Looks like the Saudis want prices to be a bit firmer:

Rail Week Ending 27 August 2016: All Rolling Averages Worsen And Remain In Contraction

Sept 2 (Econointerest) — Week 34 of 2016 shows same week total rail traffic (from same week one year ago) contracted according to the Association of American Railroads (AAR) traffic data. This week, all rolling averages’ contraction worsened.

Analyst Opinion of the Rail Data

We review this data set to understand the economy – and one element continues to stand out. If I remove coal and grain from the analysis, rail is declining a steady 5% year-over-year for the last 14 weeks. I do not understand what is going on because this piece of data says goods consumption is down 5% – and it is not being confirmed by any data coming from the Federal Reserve, US Census or BEA. This piece of data says the USA is in a recession – but the monetary measures say the economy remains in expansion.

The contraction began over one year ago, and now rail movements are being compared against weaker 2015 data – and this is the cause periodic acceleration in the short term rolling averages. Still, rail is weak to very week compared to previous years.

This analysis is looking for clues in the rail data to show the direction of economic activity – and is not necessarily looking for clues of profitability of the railroads.

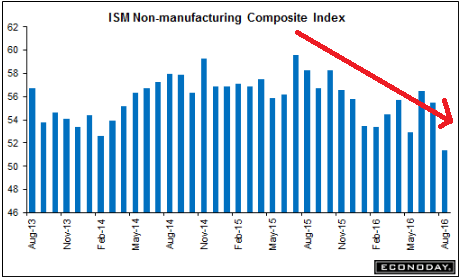

As previously discussed, the slowdown ‘spilled over’ into the service sector which has now been decelerating going on a year or so:

Highlights

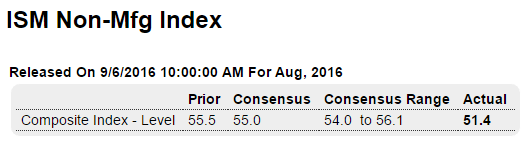

What had been one of the most consistently positive indicators stumbled badly in August as the ISM non-manufacturing index fell more than 4 points to 51.4. This is the lowest rate of composite growth for this sample of the whole cycle, since February 2010.

And the composite score is no fluke with new orders falling nearly 9 points to 51.4 for their lowest score since December 2013. New export orders are a particular disappointment, also down a steep 9 points and in contraction at 46.5 which is also the lowest score since December 2013. And backlog orders are also in contraction, down 1-1/2 points to 49.5.

August’s lack of orders points to a weak spot ahead for other readings including business activity which has already slowed sharply, down 7-1/2 points to 51.8. Employment in the sample is still rising but only marginally, down 7 tenths to 50.7. Inventories are in contraction and prices paid are showing only modest pressure.

But there are positive spins to the report. New orders have been exceptionally strong in recent months including July’s 60.3 and the prior strength should help ISM’s sample bridge what hopefully will prove a one-month breakdown. Another positive is that most readings are still over 50 to indicate monthly growth which is underscored by what is still favorable breadth as 11 of 18 industries are still above 50. This report is not make-or-break for the economic outlook but it certainly will not raise pressure for a rate hike at this month’s FOMC meeting.