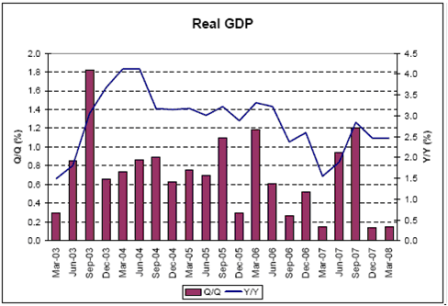

No recession here, and Q1 likely to be revised higher when March trade numbers come out.

Q3 could be 2% depending on the multiplier from the fiscal package, and by Q3 other government spending will be kicking in for the elections and housing is unlikely to be subtracting from GDP. It could even be adding by then.

As suspected, the current weak housing market has been offset by strong exports.

Financial sector losses have nothing to do with GDP unless they somehow reduce aggregate demand.

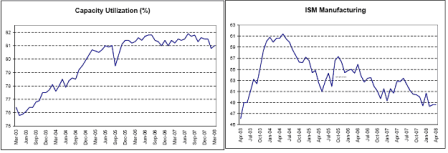

The prime suspect was the credit channel, but so far the evidence shows only limited damage due to tighter credit conditions, and not the downward spiral feared by the Fed and many other private economists.

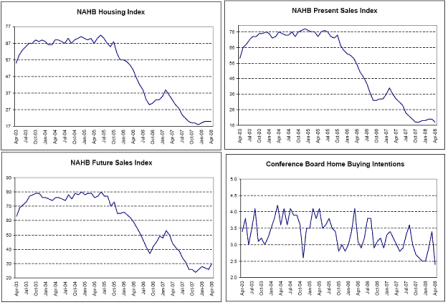

On the soft side, but no recession.

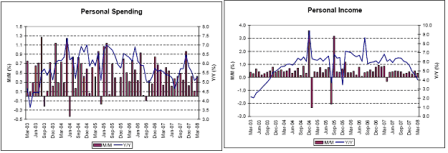

The consumer is muddling through as best as can be expected in an export economy.

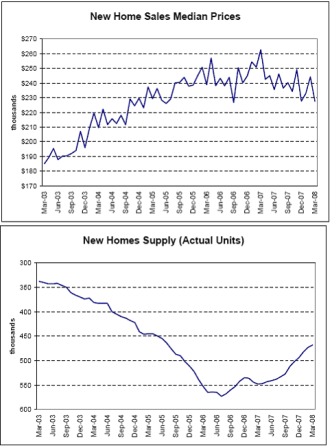

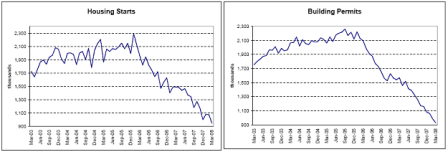

Median prices are soft and may or may not have bottomed, as actual inventories have worked their way down to relatively normal levels for a relatively normal sales pace (which we don’t have yet).

The bulk of the adjustment may have been bottoming around October/November.

Low starts have reduced supply as builders and buyers remain cautious.

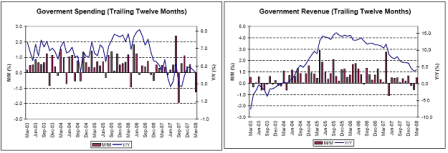

Government spending is roaring back and added nicely to Q1 GDP (March print above has timing issues and wasn’t functionally as low as indicated).

Revenue also holding up, indicating no recession yet.

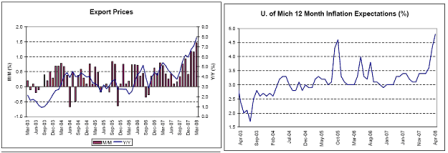

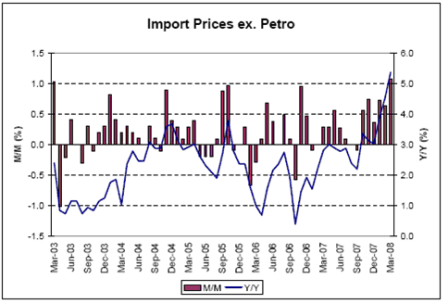

Every price chart is looking higher, and expectations have elevated, and the Fed keeps cutting rates. Who would’ve thought?

Fisher and Plosser make the mainstream case and are outvoted.

Wages remain ‘well contained’.

(If you don’t count import prices from China..)

Globalization is now inflationary.

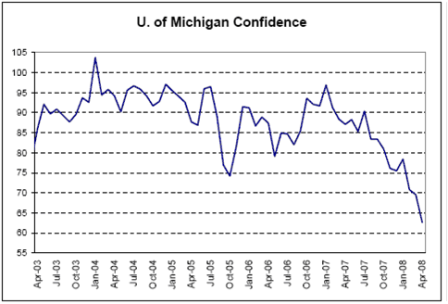

All the confidence surveys look about this weak, and at recession type levels, and about 90% of voters think we are in a recession.

American’s aren’t used to an export economy with declining real terms of trade – a mercantilist concept publicly supported by Bernanke and Paulson.

And they don’t seem to like it.

[top]