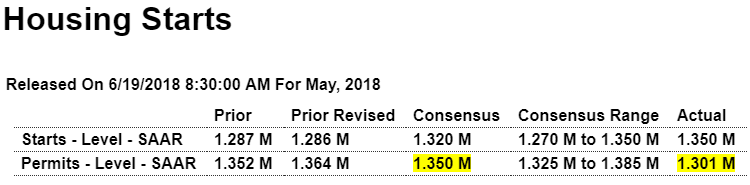

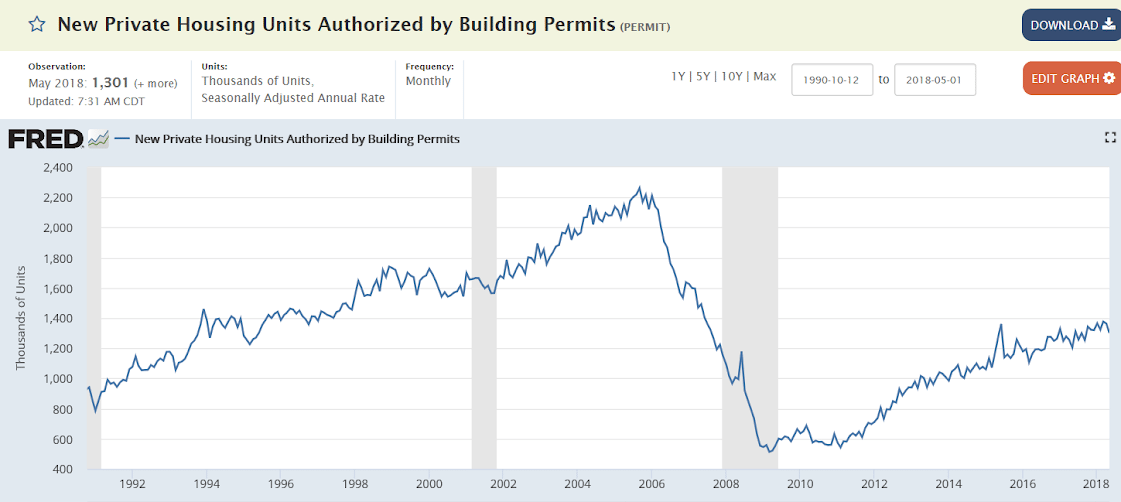

No houses get built without a permit:

Highlights

The good news in May’s housing starts report is centered in the present, less so in the outlook. Starts jumped 5.0 percent in the month to a 1.350 million annualized rate that hits the top end of Econoday’s consensus range and that should give a boost to residential investment in the second-quarter GDP report. Good news also comes from completions which rose 1.9 percent to a 1.291 million rate which will help feed a housing market starving for immediate supply.

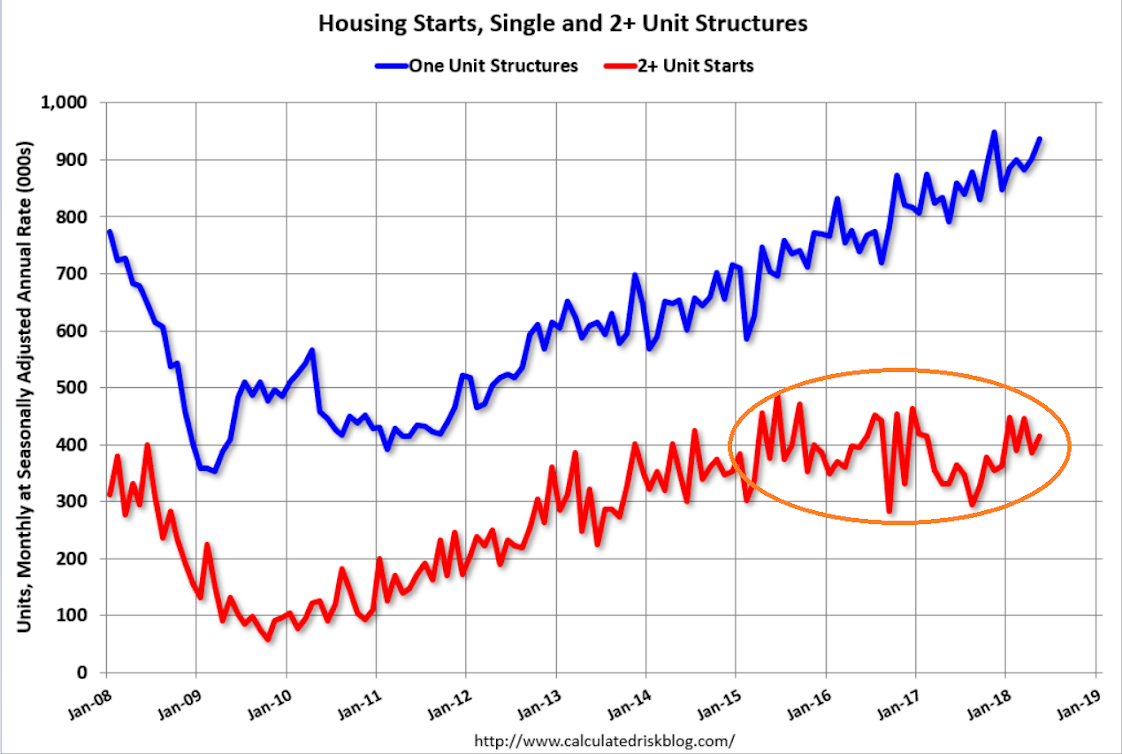

The question of future supply is still very positive but, however, has not improved in the May report as building permits fell for a second straight month and very steeply in May, down 4.6 percent to a 1.301 million rate. Weakness includes single-family homes, down 2.2 percent to a 844,000 rate, and once again multi-family units which are down 8.8 percent to a 457,000 rate.

Back to the good news as the breakdown for starts shows a 3.9 percent rise in single-family homes to 936,000 and a 7.5 percent gain for multi-units to 414,000. The gain for completions is entirely centered in the key single-family category, up 11.0 percent to 890,000 to offset a 13.8 percent decline for multi-units.

Building in the housing sector, given reports of shortages of construction workers and also construction equipment, may be progressing at the fastest rate possible based on year-on-year rates of growth: at 20.3 percent for starts, 10.4 percent for completions with permits at 8.0 percent.

The new home market, where sales are up in the low double digits, is a leading sector of the economy but appears to be bumping up against capacity constraints. Showing much less strength than new home sales have been resales which have been surprisingly flat and which will be updated with tomorrow’s existing home sales report.

The multi family component has flattened which has caused total housing starts to decelerate:

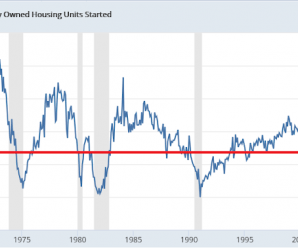

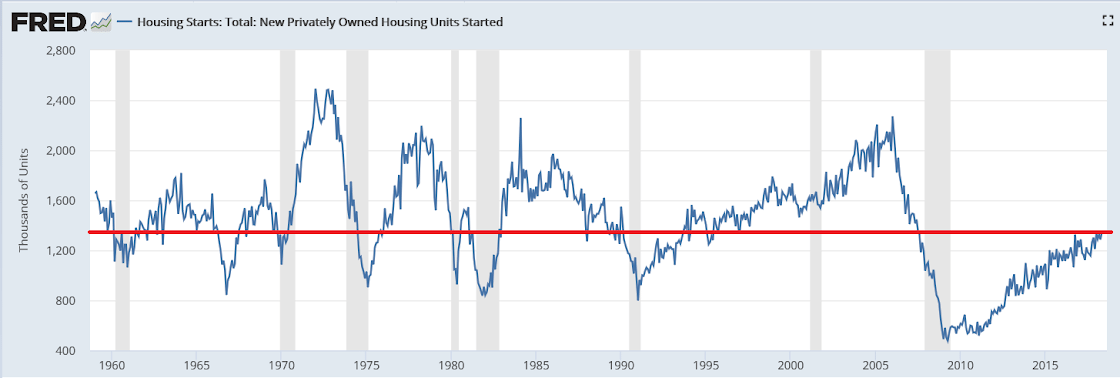

The longer term chart shows that housing continues to be depressed, with higher levels recorded in the 1960’s when the population was half of what it is today:

Permits look to have flattened most recently, and also remain depressed historically:

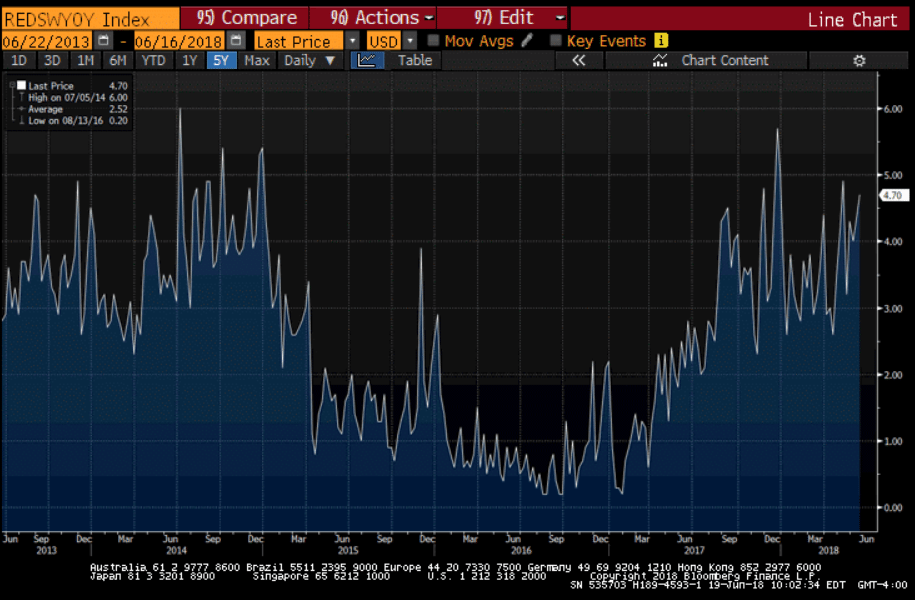

Same store retail sales appear to be doing ok, so seems store closings may have run their course?

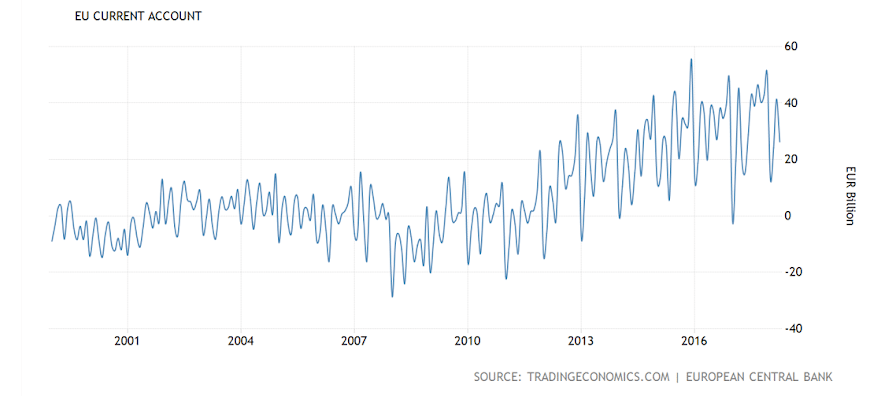

This is very euro friendly though currently world events are keeping porfolio managers underweight euro, as they focus on ECB rate policy which fundamentally doesn’t work the way they think it does.

Euro Area Current Account

The Eurozone’s current account surplus increased to EUR 26.2 billion in April 2018 from EUR 19.6 billion in the corresponding month of the previous year. The services surplus went up to EUR 7.9 billion from EUR 5.7 billion; the primary income surplus widened to EUR 5.6 billion from EUR 5.2 billion and the secondary income deficit decreased to EUR 9.9 billion from EUR 16.2 billion. On the other hand, the goods surplus narrowed to EUR 22.6 billion from EUR 24.9 billion. Considering the January to April period of 2018, the current account surplus rose to EUR 104.6 billion from EUR 82.2 billion in the same period of 2017