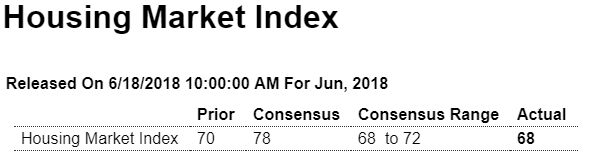

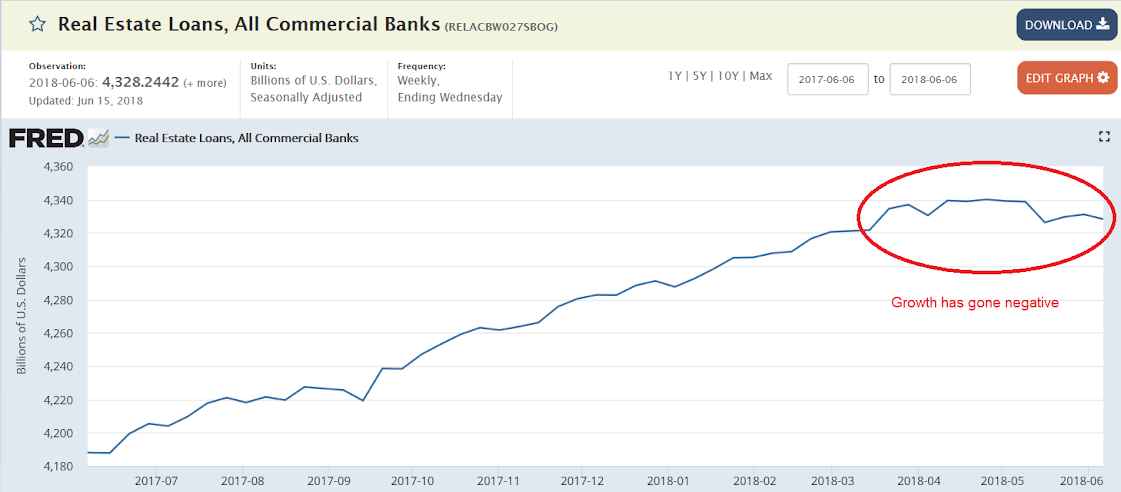

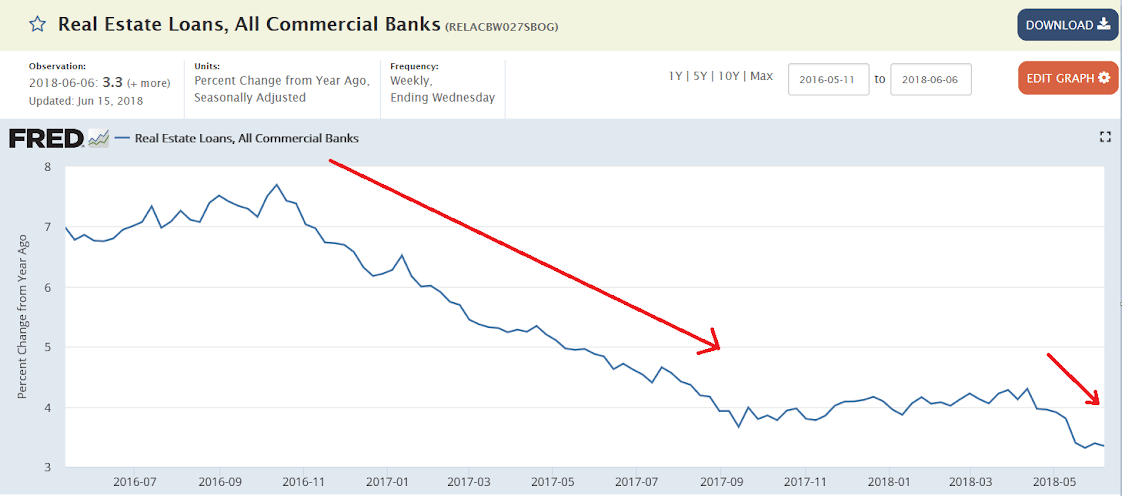

A lot less than expected as the housing slump continues:

Highlights

Acceleration is not the indication from the home builders’ housing market index which, though at a high level, edged back 2 points in June to 68 which is at the bottom end of Econoday’s consensus range. Current sales at 75, future sales at 76, and traffic at 50 all slipped 1 point in the month. The reading for traffic is the lowest since November and is not a good sign for the homestretch of the Spring housing season.

The West is a focused region for home builders and leads the regional breakdown followed by the South and Midwest and then the Northeast which though last has been showing improvement.

The new home market has been moving higher, both sales and permits, though indications including prices have been pointing to slowing growth. Watch for housing starts tomorrow where positive results are expected.

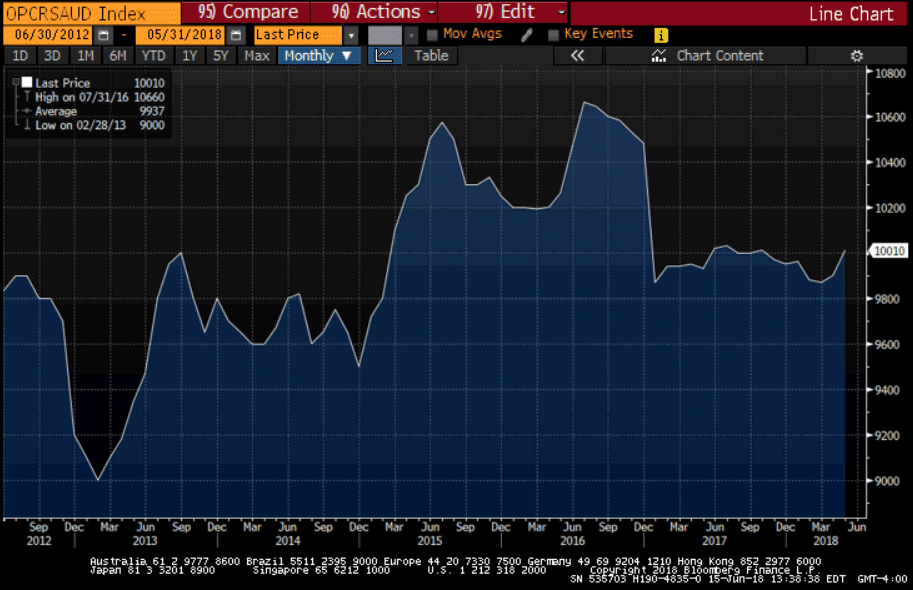

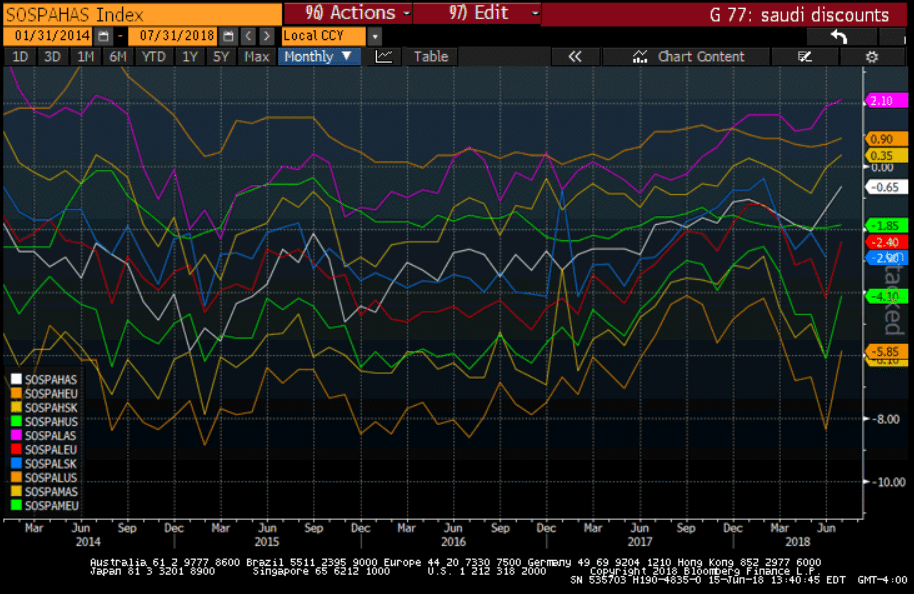

Can’t say what they are up to currently. Could be fine tuning to keep things steady, but hard to say what their actual price target is vs the $US, as they may be targeting a euro price,

for example:

Sales at their posted prices seem to be reasonable stable: