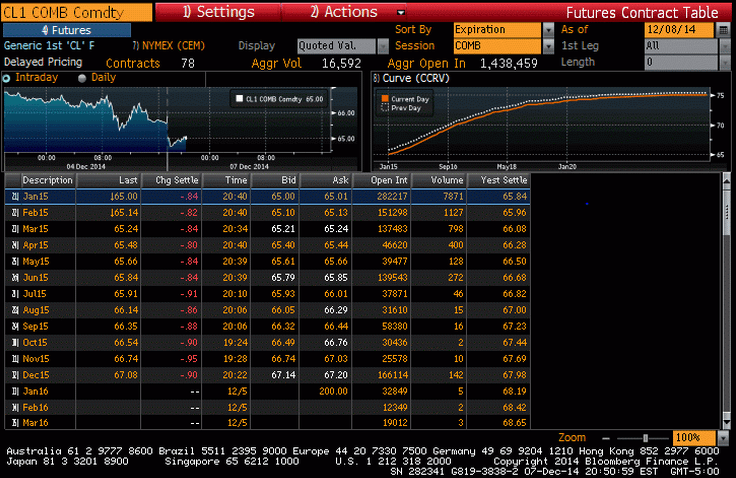

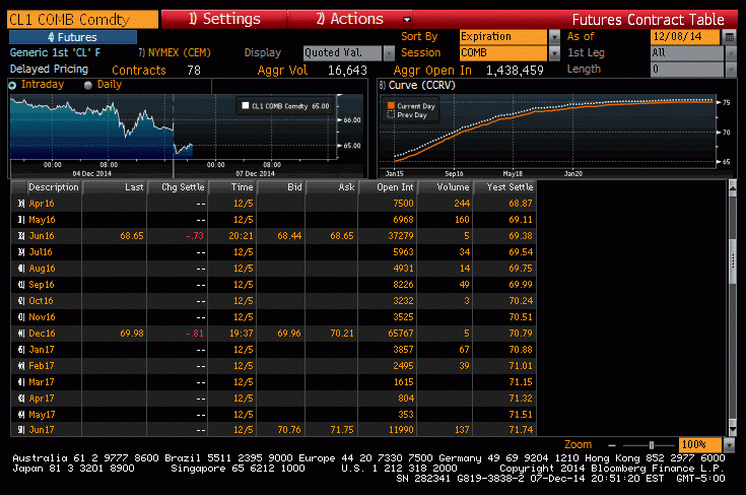

When there is a surplus of physical supply the nearby contracts trade at lower prices, with prices going higher as you go further out to discount storage charges. That is, with a physical glut of supply the storage facilities fill up and the price of storage goes up.

Likewise, when spot is in short supply, it trades higher than the out months, indicating refiners are willing to pay more to get what they immediately need.

Also note that buyers of futures are matched by sellers who are either getting outright short, or are buying spot and selling futures due to a favorable spread called the ‘carry’ that rewards them for taking delivery and redelivering in the future at the higher price. So again, the wide ‘contango’ as its called, with futures higher than spot, is the evidence of a spot surplus of supply. This contango can be over $1/month, depending on the size of the surplus.

So the markets are telling us price is going down without any sign of a surplus of actual output, as further confirmed by Saudi output figures posted previously.

It all comes down to the supplier of last resort, the Saudis, setting the price, also as previously described.

Cuts happening fast!!!

Oil giant BP is accelerating plans to cut hundreds of jobs within its back-office departments – many of them based in the UK and US.

Dec 7 (BBC) — The company, which has been downsizing since the oil spill in the Gulf of Mexico in 2010, said it had long planned the cuts, but is speeding up the process due to falling oil prices.

Crude prices have fallen by almost 40% this year, reducing oil firms’ margins.

BP employs almost 84,000 people worldwide, and some 15,000 in the UK.

In the US, the firm employs 20,000 people, many of whom are based in Texas.

“The fall in oil prices has added to the importance of making the organisation more efficient,” a BP spokesman told the BBC, “and the right size for the smaller portfolio we now have”.

Earlier on Sunday, The Sunday Times newspaper quoted BP’s finance director, Brian Gilvary, as saying “headcounts are starting to come down across all our activities”.

He added that the cuts would apply to “essentially the layers above operations”.