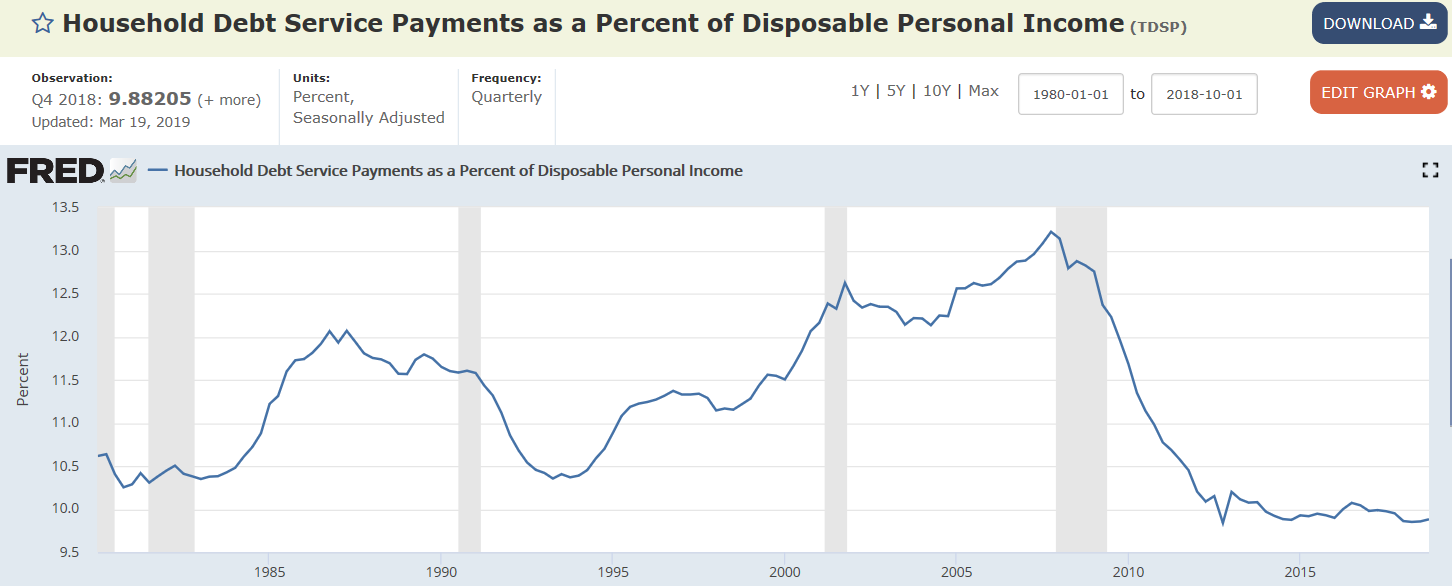

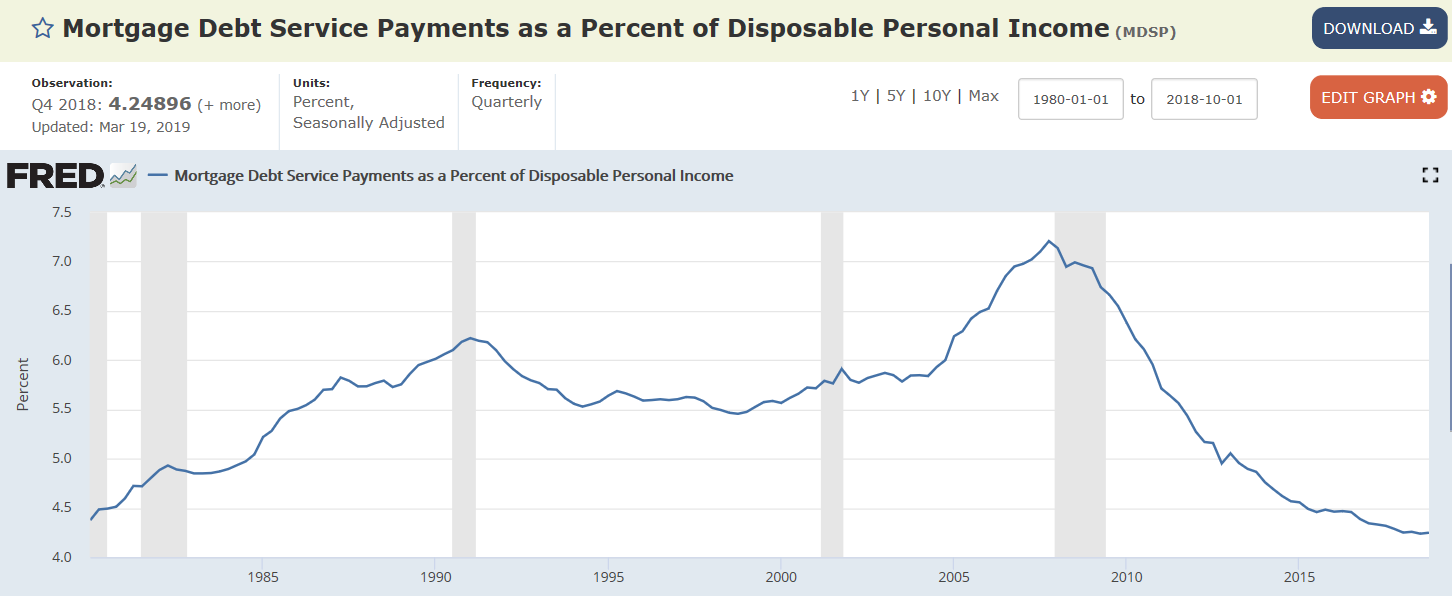

Interesting as debt service and financial burdens ratios remain historically low:

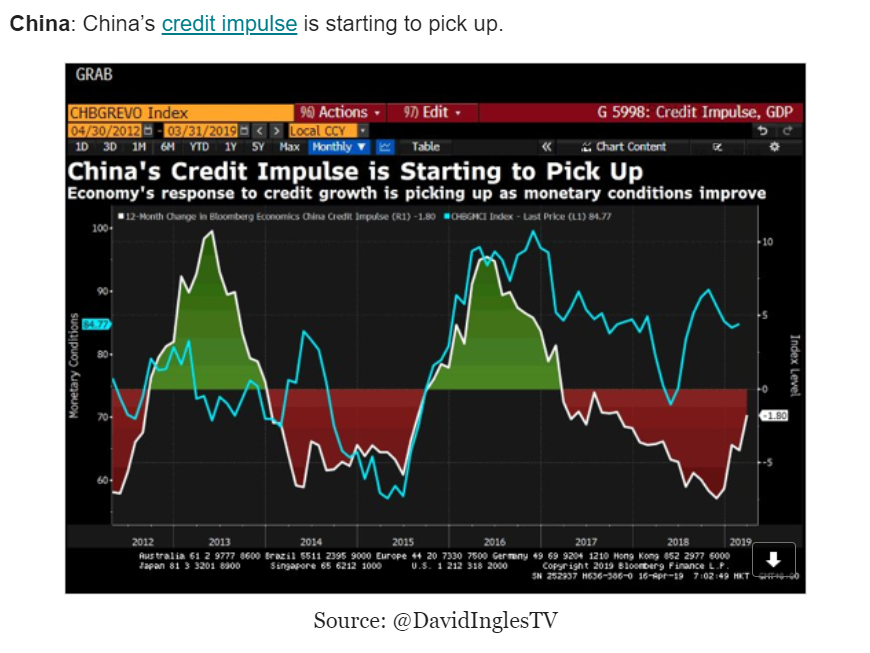

They’ve made fiscal adjustments that may be kicking in:

Bank of Japan to be top shareholder of Japan stocks

Bank of Japan to be top shareholder of Japan stocks (Nikkei) The BOJ held over 28 trillion yen ($250 billion) in exchange-traded funds as of the end of March — 4.7% of the total market capitalization of the first section of the Tokyo Stock Exchange. Assuming that the bank maintains its current target of 6 trillion yen in new purchases a year, its holdings would expand to about 40 trillion yen by the end of November 2020. This would place it above the GPIF’s TSE first-section holdings of more than 6%. The BOJ has likely also become the top shareholder in 23 companies through its ETF holdings. It was among the top 10 for 49.7% of all Tokyo-listed enterprises at the end of March.

This could explain why same store sales have been growing by about 5% year over year:

CNN: American retailers already announced 6,000 store closures this year. That’s more than all of last year.