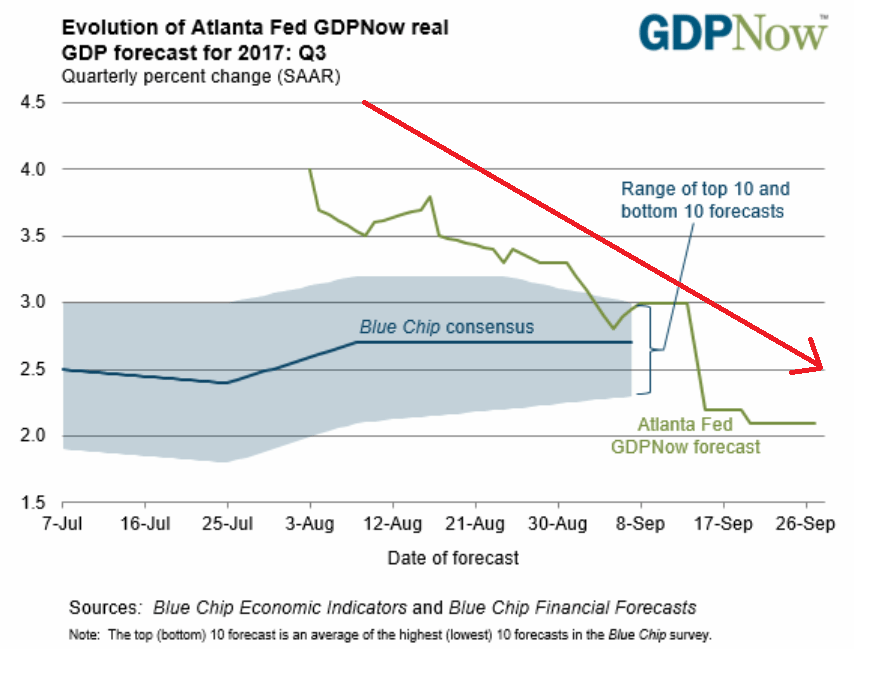

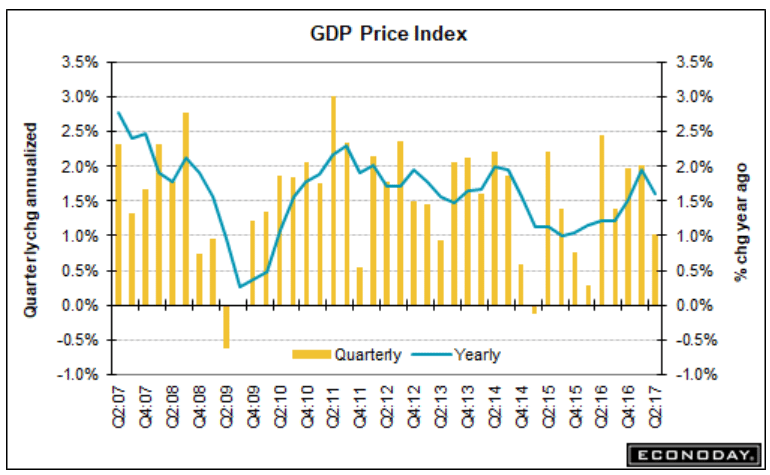

Revised higher due to inventory building- not good- and weak prices also tend to indicate low demand. And note how q3 gdp estimates have been coming down as well:

Highlights

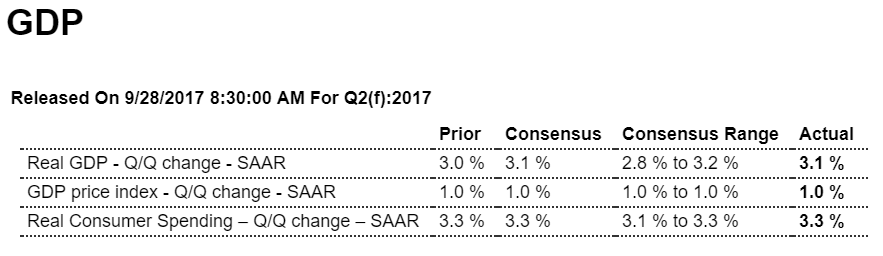

Second-quarter GDP proved strong, at an as-expected 3.1 percent annualized rate for the third estimate driven by consumer spending at a 3.3 percent rate. Nonresidential fixed investment, at a 6.7 percent rate, was also a strong contributor and offsetting a 7.3 percent decline for residential investment. Government purchases, at minus 0.2 percent, were a slight drag on the quarter while both net exports and inventories were slight positives. GDP prices, like other inflation measures, were soft, up 1.0 percent overall and 1.1 percent for the core.Today’s report confirms that the economy was showing solid momentum going into the third quarter where this morning’s preliminary data for August net exports and August inventories are very strong.

Highlights

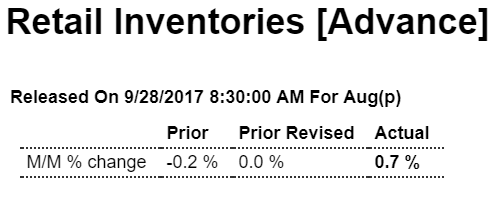

Retail inventories rose a sharp 0.7 percent in August and are led by a 1.2 percent build in vehicle inventories which, following the month’s weak vehicle sales, hints at overhang. Replacement demand following Hurricane Harvey, however, should soak up some of the inventory. Retail inventories excluding vehicles rose 0.4 percent. Overhang or not, retail’s build together with a 1.0 percent jump in wholesale inventories, where preliminary data were also released this morning, are immediate positives for third-quarter GDP.

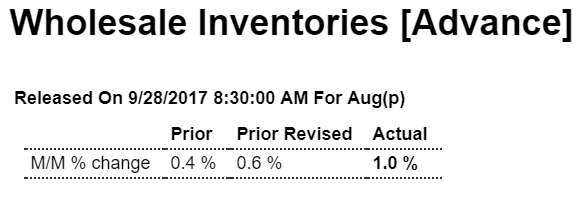

Highlights

Wholesale inventories rose a very sharp 1.0 percent in August, split evenly between a 1.0 percent build for durables and a 1.2 percent build for nondurables. This along with a heavy 0.7 percent build for preliminary retail inventories, which were also released this morning, are positives for third-quarter GDP.

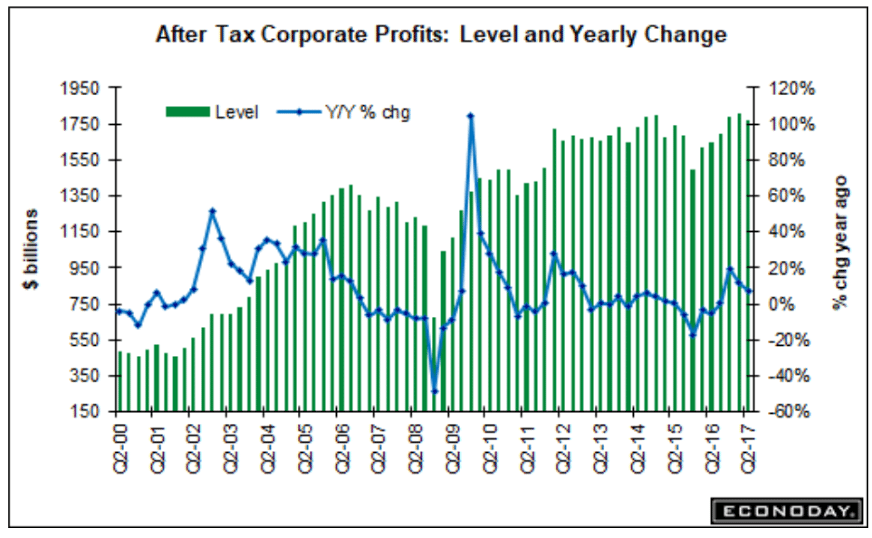

The chart shows corporate profits have been largely flat for over 5 years, with a dip when oil capex collapsed and a subsequent recovery only back to prior levels:

Looking like just another politician in that regard: