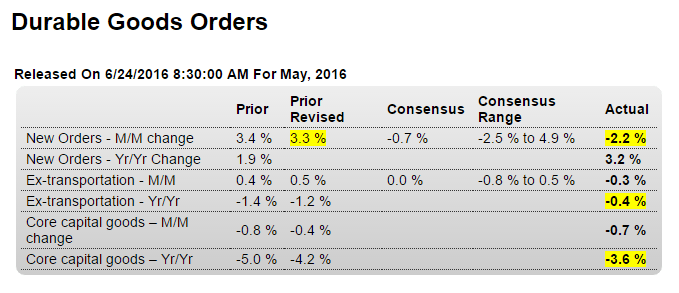

Weaker than expected, and turns out it was up in April followed by down in May as previously discussed:

Highlights

May proved to be a generally weak month for the factory sector. Minus signs spread across the durable goods report with total new orders down a very sizable 2.2 percent and ex-transportation orders, which exclude aircraft and vehicles, down 0.3 percent.The worst news comes from capital goods, a sector where weakness points to weakness in business investment and ultimately the nation’s productivity. Orders for core capital goods fell 0.7 percent in the month while shipments, which are inputs into the nonresidential investment component of GDP, fell 0.5 percent.

Overall shipments also fell, down 0.2 percent with inventories in thankful contraction, down 0.3 percent and holding the inventory-to-shipments ratio unchanged at 1.65. Unfilled orders, which outside of April’s 0.6 percent gain have not been strong, rose a modest 0.2 percent in May.

Vehicles, like they were in the industrial production report, were once again very weak with orders down 2.8 percent and shipments down 3.4 percent. Vehicle sales, however, have been solid and point to a rebound for the related factory data. Orders and shipments for commercial aircraft remain solid with orders in May up an unusually tame 1.0 percent. Machinery orders, at the heart of the capital goods group, are down for a second month with both primary and fabricated metals showing order declines.

The decline in capital goods is certain to pull back second-quarter GDP estimates which, in the 2 percent range, aren’t that strong to begin with. The dollar’s decline this year has not done much to lift exports or the factory sector which going into Brexit, and the ensuing spike in the dollar, was simply flat.

Revised down a bit:

Brexit comments:

So should Parliament follow through and somehow break their EU ties, what’s left is to (re)negotiate what I’ve read is thousands of trade related agreements. And at the rate of maybe one per year that could take quite a while….

The question then is whether current arrangements are allowed to remain pending negotiations, or if trade itself is halted pending negotiations. Seems the former is in the best interest of both sides, which is not to say that’s what they will do, of course.

As for other EU members leaving, it’s a whole lot more problematic as it would entail creating new currencies, which has not had the support of the majority of the voters in any euro area member nation.

Wouldn’t surprise me if the whole thing falls out of the news cycle over the next week or so.