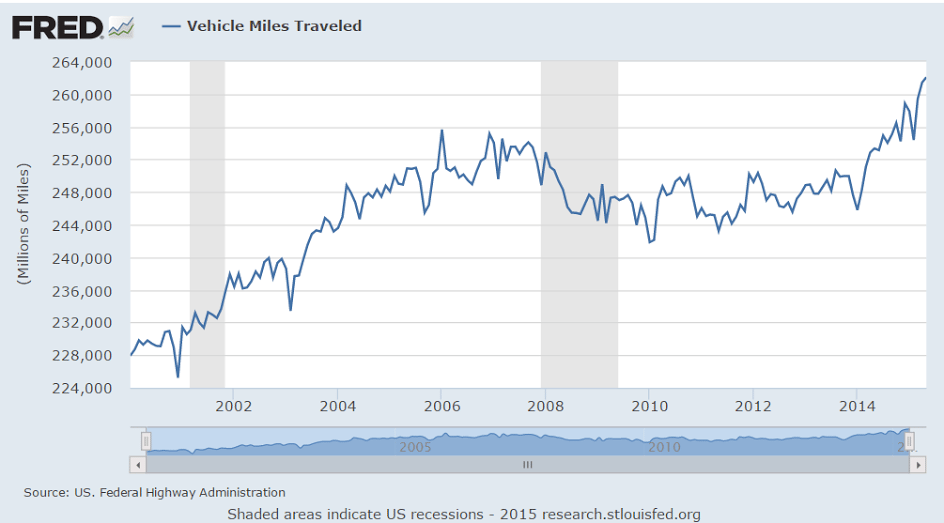

With prices down, drilling is down over 50%, and production is beginning to fall as well. At the same time, gasoline consumption and miles driven are both up. Therefore, some of the money saved due to lower prices is being spent to buy more gasoline, which, with domestic production falling, means more imported oil and gasoline, which does nothing for the economy. And works to weaken the $US.

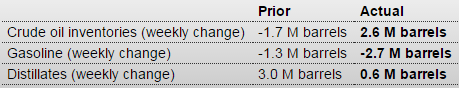

EIA Petroleum Status Report

Highlights

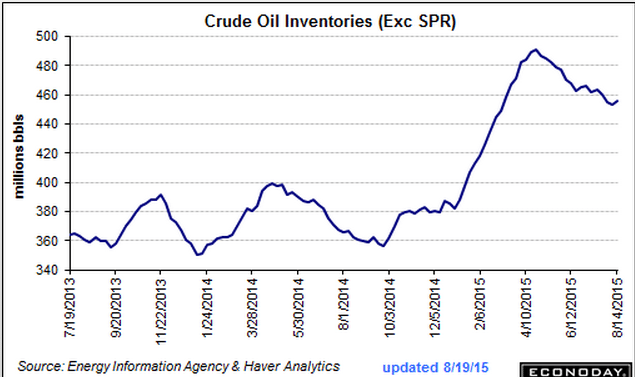

Oil is moving lower following a 2.6 million barrel build in weekly oil inventories to 456.2 million barrels. A rise in imports fed the build. Demand readings are very strong in this report with gasoline up very sharply, at 6.5 percent year-on-year. Refineries increased production of gasoline where inventories nevertheless fell 2.7 million barrels. The decline in prices is boosting fuel demand. WTI is down 75 cents and is below $42.

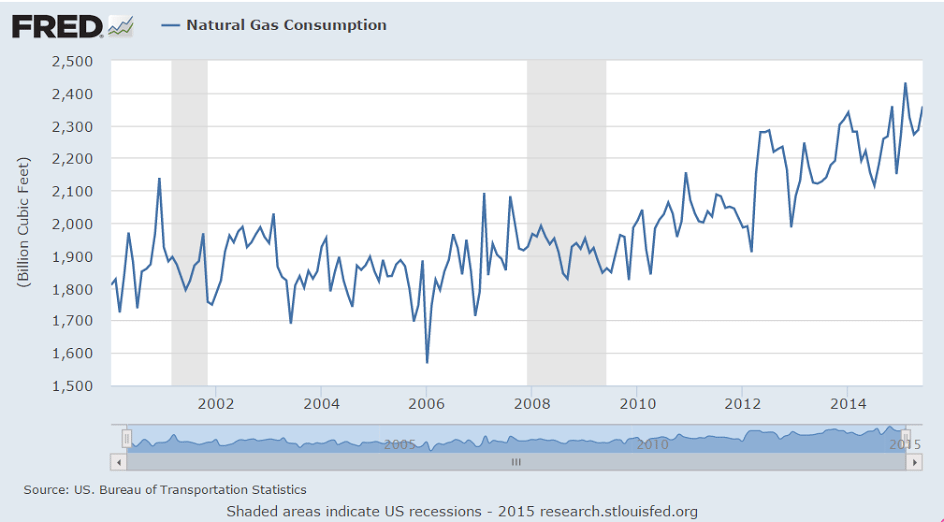

At the same time, since natural gas is a by product of shale oil drilling, with drilling down natural gas production is that much lower than otherwise, even as demand continue to grow.

And unlike oil, natural gas is very expensive to import as it must first be liquified, so as demand increases and supply fades, the price is likely to go up to the point where imports make sense, or where utilities and others substitute other fuels for natural gas. However for the most part that would mean coal which is becoming more and more politically incorrect.