Employment Situation

Highlights

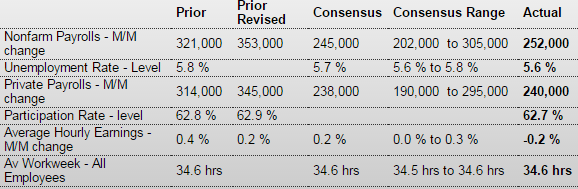

The December employment situation was somewhat stronger than expected at the headline level but the payroll numbers softened. In terms of actual numbers, the report was mixed.

Payroll jobs advanced 252,000 after jumping a revised 353,000 in November. Analysts projected a 245,000 gain. October and November were revised up notably by a net 50,000. The unemployment rate decreased to 5.6 percent from 5.8 percent in November. Expectations were for 5.7 percent. Wages actually fell back for the latest month.

Going back to the payroll report, private payrolls increased 240,000 after rising 345,000 in November. Expectations were for 238,000.

Goods-producing jobs jumped in December, led by construction which advanced 67,000 in December after a 20,000 increase the month before. Manufacturing employment increased 17,000, following a jump of 29,000 in November. Mining rose 3,000 in December, following a 1,000 boost the prior month.

Private service-providing jobs gained 173,000 after a 294,000 jump in October. The latest increase was led by professional & business services. Government jobs increased 12,000 after rising 8,000 in November.

Average hourly earnings slipped 0.2 percent in December after gaining 0.2 percent the prior month. Expectations were for a 0.2 percent rise. Average weekly hours were unchanged at 34.6 hours and matched expectations.

The December jobs report was mixed. Payroll gains beat expectations but slowed from November. Wage growth softened. The unemployment rate dipped but partially on a lower participation rate. Still, the labor market is showing overall improvement. However, today’s numbers will only increase debate within the Fed on just how strong or soft the labor market really is.

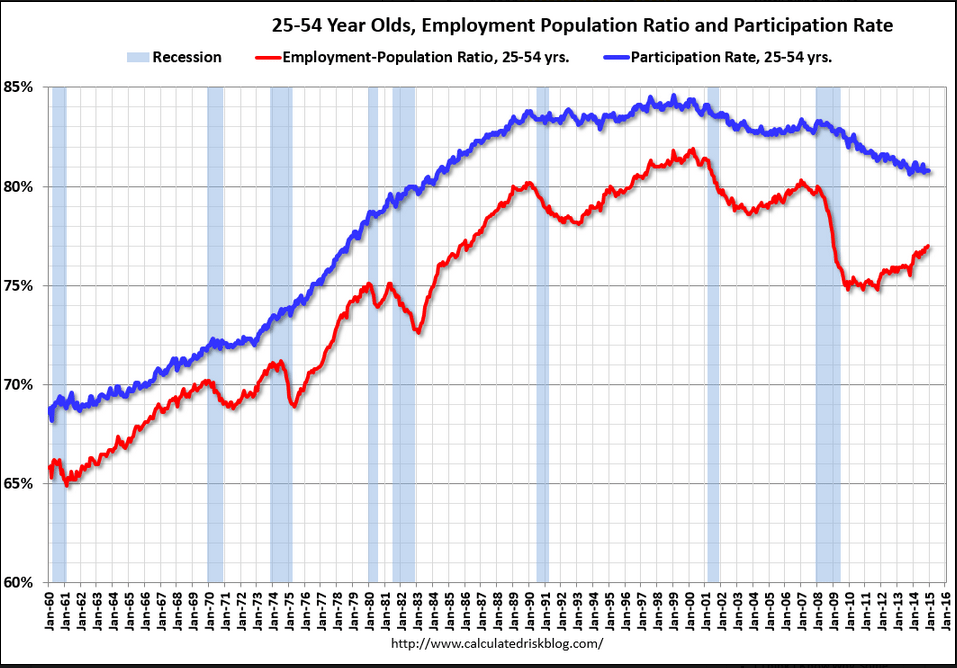

This chart takes out the ‘demographics’ by looking only at 24-55 year old Americans.

It shows how ‘the problem’ remains a massive shortage of aggregate demand:

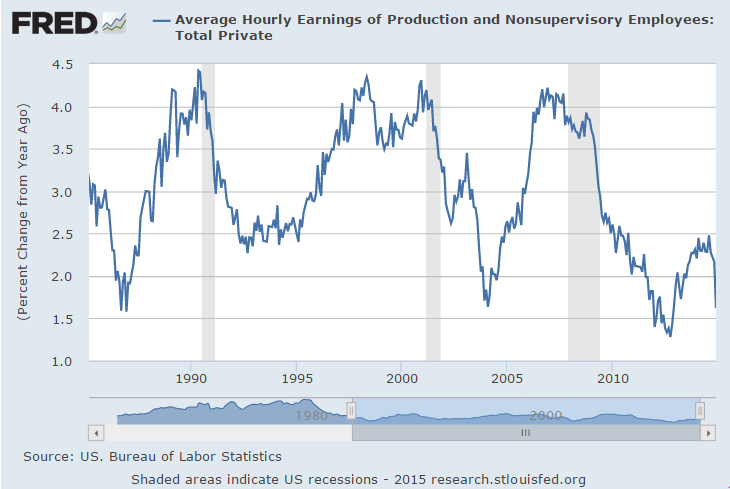

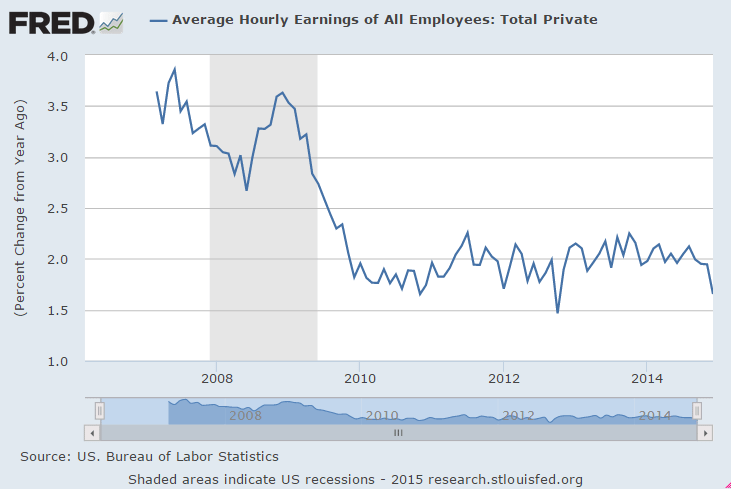

Not long ago the mainstream raised the alarm that average hourly earnings were ‘accelerating’ and when this happens it doesn’t stop for an average of 4 years, so the Fed better hike now to avoid a serious inflation problem. When I suggested it might roll over this time as it did in 2003, that notions was immediately dismissed:

Maybe higher paying energy jobs being replaced with lower paying fast food, retail, education, and healthcare types of jobs?

Wholesale Trade

Inventories look a bit heavy in the wholesale sector, up 0.8 percent in November vs a 0.3 percent decline in sales that lifts the stock-to-sales ratio to 1.21 from October’s 1.20 and compared to 1.19 in September. Weak sales made for unwanted inventory builds in metals, chemicals, lumber, machinery and farm products.

The nation’s inventories have been steady though today’s report does hint at slowing demand going into year end. Watch for the final data on November inventories in Wednesday’s business inventories report.

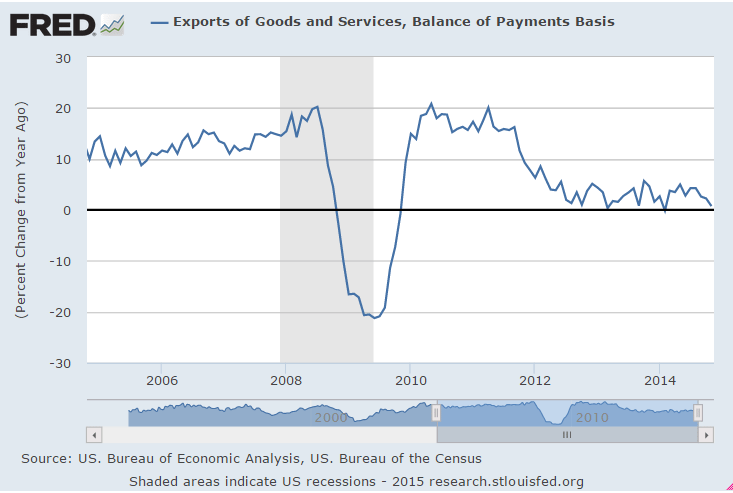

I’m suspecting US exports are in the process of declining due to the lower oil price and the weak global economy. Oil producers both have less to spend due to falling revenues and they will also reduce capital expenditures that are no longer profitable.

And while ‘global consumers’ will have more to spend due to falling fuel costs, seems to me that nations other than the US will benefit from that type of spending.

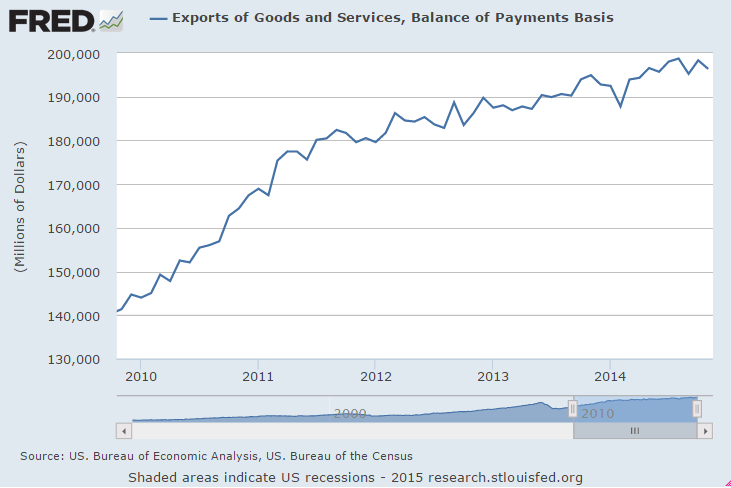

You can see how US exports have rolled over recently:

Year over year growth is now near 0:

To the point of ‘bad inflation’ in Japan:

Japanese People Feel Their Lives Are Worse Off

Jan 8 (WSJ) — A Bank of Japan survey of more than 2,000 people found that falling real incomes and rising prices have made people feel worse off than at any time in the past three years. About 51% said the comfort of their life has diminished over the past year, while just 4% felt life was getting better. The differential, about 47 percentage points, was the worst level since December 2011, the central bank said. Respondents to the survey also tended to be pessimistic about the year ahead. Nearly 38% said they thought the economy would get worse over the next year. In the previous poll, taken in September 2014, only about 32% thought that. And more than half of respondents said they believed growth in the future would be lower than it is now.