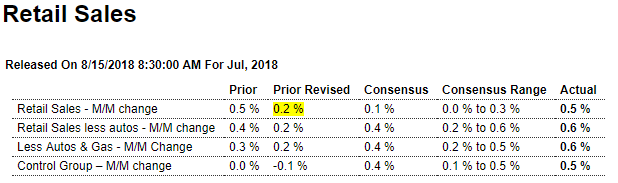

June was revised lower, so best to hold back judgement on July until August is released. Note vehicles were revised quite a bit lower for June, with the initially reported .9 jump suspect in any case:

Highlights

Demand for autos has cooled but not overall retail sales which rose 0.5 percent in July to easily top Econoday’s consensus range where the high forecasts were only at 0.3 percent. A downward revision to June, however, is an offset, now at a 0.2 percent gain vs an initial 0.5 percent. This will trim the second estimate of second-quarter GDP but the strong gain for July will lift early estimates for third-quarter GDP.

Motor vehicle sales did manage, despite July’s downturn in unit sales, to post a gain of 0.2 percent but the downward revision to June is centered here, now at only a 0.1 percent for this component vs an initial jump of 0.9 percent. But restaurant sales, which like autos are a discretionary category, rose a very strong 1.3 percent which is on top of 1.6 and 2.8 percent gains in the prior two months. Also very strong are sales for e-commerce as nonstore retailers posted a 0.8 percent July gain following a 0.7 percent rise in June.

Gasoline sales are also positive, up 0.8 percent in July and probably reflecting strength in summer driving demand, not just changes in prices. Apparel sales popped back up in July as did department store sales. Building materials, however, were flat with June sales for this category revised sharply lower to only a 0.1 percent gain. This along with a 0.5 percent decline in furniture sales are negative indications for residential investment.

But this report is not about negatives but positives — and that is strength in the central driver of the economy which is consumer spending and which is getting a major boost from strength in the labor market.

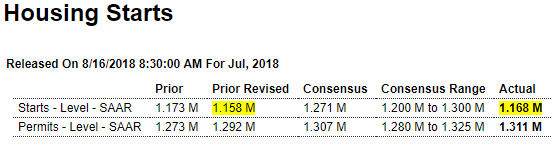

Weak and worse than expected but permits holding up. June revised lower slightly lowers q2 GDP:

Highlights

Capacity constraints in construction may very well be slowing down the sector as housing starts have turned lower. They did rise 0.9 percent in July to a 1.168 million annualized rate but follow a sharply downward revised 1.158 million in June. July’s result is far below the low end of Econoday’s consensus range at 1.200 million. Year-on-year, starts are down 1.4 percent with completions, at a 1.188 million rate, down 0.8 percent and homes not started, at 175,000, up 23.2 percent. Lack of available construction labor and high costs for lumber, which are tied in part to tariffs, are negative factors.

Showing much less weakness are permits, up 1.5 percent in the month to 1.311 million which compares favorably with Econoday’s 1.307 million consensus. Year-on-year, permits are up 4.2 percent with strength centered where it should be and that’s single-family homes where permits are up a very solid 6.4 percent. Multi-family permits are up 0.2 percent year-on-year.

By region, the Midwest is leading the way with mid-to-high single digit yearly gains for both starts and permits. The South is close behind with the West and Northeast lagging.

The housing sector in general is lagging though the gain in permits is a plus that, by contrast, underscores the capacity issues that are slowing down active construction.

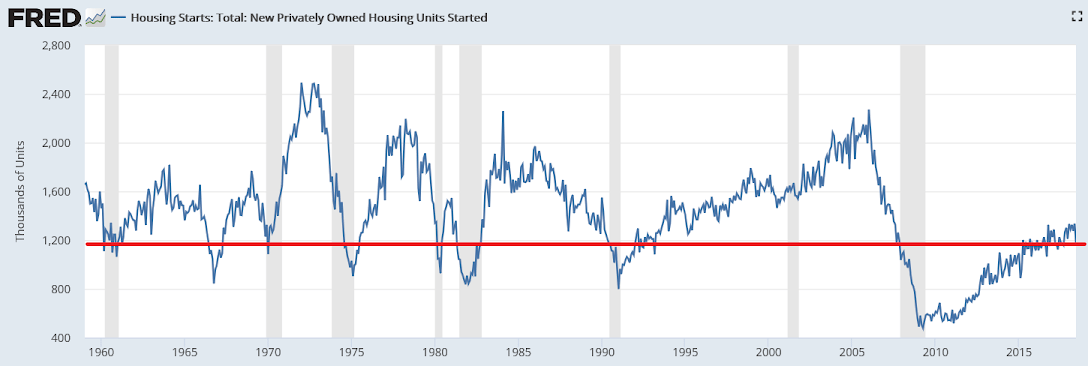

Stalling out at the lows of 1960… :(

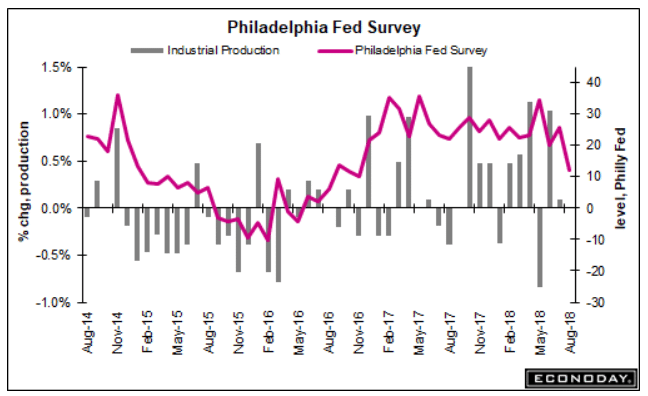

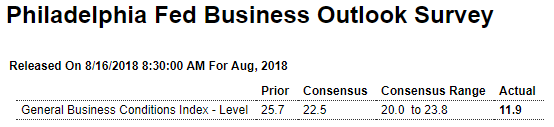

This is a negative surprise, and note the chart:

Highlights

Rates of growth may finally be slowing in the Mid-Atlantic manufacturing sector based on the Philly Fed general conditions index which fell sharply to 11.9 in August. This is the lowest reading in nearly two years and is far below Econoday’s low-end estimate of 20. It also follows June’s reading of 19.9 which also marked a turn lower for this index.

New orders are the life blood of business and growth here is clearly slowing, at 9.9 and also near a 2-year low. Other readings also show moderation with backlogs building at a slower rate, shipments strong but also slowing, employment strong but easing slightly, and the workweek also down slightly. And price pressures, though highly elevated, are easing slightly both for inputs and selling prices.

Not easing is the 6-month outlook which is up nearly 10 points to 38.8. This is very solid and does not speak to fundamental concerns about tariffs and trade wars.

Slowing should be no surprise for this report which was the first of the regional and private reports to shoot higher after the 2016 election. Slowing in orders should help limit the risk of capacity constraints for this sample.