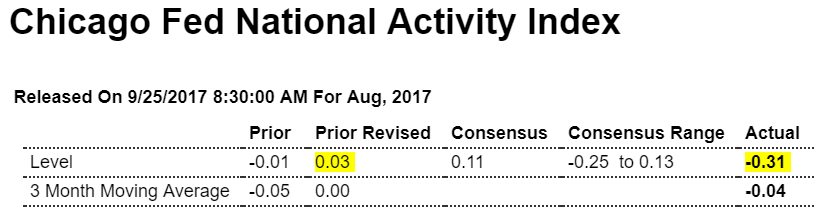

Note the shift:

From NY Fed’s Dudley. I added a chart after several of his statements so you can see

what he sees as support for his statements. Looks a lot to me like he’s trying to manage expectations?

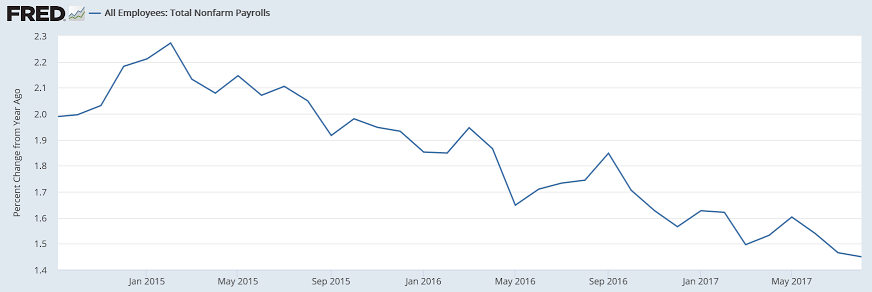

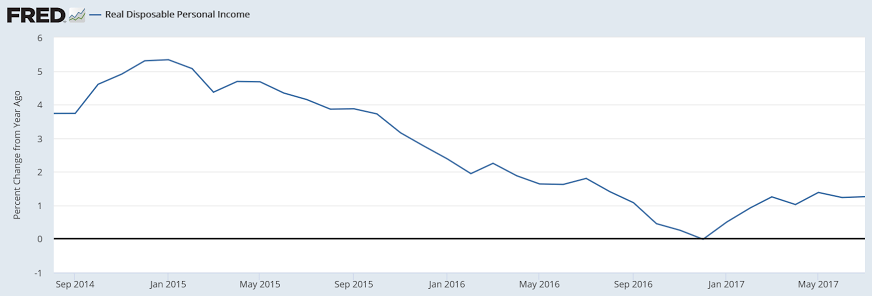

“The fundamentals supporting continued expansion are generally quite favorable. Low unemployment, sturdy job gains,

and rising wages—even at a pace below previous expansions—

are lifting personal income.

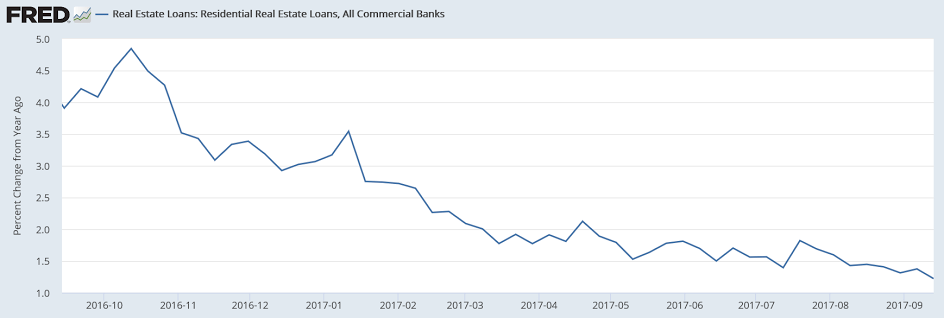

Household wealth has been boosted by rising home and equity prices, and household debt has been growing relatively slowly, contributing to a healthy household balance sheet. Thus, consumer spending should continue to advance in coming quarters.

(the will likely be revised lower as the latest retail sales reports was lower than expected and revised the prior month lower)

Also, this doesn’t show any signs of turning around and contributing more to consumer spending?

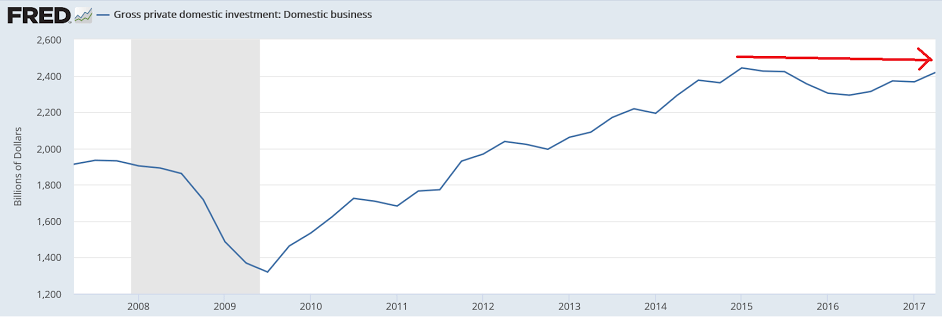

Business fixed investment outlays are also likely to continue to rise.

Why? Looks more like it’s flattened out after a dip from the oil capex collapse, especially with the recent softness in consumer spending and personal income:

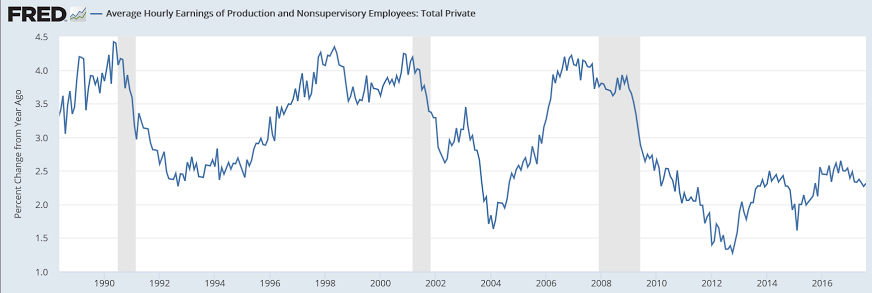

With the supply of labor tightening, there are greater incentives for businesses to invest in labor-saving technologies.

(There’s been just as large a benefit from investing in labor-saving technologies over the last several years, as real wages aren’t

materially higher than they were.)

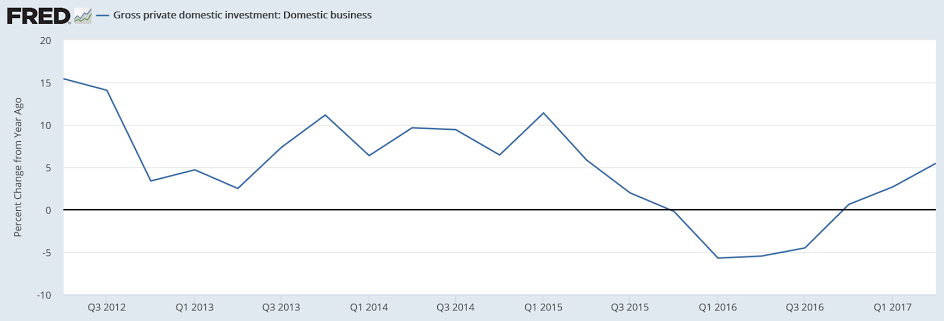

Investment spending should also benefit from a better international outlook and improvement in U.S. trade competitiveness caused by the dollar’s recent weakness.

He thinks exports to emerging market nations will pick up?

Again, looks like there’s been a flattening after the collapse of oil capex:

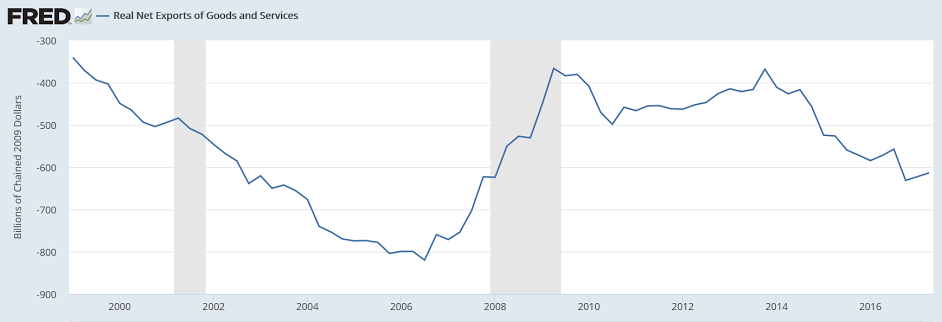

The softer dollar and solid growth abroad also suggest that the trade sector will no longer be a significant drag on economic growth.

Except we have to first get past the J curve effect and the recent higher prices for imported oil before the current trend reverses:

With a firmer import price trend and the fading of effects from a number of temporary, idiosyncratic factors, I expect inflation will rise and stabilize around the FOMC’s 2 percent objective over the medium term.

Agreed that the higher oil prices and other weaker dollar effects could add a few tenths to headline cpi, but core inflation might stay low for longer.

In response, the Federal Reserve will likely continue to remove monetary policy accommodation gradually.

No mention of the strong deceleration of bank loan growth when the only channel from rates to growth is credit…