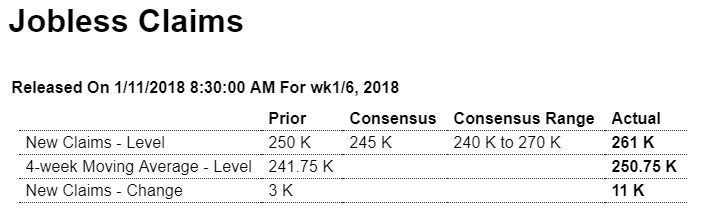

Yes, they have been made very hard to get, and now economists are getting concerned that they are moving higher:

Highlights

In what might be an early sign of loosening in the labor market, initial jobless claims rose 11,000 in the January 6 week to a higher-than-expected 261,000. The gain is widespread and not centered in Puerto Rico where claims, at 1,778, are down about 500 in the latest week and back to pre-hurricane levels. Only one state, Maine, was estimated in the week. The 4-week average, at 250,750, is up a steep 9,000 in the week and is roughly 15,000 above the month-ago trend which offers an early hint of trouble for the January employment report.

In data for the last week of December, continuing claims showed improvement, down 35,000 to 1.867 million which is a new 44-year low. The unemployment rate for insured workers is down 1 tenth to 1.3 percent.

Initial claims, aside from hurricane distortions in September and October, were remarkably steady and favorable throughout last year which makes the gain in the first week of this year stand out. Next week’s initial claims data will be very closely watched and will track the sample week of the January employment report.

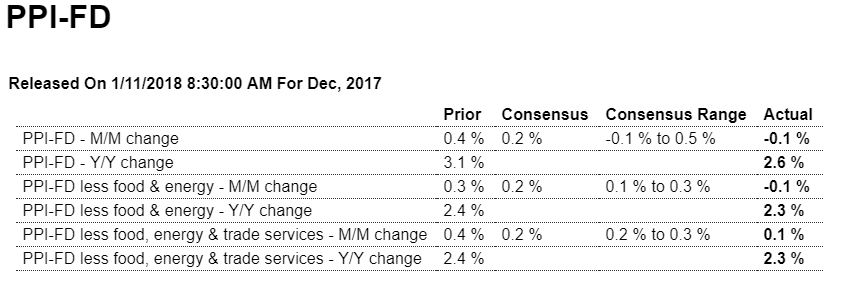

Interesting how 2017’s 10% or so drop in the dollar and increase in oil prices didn’t translate into higher prices in this series:

Highlights

Yesterday’s weakness in import and export prices did in fact point to wide weakness in today’s producer price report where the headline, at minus 0.1 percent in December, is 3 tenths below Econoday’s consensus for the first decline since August 2016. Ex-food and ex-energy is also at minus 0.1 percent and when also excluding trade services, which were very weak, prices came in at plus 0.1 percent. Year-on-year rates, which had been on the rebound, all fell back with total prices down 5 tenths to 2.6 percent.

Service prices are less sensitive to change than commodity prices and December shows wide weakness with the trade services component down a very steep 0.6 percent for the second straight decline and the third in the last four months. Goods prices were unchanged in December with key readings here showing a 0.7 percent decline for food, no change for energy and a 0.3 percent decline for finished goods with light trucks unchanged, cars up 0.2 percent and computers down 0.7 percent.

Down is definitely the theme of this report which points squarely at disappointment for tomorrow’s consumer price report where expectations are already soft, at an Econoday consensus gain of only 0.1 percent and 0.2 percent for the core (ex-food and ex-energy). The absence of inflation is a stubborn theme of the economy.

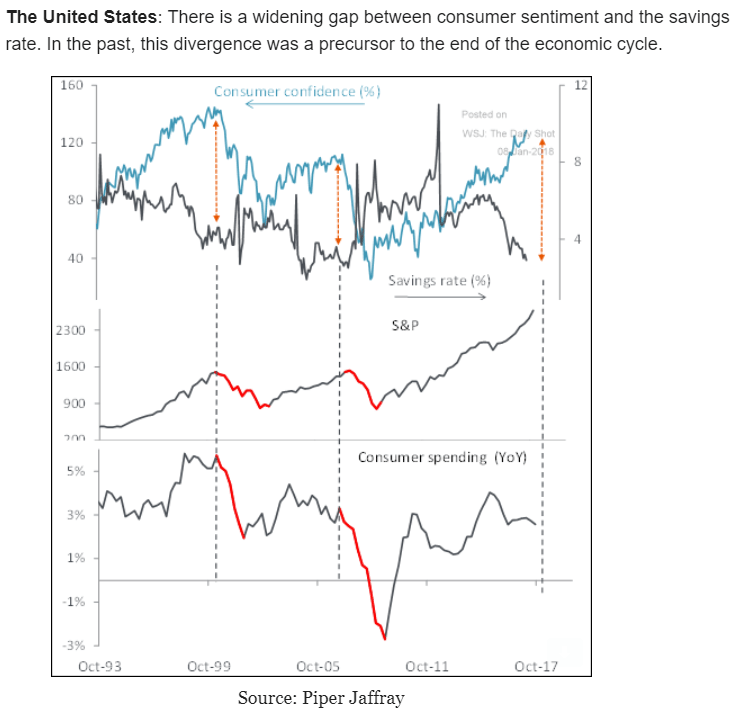

Others catching on: