Bad:

PMI Manufacturing Index

Highlights

The manufacturing PMI has been consistently running warmer than other manufacturing surveys which helps put into context the disappointment of December’s slowing to 51.2, down from 52.8 in November. The final reading for December is 1 tenth lower than the mid-month flash. Near stagnation in new orders is a key negative in the report, one that points to further slowing for the headline index in coming readings. Orders are still growing but at their slowest pace of the recovery, since September 2009. Backlog orders are contracting sharply, the most since September 2009 as well. The report points to widespread weakness across orders including for export orders where manufacturers continue to site strength in the dollar as a negative.

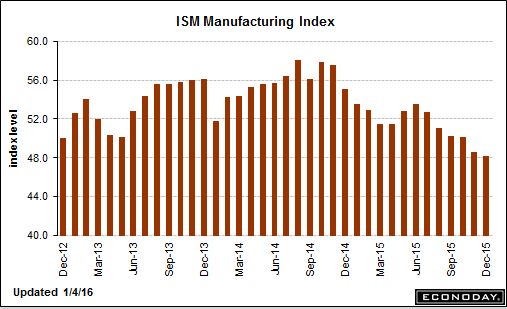

Very bad, employment down, but export orders did manage a bounce:

ISM Mfg Index

Highlights

ISM manufacturing sample is reporting the weakest conditions since July 2009. At 48.2, December is much lower than Econoday’s 49.2 consensus and is only the third sub-50 reading of the recovery. But the story is much the same as it was in November which came in at 48.6 with both months showing slight contraction underway for both new orders and production. Employment in the sample, however, is noticeably weaker than November, at 48.1 for a more than 2 point decline and the second sub-50 reading in the last three months. A sizable 4.5 point rise for new export orders to 51.0 is a positive in the report. Inventories are steady and low but the sample still say inventories are a little bit high which betrays caution in their outlook. Prices for raw materials continue to contract, a reminder that low oil and commodity prices are making it difficult for the Fed to reach its 2 percent inflation target. This report points to ever softer conditions for a sector that, held down by energy and weak foreign demand, showed very little life during 2015.

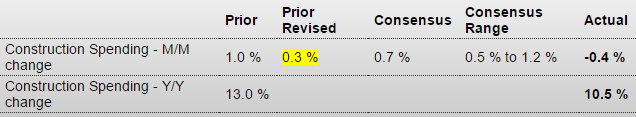

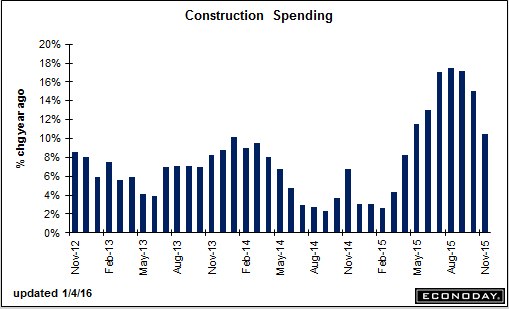

And more bad. Note the ‘processing error’ which resulted in reductions to prior months. As suspected, things have been worse than reported ever since the collapse in oil capex a little over a year ago. And as the chart shows, the blip up as the NY tax credit expired in June continues to reverse:

Construction Spending

Highlights

Construction spending had been a highlight of the U.S. economy but less so with November’s report where the headline fell 0.4 percent, far below the Econoday consensus for plus 0.7 percent. The year-on-year gain for spending, at 10.5 percent, is the lowest since April last year. Today’s report also includes sharp downward revisions to prior months, the result of a processing error going back to January last year. October’s initial 1.0 percent monthly gain is now cut 7 tenths to 0.3 percent while September is now at plus 0.2 percent vs an initial plus 0.6 percent.

The processing error, unfortunately for the housing outlook, is centered in the residential component where prior strength has been cut back. Still, residential spending rose 0.3 percent for a second month in a row that follows September’s very solid 1.2 percent gain. Spending on new single-family homes has been rising strongly with the year-on-year rate at a very solid plus 9.3 percent. Spending on multi-family homes did fall in November but has been in fact booming in prior months, up 24.5 percent year-on-year.

Spending on nonresidential construction has also been solid, down in November but with the year-on-year rate at plus 13.6 percent. Public spending has been led by the educational component, up 15.2 percent year-on-year, with highway spending behind at plus 5.6 percent.

Canada Manufacturing PMI at Record Low

Jan 4 — The RBC Canadian Manufacturing PMI dropped to 47.5 in December of 2015 from 48.6 in the previous month. It is the fifth contraction and the lowest reading on record due to weak output, new orders and employment.

China Caixin Factory Activity Contracts for 10th Month

Jan 4 — The Caixin Manufacturing PMI in China dropped to 48.2 in December of 2015 from 48.6 in November and below market expectations. While the reading was the lowest in 3 months, factory activity has been in a contraction since March. Production declined for the seventh time in the past eight months, driven in part by a further fall in total new work. Client demand was weak both at home and abroad, with new export business falling for the first time in three months. Manufacturers continued to trim their staff numbers and reduce their purchasing activity in line with lower production requirements. Meanwhile, deflationary pressures persisted, as highlighted by further marked declines in both input costs and selling prices.