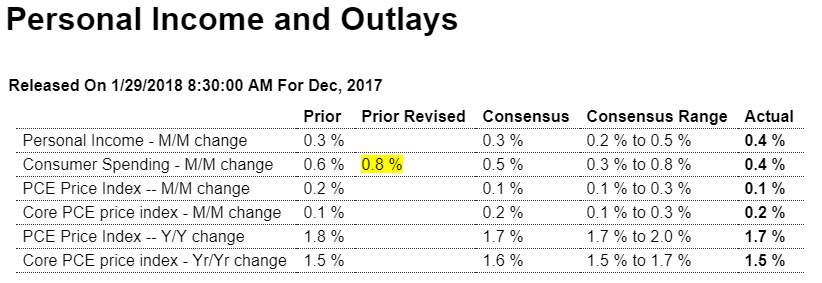

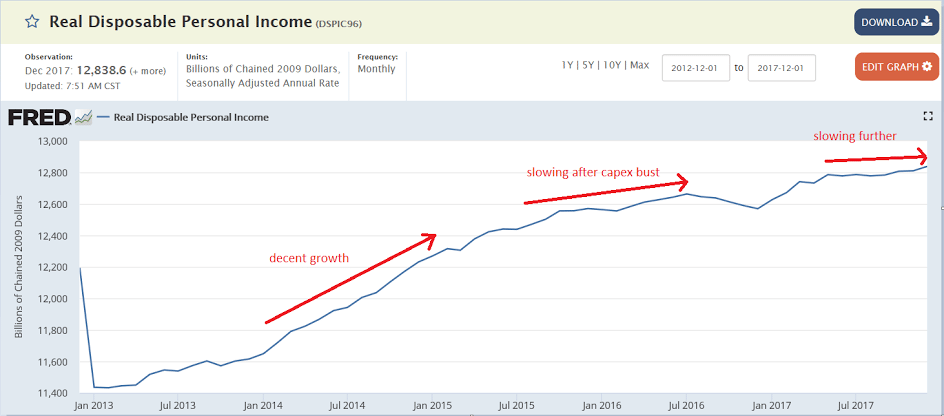

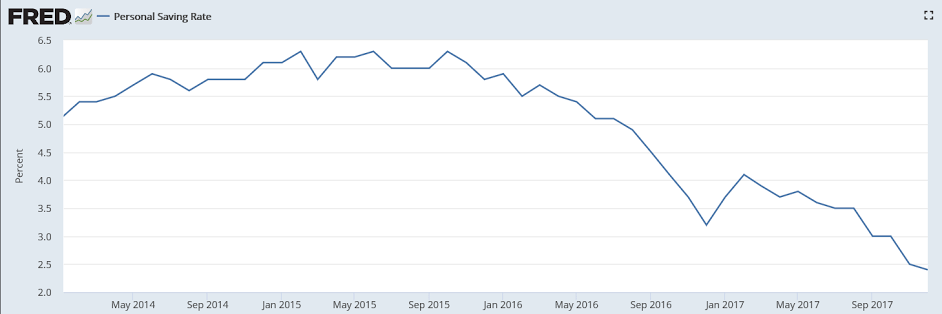

Pretty much in line with expectations, but last month’s spending increase means what I think was an unsustainably low savings rate is now even lower.

Highlights

Personal income rose 0.4 percent in December with wages and salaries up a solid 0.5 percent. Spending also rose 0.4 percent in December with November revised 2 tenths higher to a very strong 0.8 percent gain. Giving a boost to spending but hinting at trouble for the consumer is a 1 tenth dip in the savings rate to a 13-year low 2.4 percent which follows a sharply downward revised 2.5 percent rate in November (2.9 percent initially reported).

Price data remain very subdued, up 0.1 percent for the overall index and up 0.2 percent for the core which excludes food and energy. Year-on-year, the overall price index is up 1.7 percent which is 1 tenth below November while the core is stable at 1.5 percent.

The wages and salaries reading is a positive for the outlook as is the upward revision to November consumer spending. But the low reading for the savings rate is a concern and suggests that consumers dipped into their bank accounts to fund spending. Note that today’s data were part of last week’s fourth-quarter GDP report.

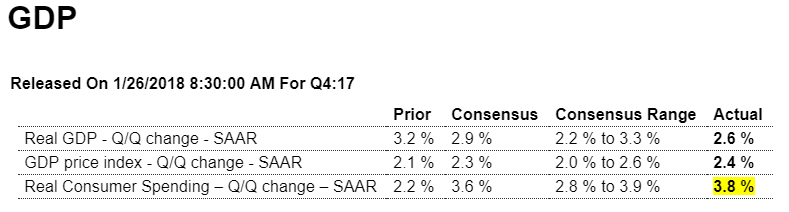

At 3.8% consumer spending is again, to me, unsustainably high given the personal income numbers, and therefore subject to either a large revision or a reversal in coming quarters. Likewise residential investment, the way I see it, is at odds with the monthly housing reports, and likewise subject to revision or reversal.

Highlights

The 2.6 percent headline rate doesn’t do justice to fourth-quarter GDP where consumer spending rose a very strong 3.8 percent that reflects a 14.2 percent burst in durable spending. Residential investment, which is another consumer-related component, rose at a very impressive 11.6 percent annualized rate. Turning to business spending, nonresidential fixed investment rose at a 6.8 percent rate which is the fourth straight mid-single digit result. Government purchases, at a 3.0 percent rate, also added to GDP in the quarter.

What pulled down fourth-quarter GDP were net exports, at an annualized deficit of $652.6 billion, and inventories which rose at a slower rate than the third quarter. Looking at final sales to domestic buyers, which excludes inventories and exports, GDP comes in at a robust 4.3 percent.

Prices also showed life in the quarter, with the index at 2.4 percent vs the third quarter’s 2.1 percent. This is a standout report led by the consumer that shows the economy accelerated into year-end 2017 with strong momentum going into 2018.

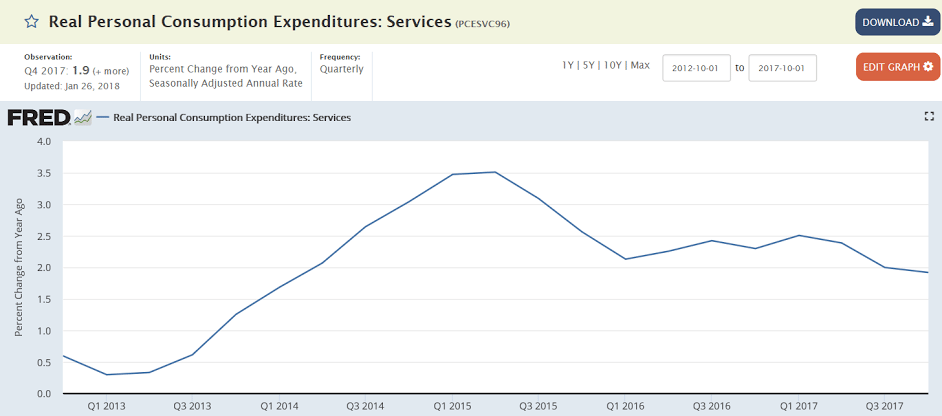

As previously discussed, weakness shifted to the service sector:

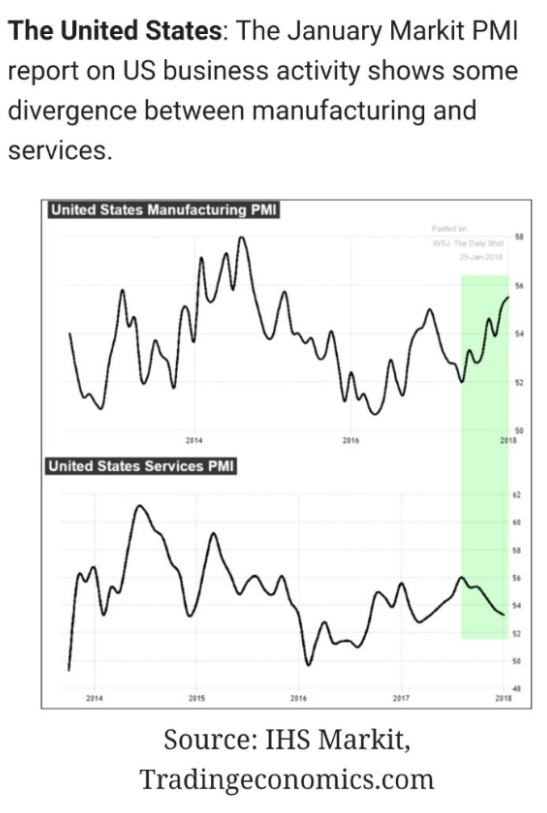

As previously discussed, services slowing while manufacturing firming:

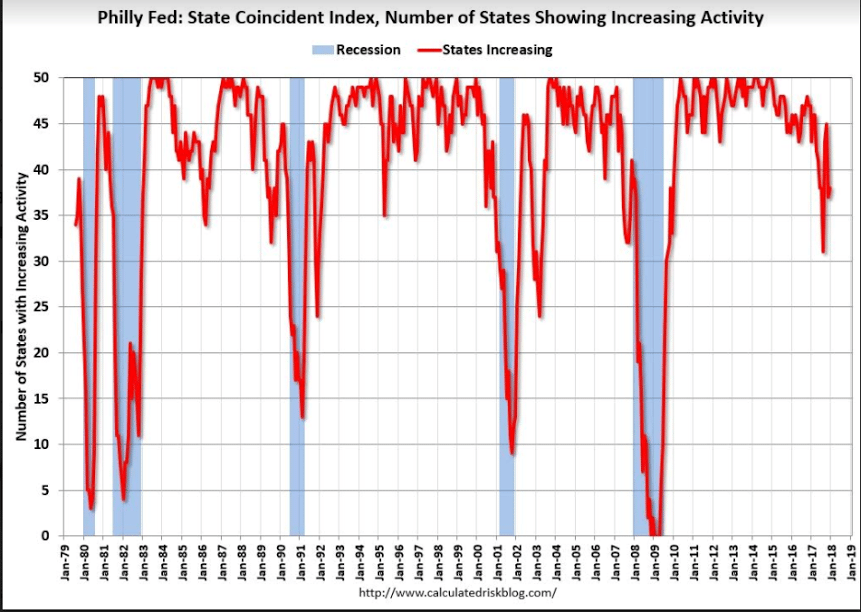

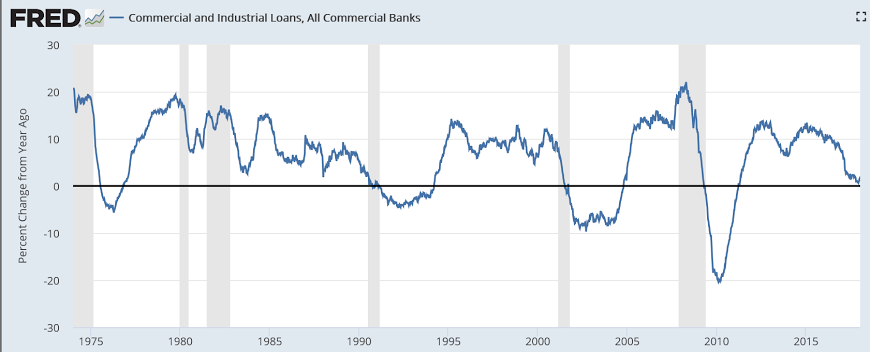

Still looking ominous:

Rail Week Ending 20 January 2018: Terrible Start to 2018

Week 3 of 2018 shows same week total rail traffic (from same week one year ago) contracted according to the Association of American Railroads (AAR) traffic data. The rolling averages for the economically intuitive sectors are now in contraction, and the decline in the last four weeks negatively affected all the averages.